Tuesday March 15: Five things the markets are talking about

Central Bank monetary policy announcements dominate proceedings this week. The main event happens tomorrow with the Federal Open Market Committee (FOMC) rate decision.

Nevertheless, it was the Australasian policy makers holding court yesterday afternoon, beginning with the Reserve Bank of New Zealand’s (RBNZ) Governor Wheeler speaking in Auckland, closely followed by the Reserve Bank of Australia (RBA) March meeting minutes, and ending with Governor Kuroda at the Bank of Japan (BoJ).

Last week, the RBNZ surprised investors by slashing their overnight rate by -25bps. With another rate cut likely in April the markets were eager to hear what the governor had to say. The RBA’s March minutes did not break any new ground from this month’s policy statement, which was largely a reiteration of the previous month.

Very few traders expect the Fed to lift interest rates this week, but the gathering is likely to contain some clues for investors about what they’re looking at. The FOMC’s two-day meet begins this morning.

1. BoJ Monetary Policy announcements

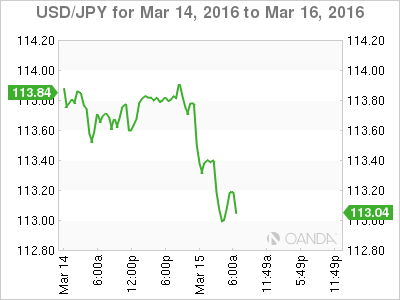

The BoJ held monetary policy steady overnight, but did cut their economic assessment and exempted the Money Reserve Funds (MRF’s) from NIRP as speculated.

The BoJ’s policy update included maintaining its ¥80T annual monetary expansion target and its -0.1% rate on excess reserves. Interestingly, the field of dissenters for the latter fell to 2 from 4. As anticipated, Governor Kuroda announced he would exempt the MRF’s from negative rates policy and promised to review financial institutions’ balances to which 0% rate is applied – these are to be reviewed every three months.

Lastly, The BoJ also unveiled a new slate of economic assessment and risks to its policy outlook relative to the previous year. Specifically, they cut overall economic assessment for the first time since late 2014, to state “Japan continues its moderate recovery trend, although exports and production have been sluggish due to the slowdown in emerging economies.”

The BoJ remains cautious on exports, viewed consumption as “resilient,” and business investment on “moderate increasing trend.” In terms of outlook, Japanese policymakers expect exports and production to remain “sluggish” and CPI to hover around 0% due to the decline in energy prices, while the risks to the outlook section saw notable additions of slowdown in China and developments in U.S monetary policy.

2. Global equities see red

Global stocks are lower this Tuesday morning as we head stateside. This is mostly on the back of weaker commodities as investors await guidance from the Fed on the course of interest rates this year.

The ‘risk-off’ trading mode after the BoJ statement is not a function of what Japanese policy makers said, but rather of what they did “not” say – they omitted the promise to take rates deeper into ‘negative territory’ as they claimed in January.

U.S. equities ended little changed yesterday in the lightest day of trading volume so far this year. Global stocks have staged a recovery in the last month, with the Stoxx Europe 600 up over +7% and the S&P 500 up over +8%, driven mostly by improving U.S. economic data and relative stability in commodities prices.

Investors want a clear signal on the course of U.S. monetary policy before investing in the next equity directional leg.

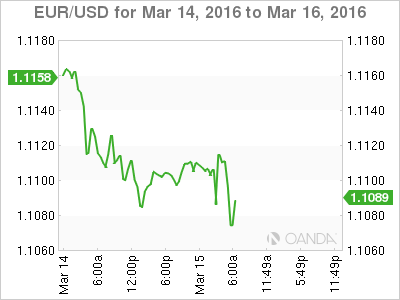

3. U.S inflation expectations have moved higher

Did the decline in U.S inflation expectations bottom out last month?

The New York Fed reported yesterday that consumers’ expected levels of inflation over the next few years rose in February, halting a trend of slow but persistent declines that has caused some worry amongst Fed officials.

The public’s expectation of inflation one-year forward stands at +2.7%, up from +2.4% in January. Even the level for three years forward came in at +2.6%, up from +2.5% in the previous month.

Even with the increase in expectations, the NY Fed said expectations “remain at the low-end of the range observed over the past two and a half years.”

If future readings continue to tick higher, that would be good news for Fed Chair Janet Yellen and company. To date, the Fed has failed to hit its desired +2% inflation target for more than three years, and it does not expect to get to the desired level for another two years. Officials believe that ‘expected’ inflation is a key driver of actual inflation.

It’s not surprising that to many, the general weakness of inflation and its expectations have been tied to ‘low’ oil prices.

The Fed will wrap up a two-day meeting tomorrow, and while there is little chance of a rate increase, everyone will be watching the statement closely for signs of whether the FOMC is leaning toward another hike in the coming months.

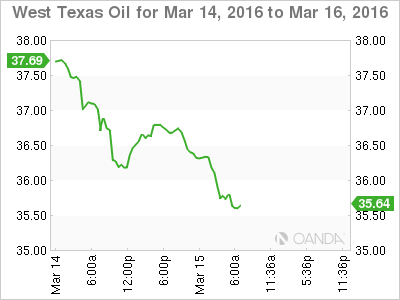

4. Oil remains on the back foot

Oil is a central focus again today, as Iran made clear yesterday that it would raise production to their pre-sanction levels of +4m bpd before it considers any production deals.

Their decision puts at risk a collective agreement from other major oil producers to maintain output at January levels to help decrease a global glut of crude and drive prices north of $40 a barrel (WTI $36.33, Brent $38.63).

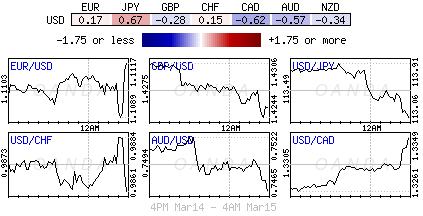

The fall in crude prices is pulling the CAD (C$1.3384) and other commodity-sensitive currencies, such as the AUD (A$0.7464) lower against the safe haven greenback. Even Emerging Market currencies are feeling the pain on a downturn in commodities prices. The USD has gained +1.1% against the Russian ruble (RUB$70.7020) and +1% against the South African rand (ZAR$ 15.6859).

5. Brexit stifles sterling

The Brexit polls continue to be a headwind for the pound. According to the latest EU referendum poll from ORB/Telegraph, +49% would be in favor of leaving EU and +47% would be in favor of staying.

GBP has weakened by -0.9% against the USD (£1.4165) and EUR pairs (€0.7823) as we head to the New York open.

The BoE will meet on March 17. The Governor has kept the bank’s key rate on hold at +0.5% for almost seven years, and the market yield curve shows a +25 basis-point rise is not priced in for another three years.