We expect Fiserv, Inc. (NASDAQ:FISV) to beat expectations when it reports second-quarter 2017 results on Aug 1.

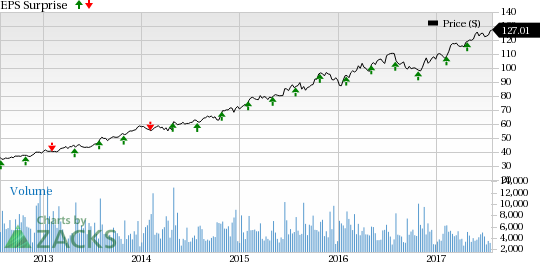

Last quarter, its earnings of $1.25 per share surpassed the Zacks Consensus Estimate by 7 cents. The company has a decent earnings track record. In the trailing four quarters, the company surpassed the Zacks Consensus Estimate twice while matching the same on the other two occasions, delivering an average positive surprise of 1.7%.

Revenues of $1.394 billion were up 4.7% on a year-over-year basis and beat the Zacks Consensus Estimate of $1.393 billion.

Fiserv’s shares have significantly outperformed the S&P 500 on a year-to-date basis. While the index gained 11%, the stock returned 19.6%. We believe that the company’s strong market position, healthy product portfolio, significant acquisition synergies and steady flow of new customers are key drivers.

Let's see how things are shaping up for this announcement.

Why a Likely Positive Surprise?

Our proven model shows that Fiserv is likely to beat on earnings because it has the right combination of the two key components.

Zacks ESP: Fiserv currently has an Earnings ESP of +1.63%. This is because the Most Accurate estimate stands at $1.25 per share, while the Zacks Consensus Estimate is pegged at $1.23 per share. A favorable Earnings ESP serves as a meaningful and leading indicator of a likely positive earnings surprise. You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

Zacks Rank: Fiserv currently carries a Zacks Rank #2 (Buy). It should be noted that stocks with a Zacks Rank #1 (Strong Buy), 2 or 3 (Hold) have a significantly higher chance of beating earnings.

Conversely, stocks with a Zacks Rank #4 or 5 (Sell rated) should never be considered going into an earnings announcement.

The combination of Fiserv’s Zacks Rank #2 and a positive ESP make us reasonably confident of an earnings beat.

What's Driving the Better-than-Expected Earnings?

Fiserv holds a dominant position in the financial and payment solutions business backed by a broad customer base and key contract wins. Additionally, strong user base of Mobiliti ASP is a key driver. Moreover, Fiserv remains focused on expanding its product portfolio and thus product-oriented acquisitions are leading to a steady flow of customers.

In May 2017, First National Bank of Pandora and Apple (NASDAQ:AAPL) Creek Bank chose Fiserv as their new technology partner. The company is also rapidly expanding in the overseas markets. In recent times, Fiserv’s offerings like Signature core account processing platform and DigitalAccess have been selected by BDO Unibank – the largest bank in Philippines – and Australia-based Bank of Sydney, respectively.

We note that across Asia-Pacific, Fiserv supports approximately 68 clients in 13 countries, including some of the largest banks in Australia, Thailand and Indonesia.

In Jun 2017, Affinity Plus Federal Credit Union chose to implement the company’s Architect Digital Banking and Payments Platform Solution. This reflects growing clout of Fiserv’s digital banking solutions among banks and credit unions.

Fiserv expects revenues from base solutions like DNA, Agiliti and Now to drive growth as well as to benefit from its five-year cost cutting program.

Other Stocks to Consider

Here are a few companies that you may also want to consider as our model shows that these have the right combination of elements to post an earnings beat in their upcoming release:

Kemet Corporation (NYSE:KEM) with an Earnings ESP of +11.11% and a Zacks Rank #1. You can see the complete list of today’s Zacks #1 Rank stocks here.

CGI Group (NYSE:GIB) with an Earnings ESP of +5.71% and a Zacks Rank #2.

Arrow Electronics (NYSE:ARW) with an Earnings ESP of +0.57% and a Zacks Rank #2.

More Stock News: Tech Opportunity Worth $386 Billion in 2017

From driverless cars to artificial intelligence, we've seen an unsurpassed growth of high-tech products in recent months. Yesterday's science-fiction is becoming today's reality. Despite all the innovation, there is a single component no tech company can survive without. Demand for this critical device will reach $387 billion this year alone, and it's likely to grow even faster in the future.

Zacks has released a brand-new Special Report to help you take advantage of this exciting investment opportunity. Most importantly, it reveals 4 stocks with massive profit potential. See these stocks now>>

CGI Group, Inc. (GIB): Free Stock Analysis Report

Kemet Corporation (KEM): Free Stock Analysis Report

Arrow Electronics, Inc. (ARW): Free Stock Analysis Report

Fiserv, Inc. (FISV): Free Stock Analysis Report

Original post

Zacks Investment Research