Helping to mitigate corrections have been the steady uptrends in the forward earnings of the S&P 500/400/600 to new record highs. Forward earnings did it again last week. What is different this time is that estimates for 2015 have stopped falling. Over the past three years, annual estimates mostly fell, yet forward earnings moved higher because the coming years’ estimates remained higher than the current years’ estimates. In calculating forward earnings, the former get more weight and the latter get less weight as time passes.

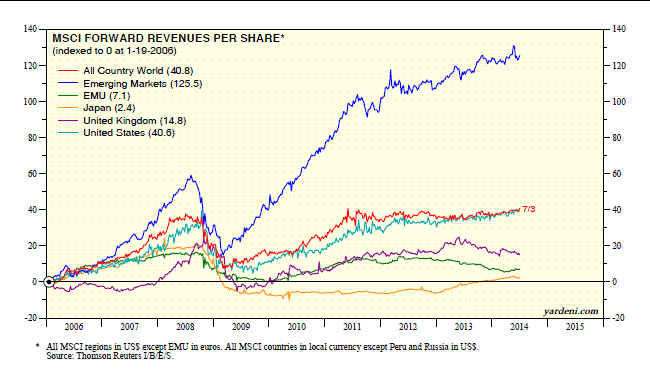

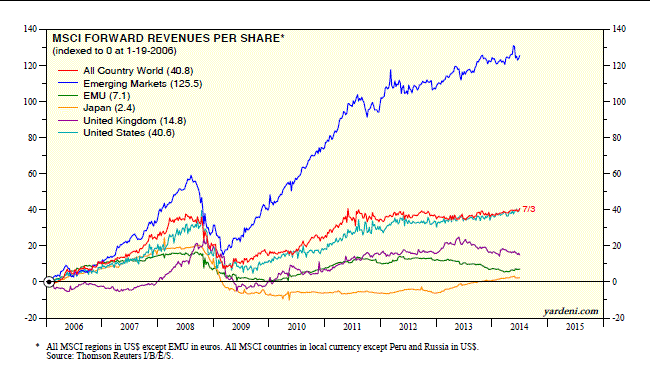

Another positive is that S&P 500 forward revenues remains on an upward trend and rose to a new high during the week of July 3. Estimates for 2014 and 2015 have been rising recently and are expected to grow 3.4% and 4.4%, respectively. With the exception of Emerging Markets, the US stands out as having one of the best-looking forward revenues profiles among the various major global MSCI composites. It has the best profile for forward earnings. The US forward profit margin is at a record high, yet still trending higher.

Today's Morning Briefing: Corrections & Complacency. (1) Panic attacks followed by relief rallies. (2) Shorter and shallower event-driven corrections. (3) From anxiety fatigue to complacency. (4) Ahead of schedule. (5) Another new high for S&P 500 forward revenues and earnings. (6) Analysts predicting solid Q2 earnings growth for most of the sectors. (7) US stands out, which is why US stocks aren’t cheap. (8) Sector valuations around the world. (9) Yellen has been worrying about income inequality since 2006. (10) Help wanted.