T2108 Status: 18.1% (as high as 19.4%)

T2107 Status: 15.3%

VIX Status: 22.4

General (Short-term) Trading Call: bullish

Active T2108 periods: Day #15 under 20%, Day #18 under 30%, Day #34 under 40%, Day #38 below 50%, Day #53 under 60%, Day #394 under 70%

Commentary

“Full bull” is a term I used to apply to stocks that I targeted for aggressively bullish trading. I think I can also apply it to Facebook (O:FB) which happens to have a very relevant ticker symbol.

Facebook (FB) soars 15.5% to close just below a new all-time high.

FB is now a poster child for “full bull” because it easily survived its test of support at its 200-day moving average (DMA) and followed that up with a stellar post-earnings performance. A fresh all-time high would have earned the triple crown. With 107.4M shares trading hands – a whopping 4x the current 3-month average – buyers have returned in force, and I expect all this momentum to lead to more all-time highs in the near future. This will be a stock to aggressively buy on the dips for swing trades.

Ironically, FB was my last standing short (hedge) for this oversold period. I used the recent selling to eliminate all the other shorts and hedges. I made a very bad execution error by failing to grab some call options to protect against just this kind of move. However, recognizing the bullishness of this move, I immediately loaded up on call options soon after the post-earnings open. To my surprise, they all sold at their price targets before the close of trading (they were $109 and $110 calls expiring next Friday).

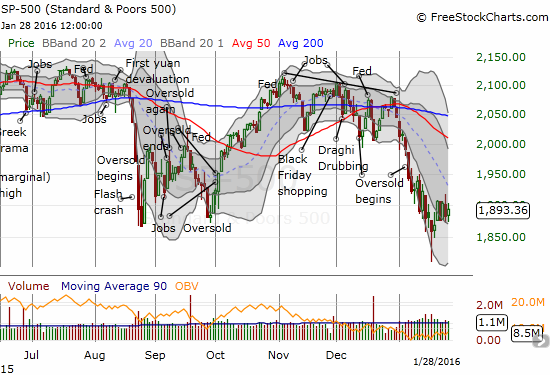

While the sparks were flying in FB trading, the S&P 500 spent the day churning in a very tight range that aligns with the tight range now in place for a fifth straight trading day.

The S&P 500 (N:SPY) is standing still after a very hectic bottom last week.

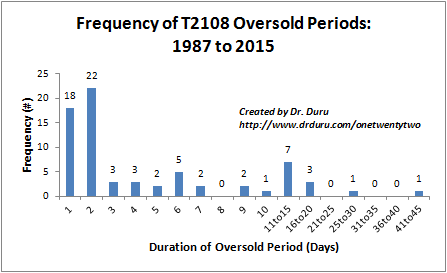

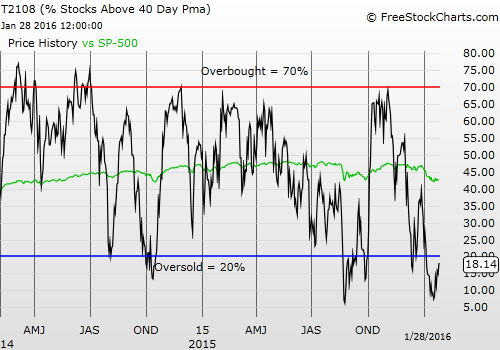

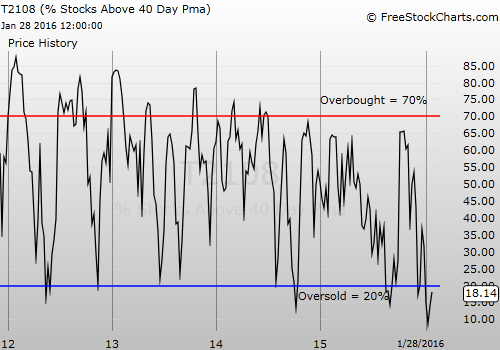

Only T2108, the percentage of stocks trading above their respective 40-day moving averages (DMAs), reveals that action is simmering under the surface. The first 30 minutes of the trading day, T2108 rocketed right to the edge of the oversold threshold (20%). It quickly collapsed from there into the gap created by the open before pulling off a steady recovery into the close. The contours of this move matched the trading in the S&P 500. It was a quick tease peering over the edge of the oversold period. This oversold period has lasted 15 days. This duration puts this oversold period in the “historic” category. Since 1987, only FIVE oversold periods have lasted longer.

This frequency (distribution) chart for oversold duration shows that over half of oversold periods last just one or two days.

This is a critical moment for bulls and buyers. My projection for a 25-day oversold period based on the number of single digit T2108 oversold days implies that the market will at best completely stall out for the next two weeks. I am still assuming that even if the oversold period comes to an end well before the 25-day projection, another oversold period will quickly follow.

