- In late night tweets, President Trump took on Bitcoin saying he’s “not a fan” and its value is “based on thin air”. Getting to the specifics, Facebook’s Libra “will have little standing or dependability”, adding they’ll need to seek a new Banking Charter and be subject to “all banking regulation”. Bitcoin initially rose on the tweet but pared gains.

- U.S. have said they will not blacklist Iran’s Foreign Minister ‘for now’.

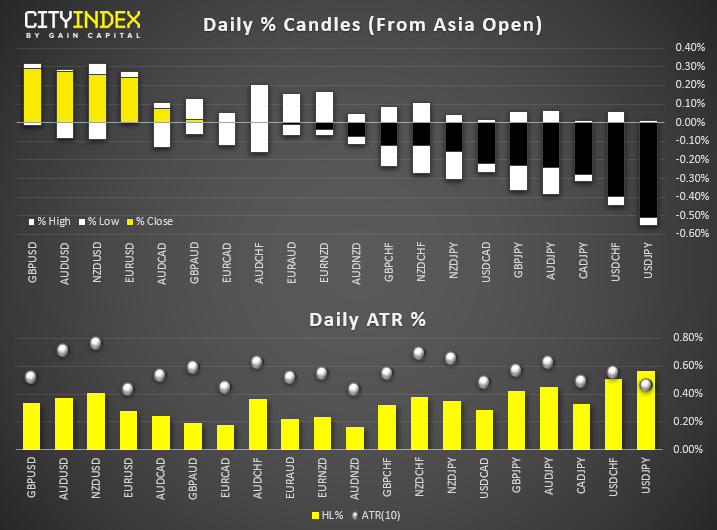

- CHF and AUD are currently the strongest majors, NZD and USD are the weakest.

- Singapore’s GDP more than missed expectations by crashing -3.4% YoY versus 0.1% expected, fanning fears that Singapore could be headed for a technical recession.

- A mixed picture among equities with the CS 300 leading Chinese indices higher, although the ASX 200 and Topix are slightly down for the session.

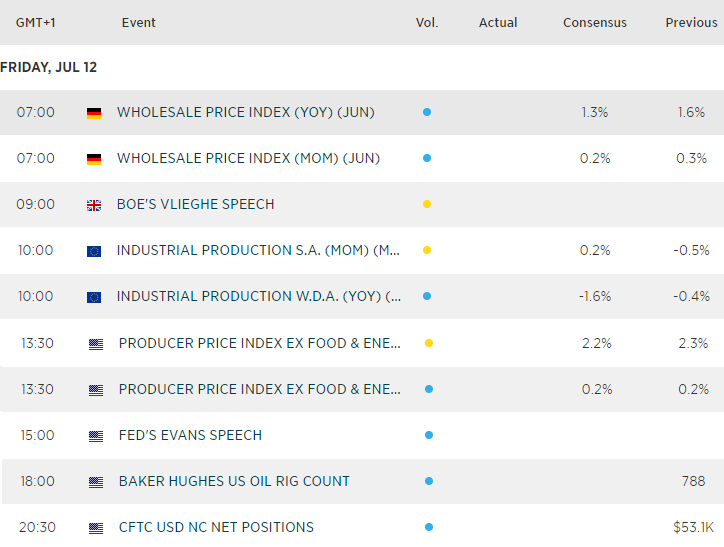

Up Next:

- Chinese trade figures are up within a couple of hours (although times do vary) which could shed further light on the impact of the U.S.-Sino trade war. Exports are expected to fall due to lower global demand. Imports (and proxy for global exports) put AUD and NZD on the radar, as they’re key trader partners with China.

- European industrial production is expected to drop to -1.6% yoy, which is quite a stretch from -0.4% prior. Perhaps this leaves some wriggle room for an upside surprise (ie not bad as feared) but, given soft data from Germany of late, it could weigh on Euro if it exceeds bearish expectations

- U.S. producer prices generally take second place to inflation data (which slightly beat expectations yesterday) but expectations are for them to slightly soften, which is plausible given they appear to have topped in December.