Market Brief

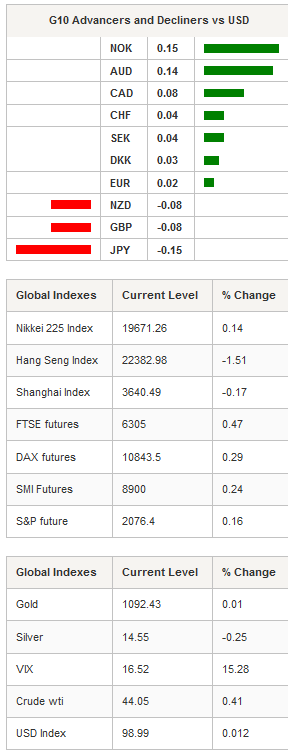

FX trading was subdued in the Asian session due to a lack of fresh news. Perhaps the lonme driver was China’s weaker-than-expected inflation which placed slight pressure on risk-taking. Asia regional indices were soft following a sharp 1% fall in the S&P 500 overnight as worries over the Feds hike increase. In a speech, Fed President Rosengren indicated that due to firm US data the Fed was prepared to increase interest rates. The Nikkei 225 and Shanghai composites were marginally higher at 0.15% and 0.14% respectfully. Yet, the rest of Asian was broadly in the red. EUR/USD traded in a tight range between 1.0766 and 1.0737 while USD/JPY bullish momentum carried the pair up to 123.33 from 123.05 (although demand was thin). The PBoC raised the fix by 24pip to 6.3602 sending the USD/CNY to 6.39. The US 10-Year yields fell slightly to 2.3401% putting USD on a back footing against most of EM Asia. In Australia, NAB business confidence fell to 2 in October while October’s business conditions remained unchanged at 9. Overall, trading was directionless and meaningless. With a significant lack of first tier data and drivers we anticipate further range bound trading in FX.

On the data front, China’s headline CPI inflation eased to 1.3 % y/y in October down from 1.6% in September, against consensus of 1.5%. The decline was largely due to a moderation in food prices. PPI deflation was flat at -5.9% y/y in October making the print the most recent in nearly 4 years of contraction. The inability for the PBoC and government measures to stimulate inflationary pressures indicates that we should see additional easing measures. We anticipated two 25bp cut in the benchmark rate and three cuts in the RRR by end of 1Q 2016. As for the yuan we are in the extreme minor in predicting appreciation in 2016. We base your bullish yuan forecast on expectations that inclusion into the IMF SDR will warrant the PBoC to create the impression of reducing the yuan’s undervaluation. Second, belief that current easing measures will support growth mid-2106 which is underestimated by investors currently. Elsewhere in Asia, Taiwan exports fell 11% in October indicating that regional trade continues to stagnate.

Weakness in Euro area rates and equities continue on mounting worries over Greece, Portugal and Spain. Yesterday, dispute between Athens and creditors will delay the disbursement of Greece next €2.15bn aid tranche. In Spain, Catalan separatist lawmakers approved a resolution that build a foundations for separation from the rest of Spain. While in Portugal, Socialist Party with the Communist Party and the radical Left Bloc left-wing parties approved a strategy to expel PM Coelho’s administration. Portugal’s yield curves continue to steepen with 10-year yields rising 15bps. We suspect that political instability and its possibility to derails Europe’s fragile growth is likely to force the ECB into action. Overall all we expected the ECB to extend the asset purchased program and cut depo rate 10bpt to -0.30%.

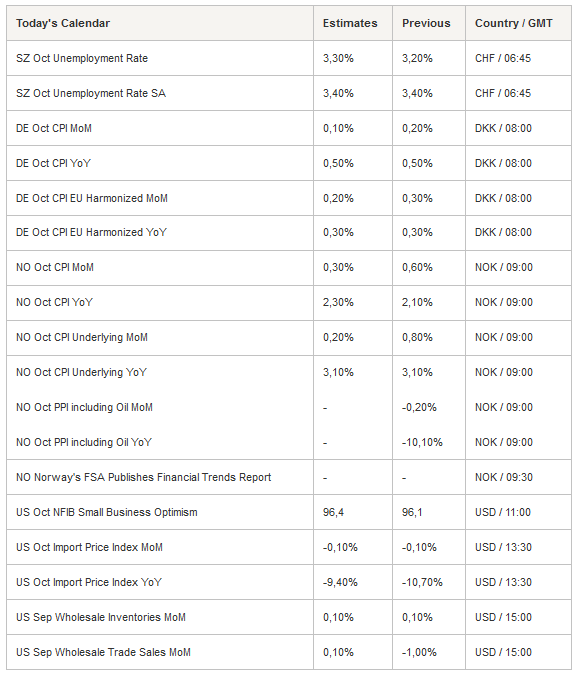

Today traders should expect French and Italian industrial production, minutes from the October Riksbank, Norwegian CPI inflation, Swiss unemployment rate, US wholesale inventories and hear from Chicago Fed President Evans.

Currency Tech

EUR/USD

R 2: 1.1387

R 1: 1.1079

CURRENT: 1.0883

S 1: 1.0809

S 2: 1.0458

GBP/USD

R 2: 1.5659

R 1: 1.5508

CURRENT: 1.5175

S 1: 1.5108

S 2: 1.5089

USD/JPY

R 2: 135.15

R 1: 125.86

CURRENT: 121.86

S 1: 120.07

S 2: 118.07

USD/CHF

R 2: 1.0240

R 1: 1.0129

CURRENT: 0.9948

S 1: 0.9739

S 2: 0.9476