The RBNZ has caught my attention this morning as it may have signalled a structural change to one of our top down thematics over the past 18 months – central bank differentials.

It has given us a very solid base for our trade themes for equities and currencies. These have included:

- Long European equities – specifically DAX and MIB

- Long Japanese equities

- Short EUR against most G10 currencies

- Long USD/JPY (a trade we closed in June)

- Long USD and long GBP against most pairs barring cable

Why the RBNZ is catching my attention is as follows:

This morning, Governor Wheeler cut the Kiwi benchmark by 25 basis points to 2.5% as expected, which saw NZD/USD shoot lower on initial reactions, and then immediately reverse on the wording of the statement that signals a change in rate outlook.

The final statement has been completely reworded and the key theme is that inflation is expected to rise in the coming period. It maintained an easing basis, however this suggests it’s in the same camp as the RBA to leave rates on hold – the market reaction suggests this is the correct conclusion.

The next conclusion to be drawn is that central bank easing globally is at an end – this is a major change to thematics if this conclusion is true but one that should be drawn.

- The ECB has likely finished adding stimulus after the December meeting showed the chamber is bare

- The BoJ has held firm over the past six months on calls for more stimulus and an increasing retching up of the QQE program - it to is out of the stimulus camp

- The RBA is holding an easing basis but the board has ‘chilled’ on further cuts as it sees no beneficial impact to cutting rates further

- Now the RBNZ is holding an easing basis but clearly in a holding formation as inflation returns

- Finally, the Fed is on the verge of lift off as employment and growth show sustained levels of growth

Are we now at that point where central banks have steered the global economy though the post-GFC era? Have we truly come to the other side of this financial period? That is what they are saying – inflation is to return, economic growth (while low by historical standards) is being maintained, employment is showing signs of upside, and confidence has been restored.

That is the theoretical conclusion from what is being seen. That means we will now put our top-down theme under review in 2016 as currencies and equities will likely have to fend for themselves on economic fundamentals going forward rather than stimulus levels.

Ahead of the Australian Open

Equities market continued their downward trade path overnight. However, the energy sector in the US surged as well as the material firms – barging buying and short covering being the most likely reasons.

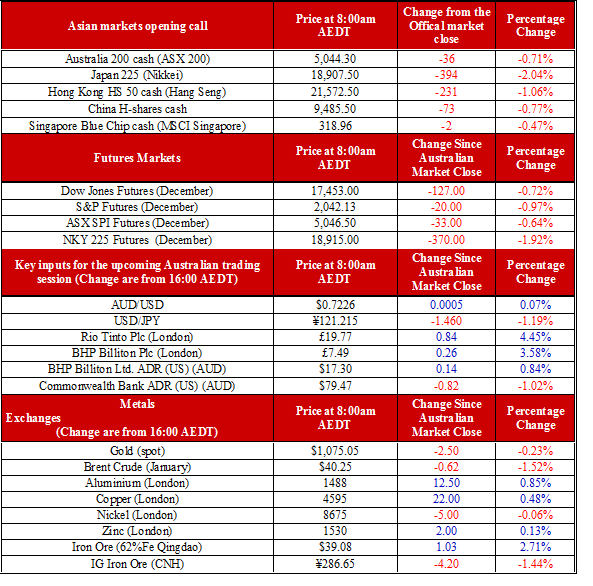

We are calling the S&P/ASX 200 down 36 points to 5044 but there were big reversals in London mining firms overnight. Rio Tinto Ltd (AX:RIO) and BHP also surged in New York, suggesting some respite from the sustained selling today for the ASX listings. Iron ore also logged its first upside print in eight days but remains below US$40 a tonne.

Australian jobs numbers come out today; it remains a volatile piece of data and the likely mass employment change remains a statistical blip for the ABS. Having seen 58,600 jobs added in October (the equivalent of the nonfarm payrolls adding 785,000 job in a calendar month) and the unemployment rate falling to 5.9%, estimates are for 10,000 jobs to be lost in November and the unemployment rate to tick back up to 6%. Confidence at the business and consumer level has been solid over the past six weeks, suggesting things should hold firm but I can see a rebalance of the data which may push the AUD around in intraday trade today.