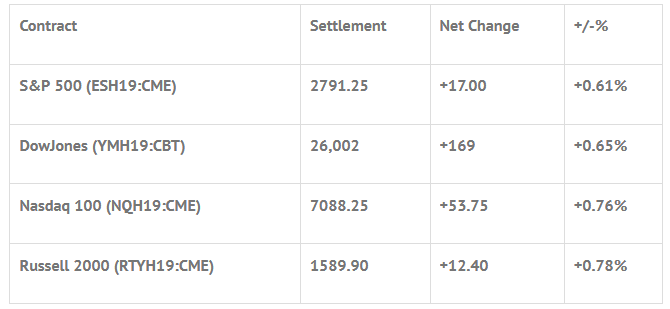

Index Futures Net Changes and Settlements:

Foreign Markets, Fair Value and Volume:

- In Asia 11 out of 11 markets closed higher: Shanghai Comp +5.60%, Hang Seng +0.50%, Nikkei +0.48%

- In Europe 12 out of 13 markets are trading higher: CAC +0.26%, DAX +0.31%, FTSE -0.20%

- Fair Value: S&P -0.05, NASDAQ +3.95, Dow -7.25

- Total Volume: 1.18mil ESH & 214 SPH traded in the pit

Today’s Economic Calendar:

Today’s economic calendar includes Chicago Fed National Activity Index 8:30 AM ET, Wholesale Trade 10:00 AM ET, and the Dallas Fed Mfg Survey 10:30 AM ET.

S&P 500 Futures: Up, Up And Away

Chart courtesy of Scott Redler @RedDogT3 – $spx futures up 12. Each week the active bulls protect the 8/21day to keep the trend intact. Now see if we hold 2794 and build. Or Not! Lots of great stock set ups along the way.

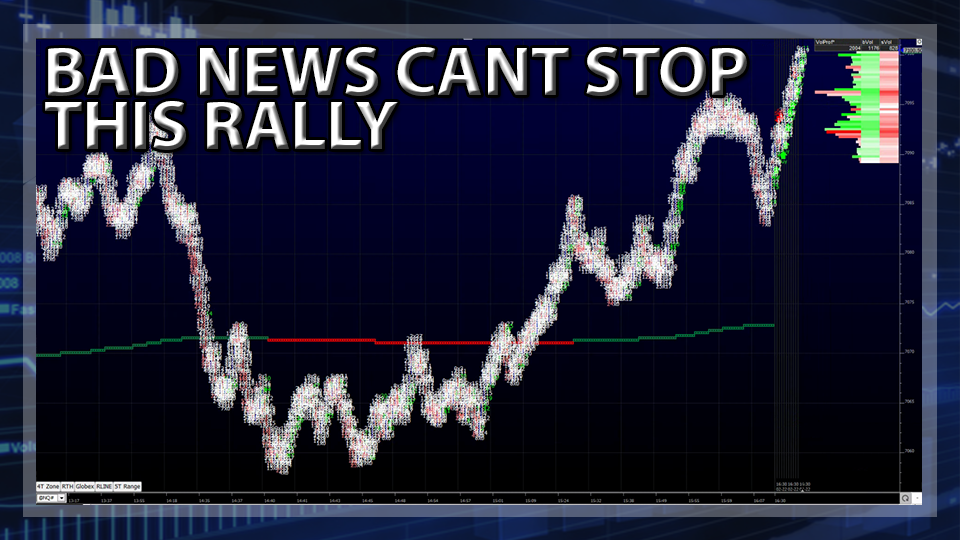

Whether it’s good or bad news coming across the wire, the markets are going up. I know there are a lot of “what ifs” out there, but after a 20% drop, and a subsequent 21% rally, the S&P 500 futures (ESH19:CME) continue to charge higher.

This week, while the President is in Vietnam negotiating with North Korea over its nuclear missile program, Trump’s former lawyer is set to testify publicly before the House Oversight Committee. Throw in the China tariff headlines, along with 25 separate economic releases, five federal reserve bank presidents speaking, and twelve t-bill or t-bond auctions or announcements, it could end up a very volatile week.

During Thursday nights Globex session, the S&P 500 futures (ESH19:CME) printed a high of 2787.75, a low of 2770.50, and opened Friday’s regular trading hours at 2781.75. The morning low print was 2778.75 right after the bell, and the morning high came in at 2794.50. The S&P’s traded 2792.25 on the 10:30 European close, and 2790.75 going into the noon hour.

The early afternoon saw a low of 2781.25, a high of 2792.25 and a print of 2782.75 going into the final hour of the day. The futures rallied into the close, and went on to trade 2798.00 on the 2:45 cash imbalance reveal, then printed 2792.00 on the 3:00 cash close, and settled the day at 2791.25 on the 3:15 futures close, up +17.00 handles, or +0.61%.

In the end, with the exception of some small pullbacks, the overall tone the market was firm. In terms of the days overall trade, total volume was on the low side, with 1.2 million futures contracts traded.

Disclaimer: Trading Futures, Options on Futures, and retail off-exchange foreign currency transactions involves substantial risk of loss and is not suitable for all investors. You should carefully consider whether trading is suitable for you in light of your circumstances, knowledge, and financial resources. Any decision to purchase or sell as a result of the opinions expressed in the forum will be the full responsibility of the person(s) authorizing such transaction(s). BE ADVISED TO ALWAYS USE PROTECTIVE STOP LOSSES AND ALLOW FOR SLIPPAGE TO MANAGE YOUR TRADE(S) AS AN INVESTOR COULD LOSE ALL OR MORE THAN THEIR INITIAL INVESTMENT. PAST PERFORMANCE IS NOT INDICATIVE OF FUTURE RESULTS.