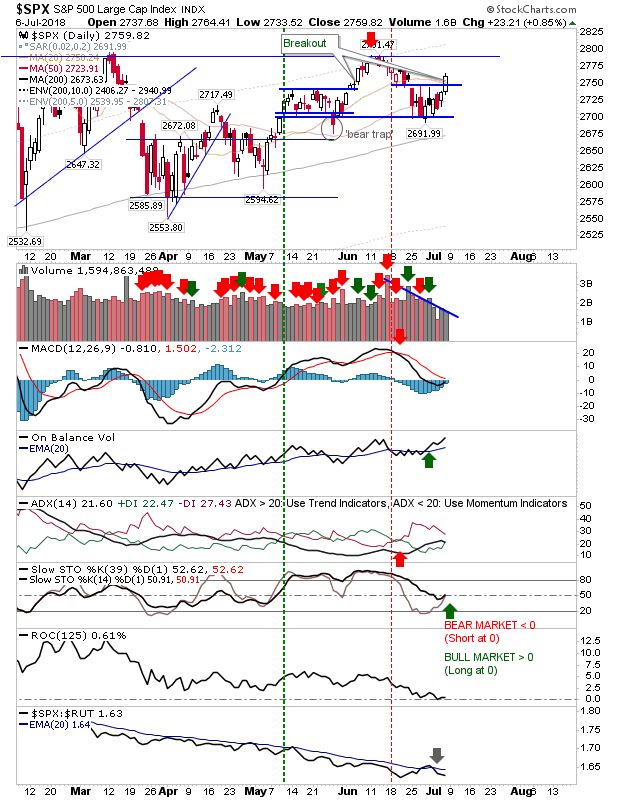

The past couple of weeks have been a period of give-and-take but this past Friday broke the mold by marking a second day of gains for many of the indices (four for the Russell 2000). More importantly, it took markets above resistance and into a position where they can mount a challenge of June highs.

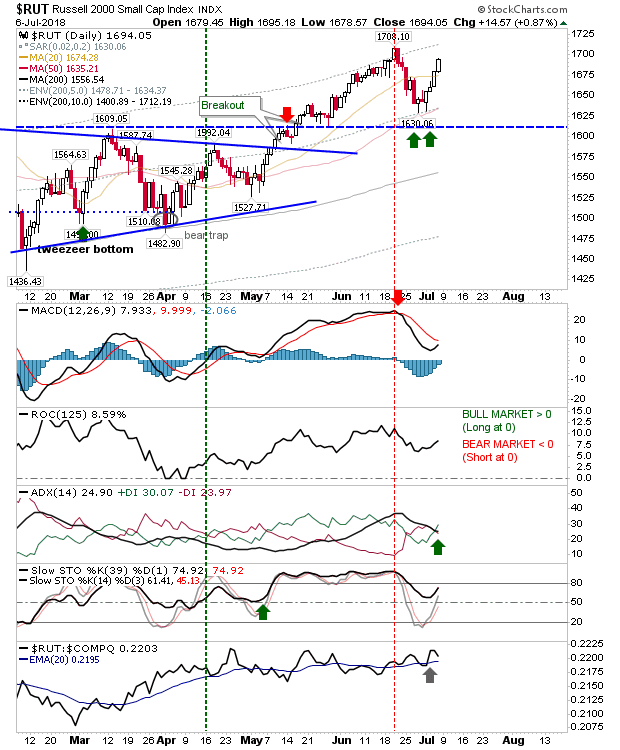

The Russell 2000 had the best of the week's action. After a successful test of the 200-day MA the index went on a four-day run of gains. Small Caps have been exhibiting quiet strength. If it can make a break above 1,710 it will mark a new all-time high for the index and return its role as market leader.

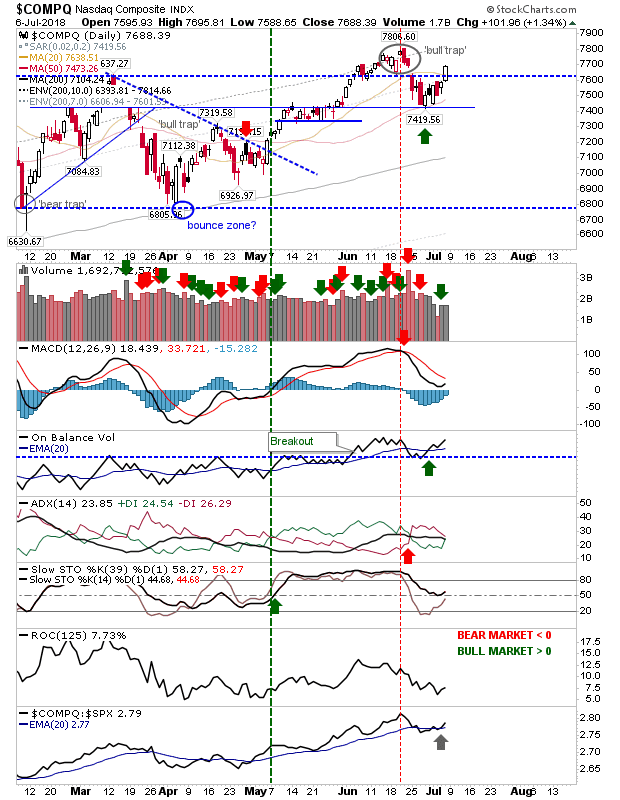

The NASDAQ pushed into its 'bull trap' with 7,806 the last barrier to new all-time highs.