So, while I welled up with anticipation after getting to peer over the edge of this extended and historic oversold period, I can easily identify all the technical damage that remains and in some cases continues to worsen. For example, two recent trades in Hortonworks Inc (O:HDP) and Atlassian Corp Plc (O:TEAM) which looked good for one brilliant day have already succumbed to fresh all-time lows. I am holding on only because of my rule against selling in an oversold period.

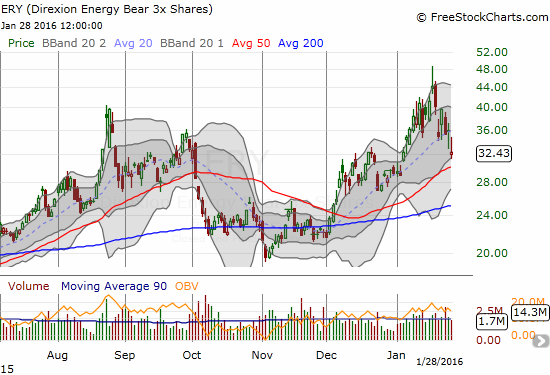

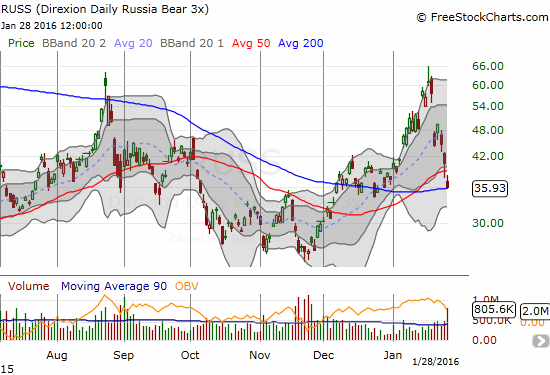

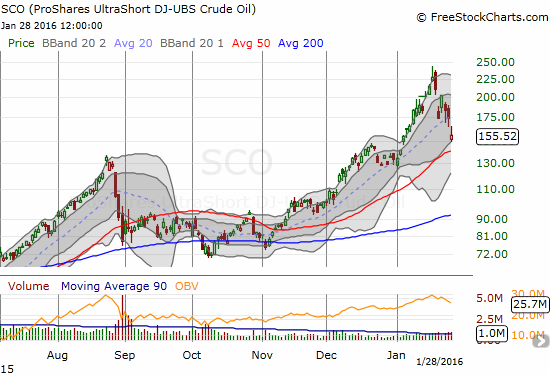

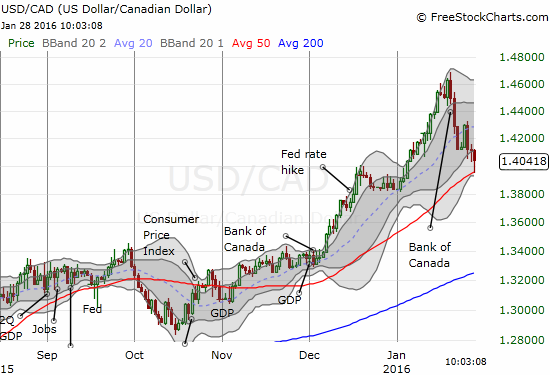

If the tides turn negative again from here, I will first look to the oil-related trades. My call for a bottom in United States Oil (N:USO) is working out very well so far but some kind of pullback could be due. USO is already up 18% from last week’s intraday all-time low. The bearish oil-related plays are all coming to important tests of uptrending support at 50 and 200DMAs: ProShares UltraShort Bloomberg Crude Oil (N:SCO), Direxion Daily Energy Bear 3X Shares (N:ERY), Direxion Daily Russia Bear 3X Shares (N:RUSS). Watching these trendlines helped me make a timely call to go long ERY in early January. Even the Canadian dollar (N:FXC) is testing similar support in USD/CAD. I will be ever more focused on these trades for short-term moves in (early) February.

ProShares UltraShort Bloomberg Crude Oil (SCO) is now down 36% from its intraday all-time high as the 50DMA presents potential support. The bulk of January’s breakout has now reversed.

Direxion Daily Energy Bear 3X ETF (ERY) has also reversed most of January’s gain with 50DMA support beckoning directly below.

Direxion Daily Russia Bear 3X ETF (RUSS) just pushed by its 50DMA support but is neatly sitting on support at its 200DMA

The Canadian dollar is testing very critical support at the 50DMA for USD/CAD. The first neat bounce has already occurred. I am watching for follow-through as my first preference is to trade with trend.

Daily T2108 vs the S&P 500

Black line: T2108 (measured on the right); Green line: S&P 500 (for comparative purposes)

Red line: T2108 Overbought (70%); Blue line: T2108 Oversold (20%)

Weekly T2108

The charts above are the my LATEST updates independent of the date of this given T2108 post.

Be careful out there!

Full disclosure: long SSO call options, long SSO shares, long TEAM, long HDP, short FB