Market Brief

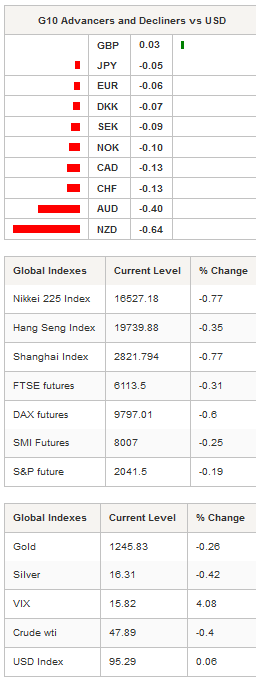

The US dollar strengthened substantially in overnight trading amid rising expectations about an upcoming rate hike by the Federal Reserve. The greenback gained ground against almost all G10 currencies with the exception of the pound sterling, which was able to stabilise slightly below the 1.45 threshold. The probabilities of a rate hike at the June meeting - extracted from the overnight index swap - rose to 27% on Tuesday from almost zero a month ago.

US treasury yields stabilised along the curve with renewed upside pressure on the short end. The monetary policy sensitive 2-year yield rose another 3bps in overnight trading, reaching 0.9050%; while the 10-year continued to ease as it slid to 1.8350%. This suggests that the market is still wary of inflation and growth expectations in the US. However, we remain cautious regarding further USD appreciation as we have the feeling that the market has been paying too much attention to recent, mainly bullish Fed discourse. We expect the Fed to adopt a very cautious approach, especially given the lack of significant improvement in the growth and inflation sides. Therefore, over the next few weeks, we expect the dollar to erase earlier gains as the penny finally drops that a June rate hike is officially off the table.

In Asia, the strong dollar continued to weigh on equities with most regional equity indices trading in negative territory. In Japan, the Nikkei was off -0.77%, while the broader Topix index eased -0.78%. In mainland China the Shanghai and Shenzhen Composites were down 0.77% and 0.85% respectively. Offshore, Hong Kong’s Hang Seng fell 0.35%, while in Singapore the STI was down 0.40%. In Europe, equity futures are pointing towards a lower open.

In Australia, the Aussie fell another 0.55% against the US dollar as Governor Stevens defended the current target band inflation target, adding that inflation was difficult to control in the short term. AUD/USD reached 0.7193 in Sydney before stabilising at around 0.7195. We maintain our negative bias on AUD/USD as the Australian economy should still suffer from a slowing Chinese economy in spite of the hype of the first quarter.

In China, the People’s Bank of China set the USD/CNY fixing higher to 6.6448 from 6.5455 in the previous day. Since the beginning of May the renminbi has continuously depreciated against the greenback, which could potentially put the capital outflow story back under the spotlight.

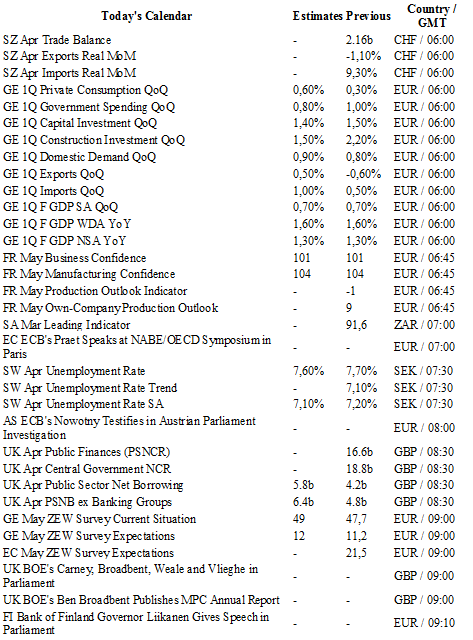

Today traders will be watching trade balance from Switzerland; GDP and ZEW from Germany; manufacturing confidence from France; unemployment rate from Sweden; BoE’s Carney speech; Turkey’s interest rate decision (cut in the lending rate expected); current account balance and foreign direct investment from Brazil; new home sales and Richmond manufacturing index from the US.

Currency Tech

EUR/USD

R 2: 1.1479

R 1: 1.1349

CURRENT: 1.1214

S 1: 1.1144

S 2: 1.1058

GBP/USD

R 2: 1.4770

R 1: 1.4663

CURRENT: 1.4483

S 1: 1.4404

S 2: 1.4300

USD/JPY

R 2: 111.91

R 1: 110.59

CURRENT: 109.24

S 1: 108.23

S 2: 106.25

USD/CHF

R 2: 1.0257

R 1: 1.0093

CURRENT: 0.9907

S 1: 0.9652

S 2: 0.9444