Traders took stock on Thursday's sharp falls with some modest buying. Collectively, Thursday-Friday's paired action might be viewed as a bullish harami across indices, and therefore a swing low. But, I would like to see markets oversold for this to be a proper swing low and this is not the case for markets now.

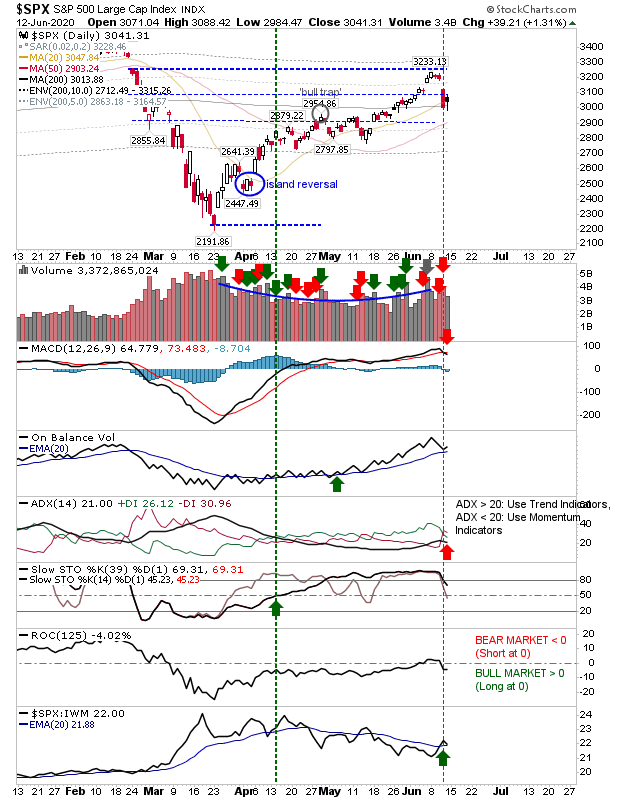

The S&P fell back to its 20-day MA but is caught between support and resistance. Technicals are a mix of bullish and bearish indicators with 'sell' triggers in the MACD and trend measure, ADX (-DI > +DI). However, bullish is the accumulation trend in On-Balance-Volume and the relative outperformance against the Russell 2000 (although this is bearish for the broader market, at least it's bullish for safety conscious Blue Chip stock buyers).

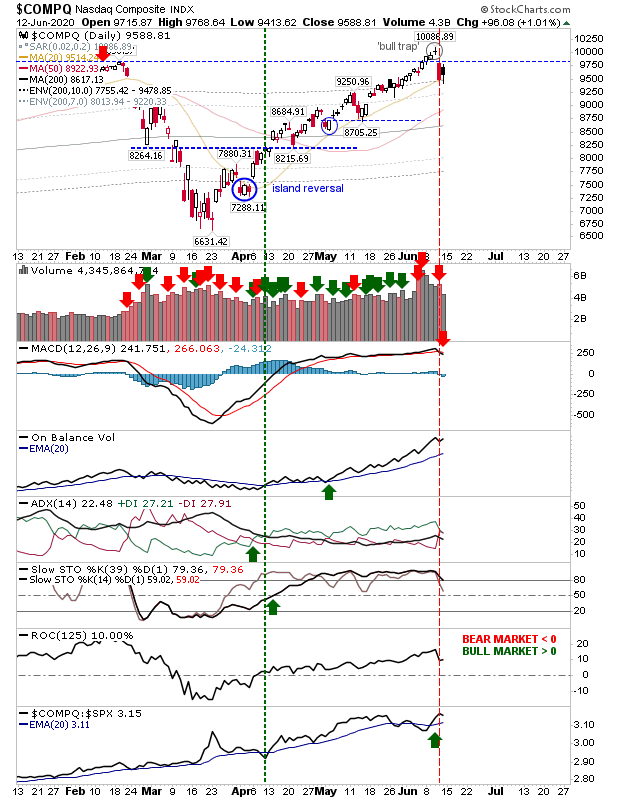

The NASDAQ has gone the way of bears with a 'bull trap' on what was a weak breakout. I don't like breakouts which feature neutral candlesticks like doji and it's worse when the doji is the actual swing high. There is a bearish 'sell' trigger in the MACD but other technicals are bullish, so the 'bull trap' is not a slam dunk. Also, Friday's buying dug in at its 20-day MA.

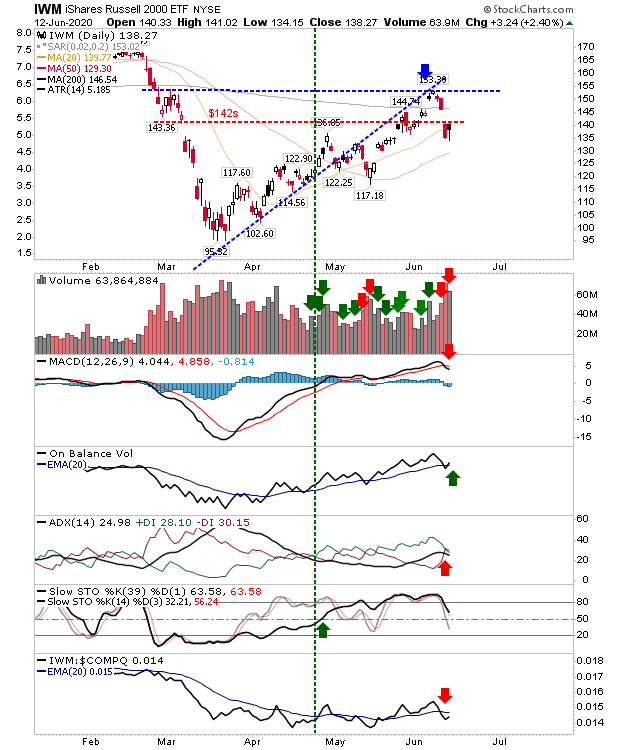

Finally, Small Caps (via iShares Russell 2000 ETF (NYSE:IWM)) took the hardest Wednesday, which carried over into Trash Thursday, before finding some love at its 20-day on Friday. Technicals are a mix of bullish and bearish indicators with the 'sell' trigger in the MACD and ADX and relative performance (vs the NASDAQ), against a weak 'buy' signal in on-balance-volume. It does look like there is more profit taking to come, but as Friday was enough to see a bullish harami (as mentioned earlier) with Friday also coming in as a 'bullish' hammer, we needn't go too hard on the index. Aggressive traders could go in here with a stop below Friday's low.

Bulls could look to the Thursday-Friday pairing as a swing low potential buying opportunity—similar how two island reversals played out in early April and mid-May (i.e. a gap down, as happened last Thursday—followed by a gap higher), but we need to see a gap higher, either Monday or Tuesday. However, if markets do push higher and run into sellers at June highs, then I can see retail traders losing their bottle very quickly.