Tuesday February 23: Five-things the markets are talking about

After one day of trading for this week, the Dow Jones Industrial Average and S&P 500 went into positive territory for the month of February. The indices were mostly supported by the big rally in oil and commodity prices, which lifted the broader energy and materials sectors. Many of the market ‘naysayers’ will now be asking how high?

These market bears did not have to wait too long for support.

1. Risk-on theme abating as PBoC resumes weaker Yuan fix

The PBoC set the Yuan mid-point at ¥6.5273 vs. ¥6.5165 – the weakest Yuan setting since February 5. The magnitude of change is also the biggest since January 7.

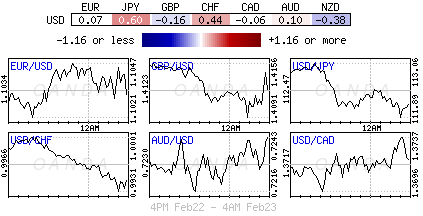

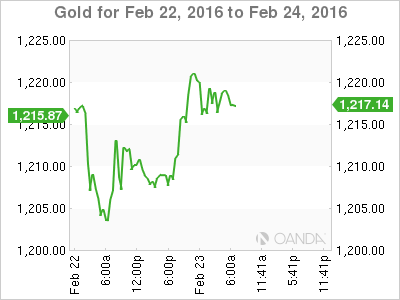

Market risk sentiment already looked fragile early on during the Asia session, but the Yuan fix was the deciding factor. Asian equity markets ended up being lower across the board despite the Monday rally stateside. Risk-aversion trading continues to command respect ahead of today’s North American open. USD/JPY has fallen below ¥112, S&P 500 futures are down -0.5%, while safe-haven gold remains better bid at $1,218.

2. Boris breaks Pound and batters EUR

Since the Mayor of London’s ‘get out’ of EU declaration over the weekend, sterling (£1.4120) has been trading under pressure.

Not just in the U.K, but investors are also concerned what a potential ‘Brexit’ would mean for the common currency. EUR hit a three-week low this morning (€1.0998) while the pound printed a seven-year low outright yesterday (£1.4069). A vote to leave would raise a lot of open-ended questions about the future of the EU. Currently, Europe does not have a plan ‘B’ if the U.K votes to leave.

Not helping the common currency is this morning’s weaker than expected German Ifo data. The headline sentiment print has disappointed at 105.7 vs. expectations of 106.7. Not surprisingly, business expectations again slipped, easing to 98.8 vs. 101.6. German numbers like this will only put further pressure on the European Central Bank (ECB) to be more proactive. Dealers will now be expecting Draghi will have to do more than just cut rates at next months ECB meeting.

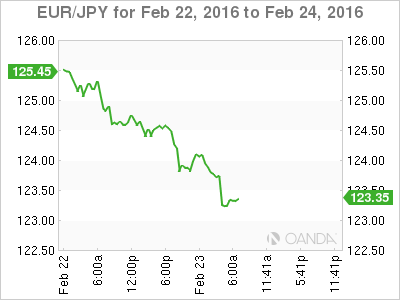

With risk aversion trading dominating, EUR/JPY has fallen to a new three-year low (¥123.24).

3. Japan not to engage in competitive yen devaluation

The Bank of Japan’s (BoJ) Governor Kuroda again appeared in parliament to proclaim that the central bank’s easing has been showing its intended effects. The Governor has pledged to continue with negative rates and QE until their +2% inflation takes hold.

Market chatter, coupled with a report from Nikkei overnight, continues to speculate that the BoJ could still ease further in March despite the negative rates reaction by investors in late January.

Kuroda’s negative interest rate had no material currency impact, apart from the initial brief yen pressure to ¥121.50 on the announcement.

Saving face is a big concern for Japan. Their Economic Minister Ishihara has insisted that Japan is not engaged in competitive currency devaluation, noting that the upcoming G20 they will be expecting to discuss with fellow members, cooperation in dealing with U.S tightening and energy market developments. U.S Treasury officials yesterday stated that the U.S. would continue its opposition to competitive currency devaluations while at the G-20 meeting this week.

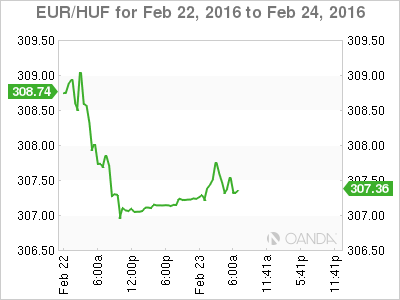

4. Hungary Central Bank (NBH) Interest Rate Decision

Hungary’s rate setters are expected to leave their base rate unchanged at +1.35% later this morning. Voting members are anticipated to reiterate that inflation remains low and that monetary policy could be eased further.

With limited tools in most central banks arsenal nowadays, NBH is likely to confirm that this will be done by using the existing program of interest rate swap tenders, and that the policy rate will be kept low for an extended period of but not cut further.

Fixed income dealers have not priced in any further rate cuts this year to date.

5. Bank of England (BoE) making no judgment on Brexit

Earlier this morning, BoE Governor Mark Carney said that the BoE is not making a “judgment on the consequences” of Britain’s referendum on its European Union membership and nor should they.

The central bank will be taking into account “the movements in asset prices.” The governor indicated that that the moves in the pound (£1.4105) and in options that insure against a fall in sterling “have spiked to levels” similar to those seen in the Scottish referendum campaign. Dealers noted last week that the cost of some options have hit its most extreme levels since Europe’s sovereign debt crisis. Implied volatility (vols.) had rallied +12% vs. +8.4% cost recorded two-months ago.

The BoE has kept its key rate on hold at +0.5% for almost seven-years and the market yield curve shows a +25 basis-point rise is not priced in for another three-years.

The lead up to the ‘Brexit’ vote is expected to be a long four volatile months for capital markets.