Freight Volume Peaked Well Before The Financial Crisis

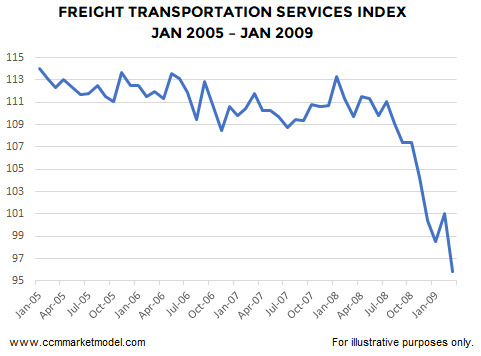

The Freight Transportation Services Index, calculated by the United States Department of Transportation, peaked in January 2005 or more than two years before the S&P 500's major top in October 2007. After the October 2007 peak in stocks, the Freight Transportation Services Index dropped sharply as shown in the chart below.

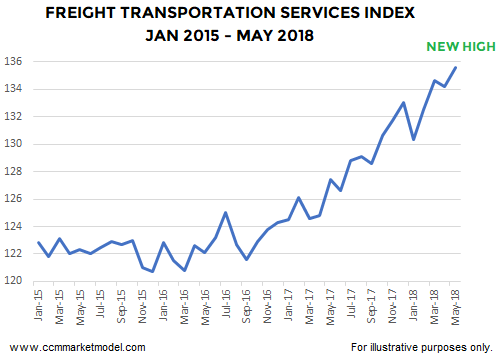

If (a) the economy was on the ropes in 2018 and (b) the January 2018 peak in the S&P 500 was similar to the October 2007 peak, we would expect to see observable weakness in the Freight Transportation Services Index. Instead of weakness, the Freight Transportation Services Index just posted a new high. Compare and contrast the chart above and the chart below.

Freight Has A Good Track Record

According to MarketWatch's Mark Hulbert, freight volume is worth watching:

Its status as a leading economic indicator rests on a strong statistical foundation... According to research conducted by the Bureau of Transportation Statistics, downward trend changes in the Freight Transportation Services Index have, at least over the past three decades, led economic slowdowns by an average of four to five months. That may not seem like a long lead time, but keep in mind that it’s rare to find indexes that are reliable coincident indicators, much less leading one.

What About The Lagging DOW?

This week's stock market video addresses the following questions: