Market Brief

FX markets started off the week quietly as traders get ready for a busy one. The Federal Reserve will take centre stage on Wednesday as Chairwoman Yellen will deliver the Fed’s latest assessment of the US economy. At this stage, the market has already priced out a rate in March but will monitor closely Janet Yellen’s speech to try to predict the central bank’s next move in this volatile environment. One thing is sure however, Janet Yellen will have to choose her words wisely as traders will be ready to press the sell button at the first negative sign. In the wake of last week’s ECB meeting, EUR/USD stabilised around the 1.1150 level but was unable to break the 1.1165-1.12 resistance area to the upside (Fibonacci 61.8% on Feb.-Mar. debasement and psychological level). A dovish statement from Janet Yellen could push the pair further north, the next resistance can be found at 1.1376 (high from February 11th).

Tomorrow's, monetary policy meeting of the Bank of Japan will attract the market’s attention. This is the first BoJ meeting since Governor Kuroda cut rates in negative territory in January. We do not expect any change but we anticipate the BoJ to reiterate that Japan’s economy is back on track and that the 2% inflation target will be reached by mid-2017. We do not expect another rate cut as the central bank still needs some time to assess the effect of negative rates on the Japanese economy. USD/JPY consolidated between 112.16 and 114.87 ahead of the central banks’ meeting. The pair should continue to trade range bound ahead of tomorrow’s meeting.

The BoE and SNB will also be in focus this week. It will be interesting to see how Governor Carney and Chairman Jordan react to the ECB massive stimulus. As stated last week, we expect the SNB to maintain a wait-and-see attitude, preferring to closely monitor the market and stand ready to act. EUR/CHF held ground above 1.0950 as SNB’s intervention fears remain. In the UK, the BoE is also expected to remain sidelined as rates are not expected to take the elevator before late 2016, at the earliest. In Asia, GBP/USD was treading water at around 1.4380 but started to move lower at the European opening. However, in our opinion the bias remains on the upside as the pair is still seen as undervalued.

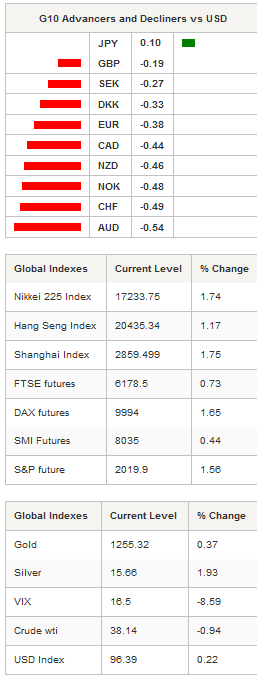

On the equity market, Asian equities rallied overnight amid positive lead from Wall Street. In mainland China, the Shenzhen and Shanghai Composites were up 1.75% and 3.56% respectively. In Japan, the Nikkei rose 1.74%, while in Hong Kong the Hang Seng surged 1.17%. In Europe, futures are pointing to a higher open of roughly 1%.

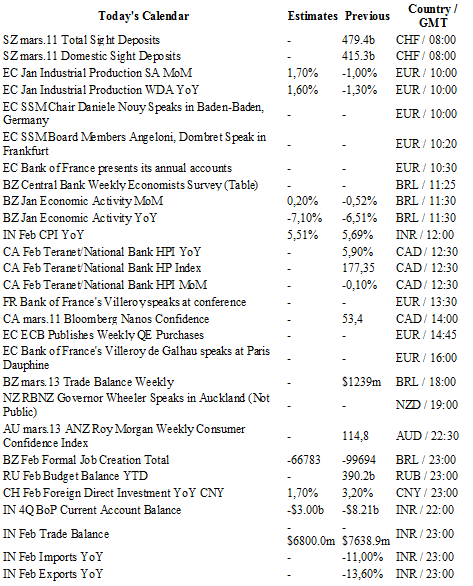

Today traders will be watching total sight deposits from Switzerland; industrial production from the Eurozone; CPI from India; weekly trade balance from Brazil.

Currency Tech

EUR/USD

R 2: 1.1495

R 1: 1.1376

CURRENT: 1.1120

S 1: 1.0810

S 2: 1.0711

GBP/USD

R 2: 1.4591

R 1: 1.4437

CURRENT: 1.4358

S 1: 1.4108

S 2: 1.3836

USD/JPY

R 2: 117.53

R 1: 114.91

CURRENT: 113.74

S 1: 110.99

S 2: 105.23

USD/CHF

R 2: 1.0257

R 1: 1.0093

CURRENT: 0.9870

S 1: 0.9661

S 2: 0.9476