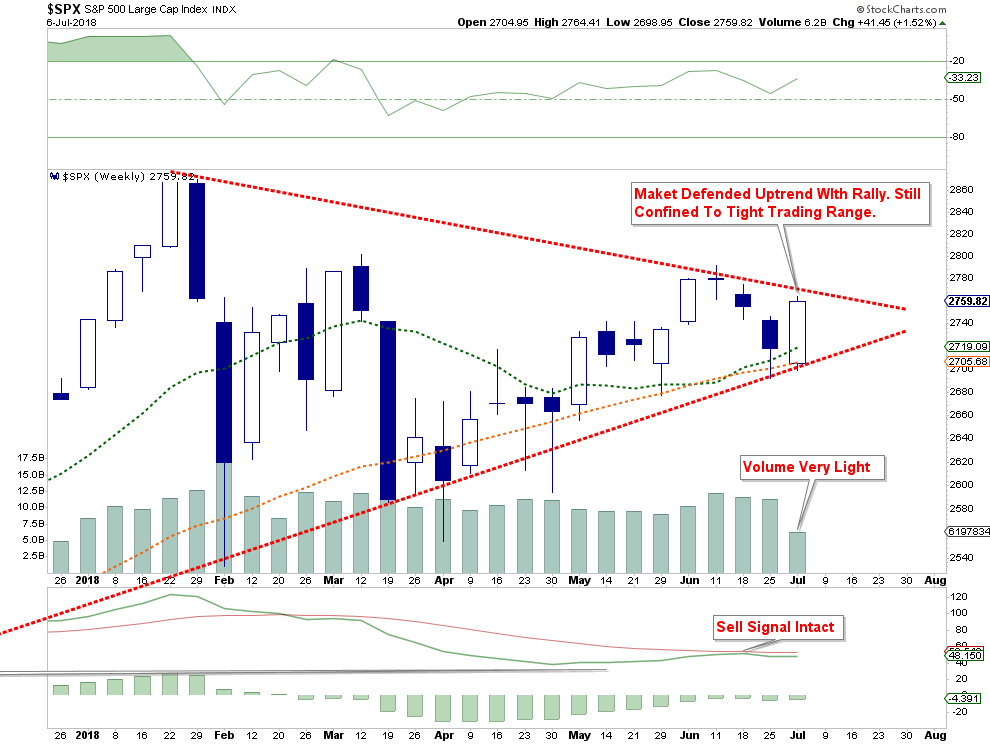

As America went back to work following “Independence Day,” the markets set off some ‘fireworks” of its own with back to back gains Thursday and Friday. Moving average lines continue to play an important role in providing levels at which buyers have consistently shown up. Last week, the Dow gained +0.7% and continues to lag behind the rest of the market mainly due to several of its constituents which are more vulnerable to trade problems. The S&P 500 gained a stronger +1.5% on the week and, as shown below, ended the week above its 50-day average. With MACD lines (lower box) getting close to turning positive, the market will have to deal with a lot of overhead resistance at both the June highs and the current downtrend line from all-time highs earlier this year.

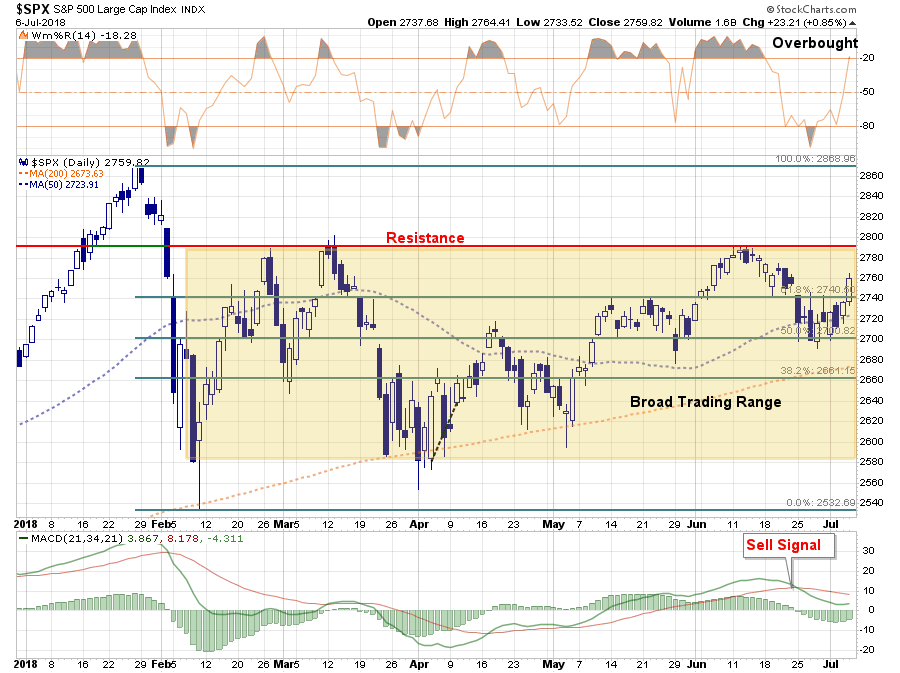

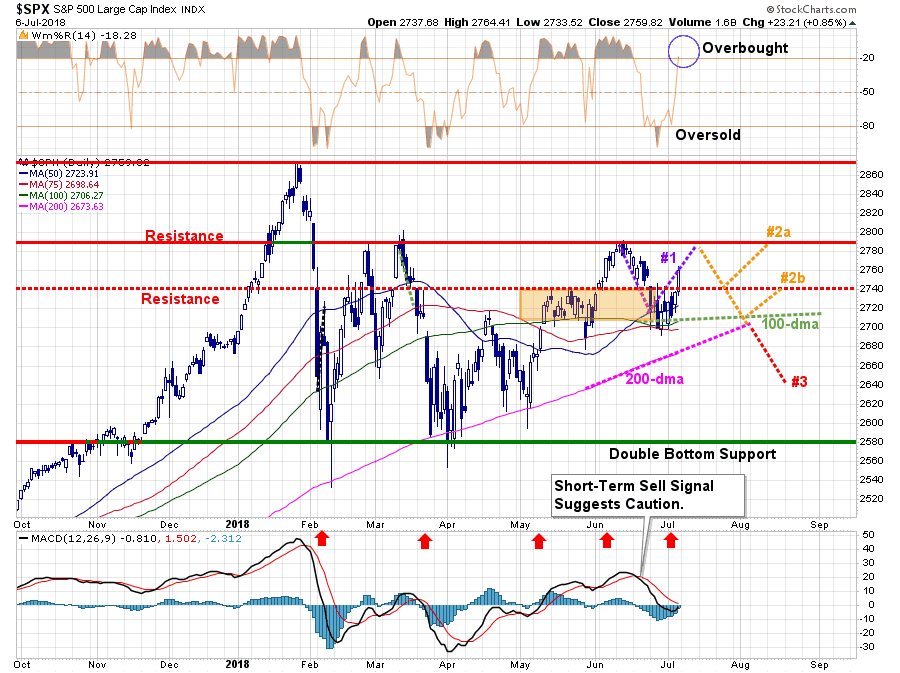

The market has remained confined to a fairly broad trading range as shown below. While the decline from the June highs reversed the short-term overbought condition, the rally from the 50% retracement level has “reversed that reversal” once again.

Love volatility yet?

With the market still on a short-term sell signal, it suggests the current rally is likely limited to the June highs keeping the markets confined to the broader trading range for now.

The good news is the break above the 61.8% retracement level, as we noted last week, keeps the markets intact (Pathway #1) for now. And, as suggested above, a retest of recent June highs seems very likely. However, Monday will be key to see if we get some follow-through from Friday’s close.

Currently, a continued trading range between the 100-dma and the June highs seems to have the highest probability levels (Pathway #2a and #2b). While there is always a risk of something going wrong (Pathway #3) the odds currently seem somewhat diminished. However, with the ongoing trade war rhetoric brewing between China and the U.S., a negative surprise certainly maintains a high enough probability to pay attention to.

As I noted over the last few weeks, participation remains concerning as Bob Farrell’s rule #7 states:

“Markets are strongest when they are broad and weakest when they narrow to a handful of blue-chip names.”

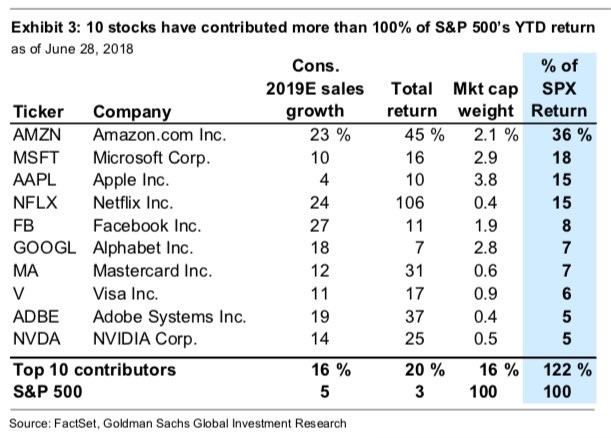

For the year, 10 stocks have made up almost entirely all of the gains of the market. Actually, a better way would be to say:

“The top-10 stocks have more than offset the losses from the rest of constituents so far this year given the markets are only up 3.22% ytd.”

The biggest risk to the markets over the next couple of months will be earnings announcements and economic data as the “trade war” continues to mount. As noted by Reuter’s Christopher Beddor:

“The U.S.-China trade war will be fought in the trenches, and it’s going to get ugly. The first round of tariffs hits on Friday, and U.S. President Donald Trump says they might come to cover more than $500 billion of goods. Exporters will feel the pain first, but uncertainty will also dampen investment, impede research and twist reform. It marks a moment of mourning for those who hoped the world’s two largest economies could work things out.

The initial round of U.S. duties cover just 2 percent of China’s total exports, calculate analysts at JPMorgan). They reckon that even if the White House slapped a 25% tariff on every Chinese product sold in the United States, Chinese economic growth would slow by only around 0.5 percentage points.

More damage could come from economic aftershocks. Equity markets in China and the United States have swooned already, in part because investors worry that global supply chains will need to reroute. Some American businesses say they are already scaling back or postponing capital spending because of uncertainties around trade, according to minutes from the Federal Open Market Committee. In China, the government has been forced to moderate monetary policy to cushion financial markets.”