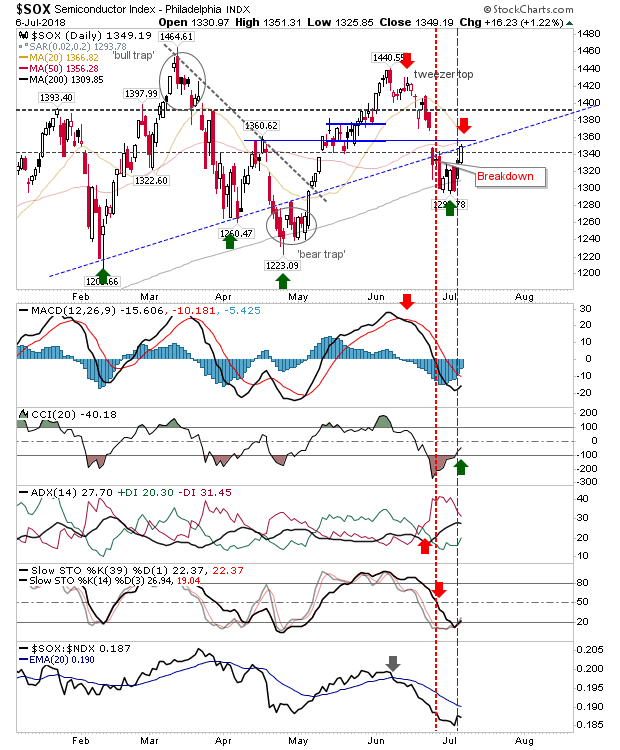

What may be more problematic is the Semiconductor Index. It enjoyed the strong gains of other indices but now finds itself up against former rising support now resistance which is also a convergence with the 50-day MA. Shorts may find play here but will need to be on their toes if the market rallies after the first half-hour of trading as this would suggest underlying strength; the June breakdown gap will act like a vacuum and 'suck' prices higher.

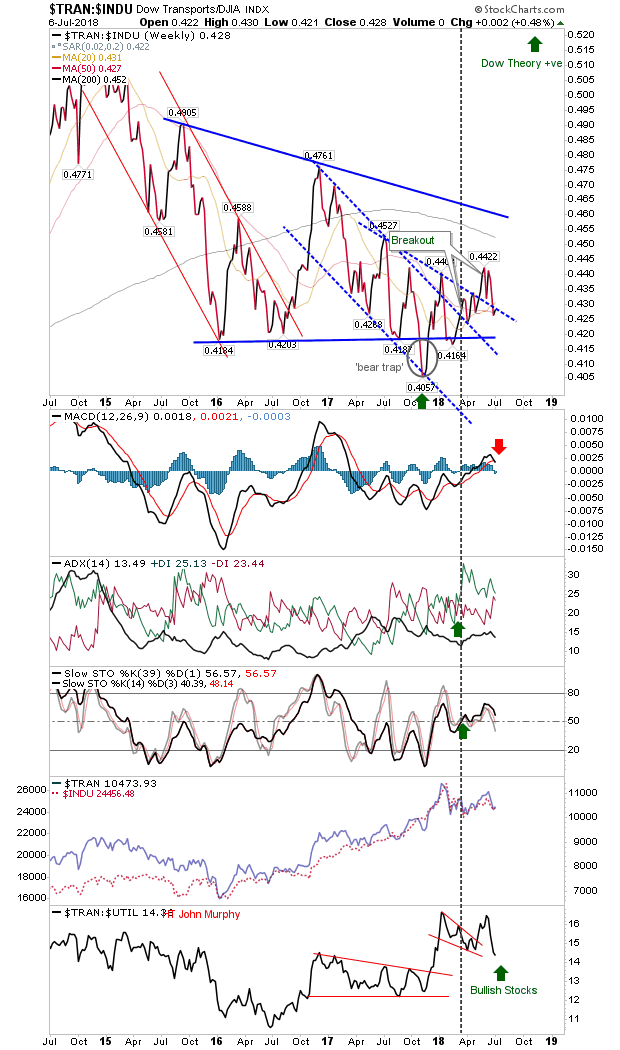

There is not a whole lot going on with the longer-term charts. The one I'm watching is the relationship between the Dow Jones and the Dow Transports Index. Transports are an important economic indicator and despite gains, have underperformed against the Dow Jones Index; an underperformance which goes back to 2015. The relationship has improved but stronger gains are needed if the March-June rallies are not some extended flash in the pan.

For Monday, it will be important to see if the mini-breakouts hang on and survive the next wave of selling—likely to occur early Monday. If they can retain the breakouts by Monday's close it will begin to attract doubters and build the confidence of existing long holders.