- Chinese GDP hit a 27-year low of 6.2% as forecast. Weak growth aside, it was a decent set of economic data. Retail sales hit 9.8% YoY, versus 8.3% expected. Industrial output rose 6.3% verses 5% expected and urban investment rose 5.8% versus 5.6% expected.

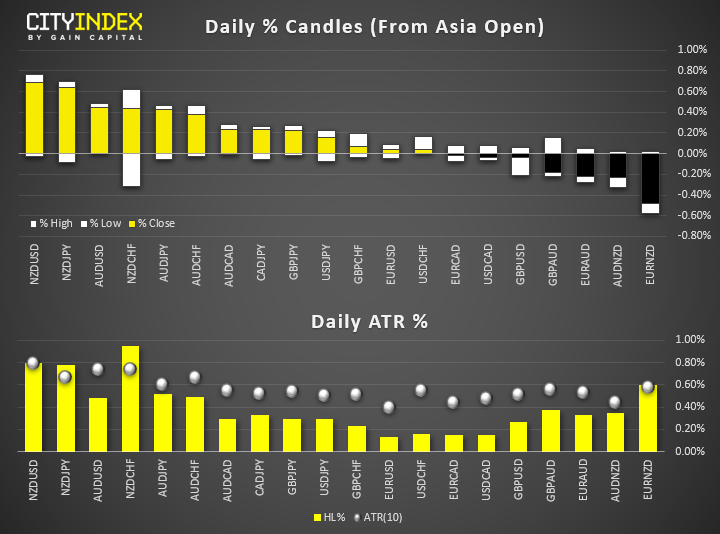

- AUD hit a 6-day high following the data and is the second strongest major of the session. The Swiss franc is currently the strongest and the British pound is the weakest.

- It was a mixed picture for equities, with Chinese shares leading the pack, whilst the ASX 200, Topix and STI trading lower.

- Huawei are reported to be planning extensive U.S. layoffs.

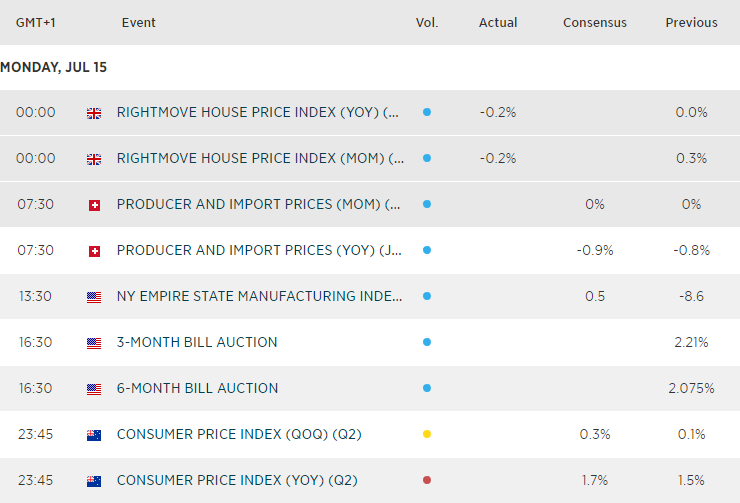

Up next:

- It’s a quiet day for economic data throughout the European and U.S. session, although in the early hours for UK, New Zealand inflation data will be of interest. Since cutting to historically low rates, RBNZ have left the door open to ease again in August, and inflation and employment data will be key data points for whether they’ll ease further or hold in August.