There was no big change in the technical picture of the indies last week, but all markets managed to make a positive close on the week. Indices started Friday with gaps higher and finished the day as much as they started.

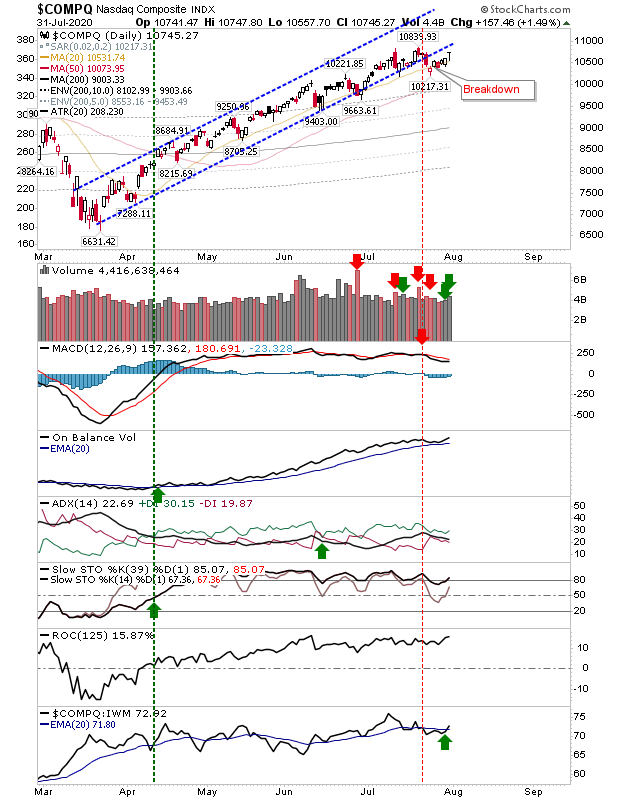

The NASDAQ's's gain wasn't enough to take out the recent swing high but it did register as an accumulation day and it continues to map a relative outperformance to its peers.

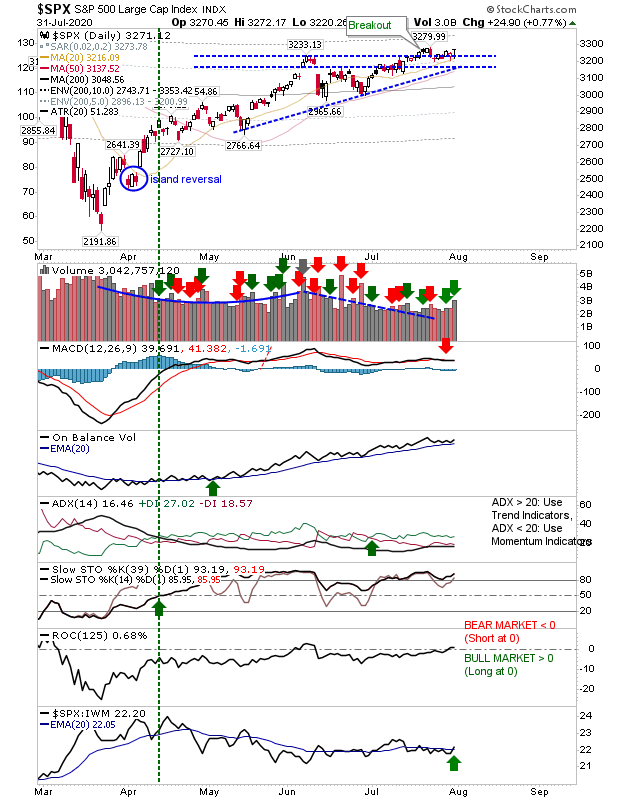

The S&P is also close to marking a new all-time high as it too finished with a doji similar to the NASDAQ on higher volume accumulation. It too is outperforming the Russell 2000.

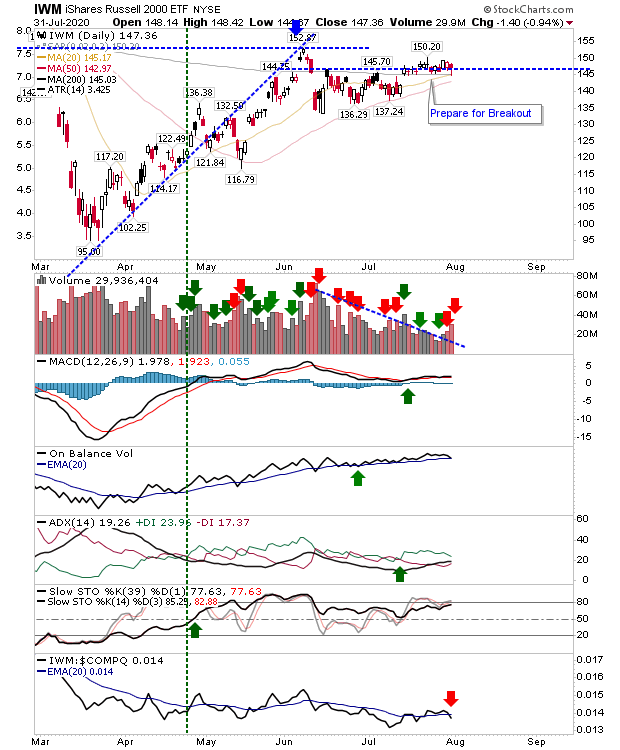

The Russell 2000 (via iShares Russell 2000 ETF (NYSE:IWM)) did not close with a doji but instead finished with a small 'hammer' on converged 20-day, 50-day and 200-day MAs.

Unfortunately, while indices had a positive close to the week, none were able to push any upward momentum in order to take out recent swing highs. This is what's needed to see rallies continue—until then, markets are in stasis.