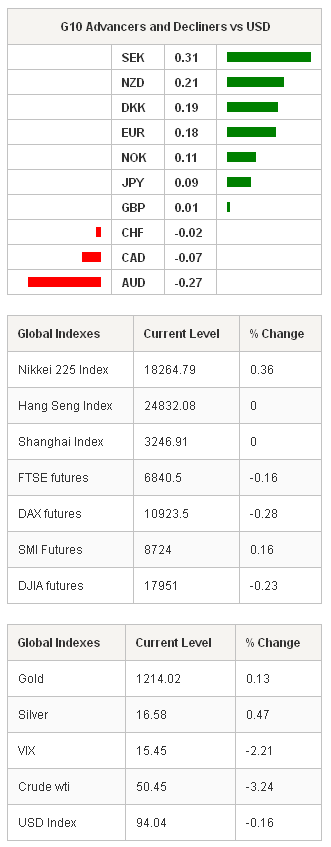

The USD came under selling pressure as the weaker US economic data and dovish FOMC minutes has pushed back expectations for a June Fed rate hike. US treasury yields followed the greenback lower with 10yrs yields at 2.08% from 2.15% the prior day. Yet the unexpected FOMC meeting minutes is really a side show to the major FX driver bailout negotiation between EU and Greece. Greek 10 year yields are hovering around 10%. We hear the two minute warning yet view both parties remain miles apart. Trading was thin in the Asian session as many participants were celebrating the New Year. The Nikkei rose 0.36% while Australia 200 fell -0.19%. EUR/USD rallied on the dovish Fed minutes to 1.1401 but failed to gather additional demand and shifted into a consolations pattern. A 11th hour deal could provide that catalyst to push EUR/USD correction to 1.1520 (23% Fibo retracement level). USD/JPY dropped to 118.44 on the Fed news but has been grinding higher as $2.517bln in expiries at 119.00 slowed the progress. Solid Japanese data in January trade and weekly MoF flow data had marginal impact. AUD/USD saw quiet trading in holiday thinned markets before rumors of S&P 500 rating downgrade, based on negative effect of weak global demand would have on Australia federal budget, sent the pair down to 0.7787.

The January FOMC minutes were more dovish than the market had expected. Fed members expressed that raising rates too soon would halt the US economic recovery and dicussed how dropping the “patients” from text would affect rate guidance. The unexpected factor was members renewed concern about the downside risk to inflation. We still expected June for the Fed to pull the trigger, but should the US continue to import the worlds accommodative policy, downside risk to inflation will intensified. Markets will focus on Chair Yellen’s congressional testimony next week for clarification.

Headlines indicates that Greece will request a six month loan extension. The optimistic news sent European stocks higher and help tighten peripheral spreads. We move cautiously into the next 48 hrs as the details for the request are far from transparent. And on the surface the ideological divide between participant is very wide. Elsewhere, as was expected the ECB has increased the emergency liquidity to Greek banks by €3.3bn to €68.3bn (it was unlikely the ECB would cut funding while negotiations progressed). This supplementary capital should handle the current level of deposit outflow for other week. However that time could quickly decrease should Greek depositors panic. The limited size and scope of the increase indicates that the ECB is squeezing Greece to agree to an extension of the bailout plan. Should Greek banks use the additional capital and the ECB rejects additional expansion its likely Greek will be force to trigger capital controls and limit domestic payments.

Currency Tech

EUR/USD

R 2: 1.1534

R 1: 1.1423

CURRENT: 1.1324

S 1: 1.1262

S 2: 1.1098

GBP/USD

R 2: 1.5486

R 1: 1.5352

CURRENT: 1.5234

S 1: 1.5197

S 2: 1.5140

USD/JPY

R 2: 121.85

R 1: 120.83

CURRENT: 120.24

S 1: 119.20

S 2: 118.34

USD/CHF

R 2: 0.9500

R 1: 0.9347

CURRENT: 0.9279

S 1: 0.9170

S 2: 0.8936