A snapshot view of last week's money flow and technical notes for the week ahead.

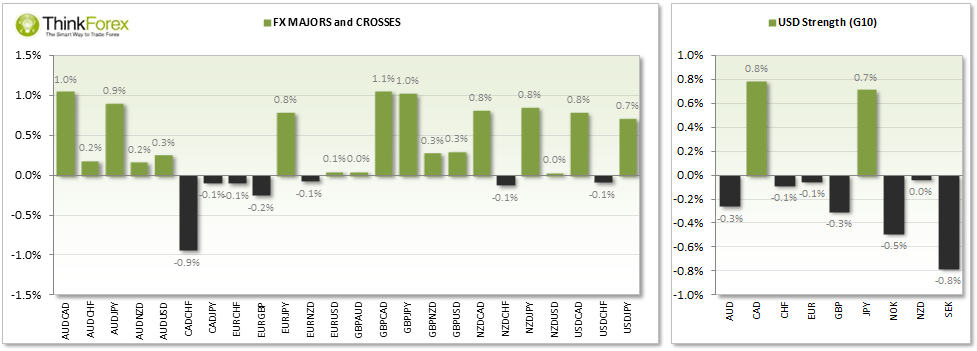

FOREX:

DXY: Bearish Pinbar suggests 81.06 resistance is an interim top and for pending weakness for greenback.

AUD/USD: Ambiguous; Either a Hanging Man or Bullish Pinbar; Closed above 0.9320 support and gapped up during Asia to suggest bullish bias.

EUR/USD: Bullish Pinbar warns of pending strength above 1.350; Break above 1.3680resistance confirms.

GBP/USD: Spinning Top warns of pending weakness or sideways trading; Creeping up broken trendline and within bearish (A-B-C correction).

USD/CAD: Bullish above 1.088 and closed the week with Bullish engulfing to confirm Bullish Wedge breakout.

USD/CHF: Shooting Star Reversal warns of potential weakness and retracement towards 0.888.

USD/JPY: Gaining bullish momentum but needs to break above 103; Near-term bias remain bullish above 102.

NZD/USD: Trades within bearish channel from May highs but Morning Star Reversal on D1 last week paints bullish near-term bias above 0.840.

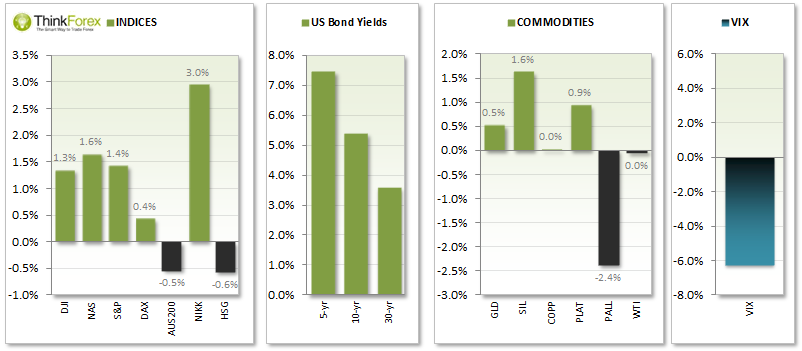

COMMODITIES:

GOLD: Retracement to $1255 achieved with Hanging Man close on Friday to warn of pending weakness; Target remains $1235; Above $1255 targets $1268.

SILVER: Spinning Top on Friday below Monthly Pivot warns of potential downside early this week; Below $18.60 targets $18.

WTI: Holding above Monthly Pivot at $102; Bias of coming week/s is for upside break of neckline from Feb '14 highs.

BRENT: Trades within longer-term triangle but below Monthly Pivot at $109.

INDICES:

US Indices break to new highs with increasing bullish momentum; Futures charts have gapped up to new highs to suggest trend continuation.

AUS200 within 150 point range for 2 months; Potential for topping pattern remains but bias is bullish above 5365 support.

DAX breaks above 10,000 and en route to our 10,500 target

FTSE 100 defends 6800 support and appears on the cusp of bullish break to test all-time highs set in 1999.