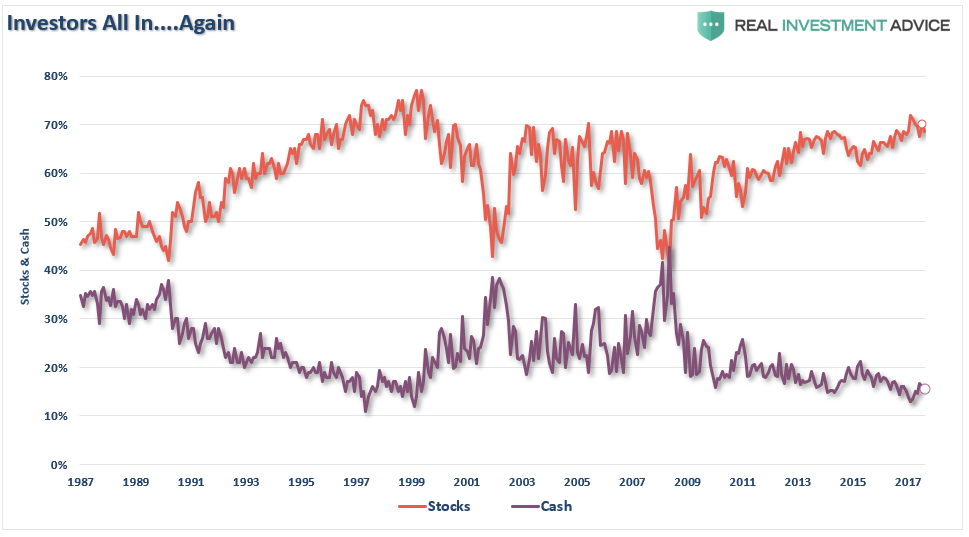

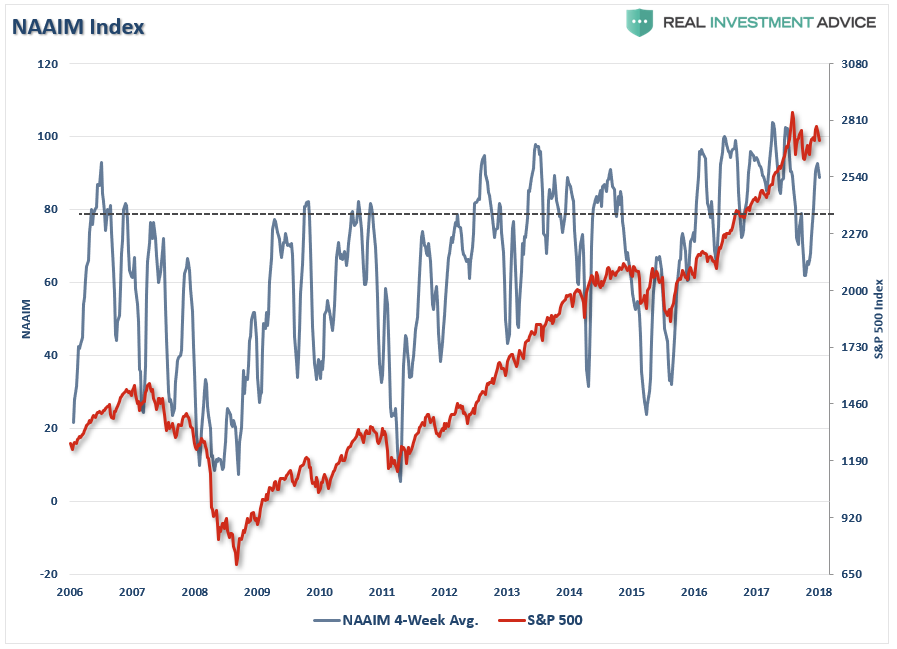

With valuations elevated and earnings expectations extremely lofty, the risk of disappointment in corporate outlooks is elevated. Furthermore, despite those who refuse to actually analyze investor complacency measures, both individual and institutional investors remain heavily weighted towards equity risk. In other words, while investors may be “worried” about the market, they aren’t doing anything about due to the “fear of missing out.”

This is the perfect setup for an eventual “capitulation” by investors when a larger correction occurs as overexposure to equities leads to “panic selling” when losses eventually mount.

It is exactly for that reason that we manage risk. But, managing risk is NOT the same as sitting in cash.

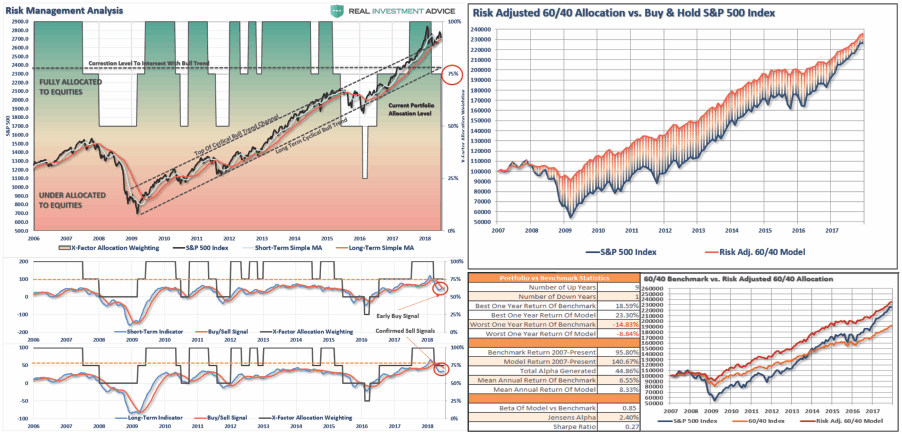

As we note each week in this missive, our portfolios remain primarily weighted towards equity risk, for now. However, in early February of this year, we reduced our equity allocation models to 75% exposure which has served us well in reducing portfolio volatility over the last few months.

These periods of either “equity risk reductions/increases” are driven by the investment discipline we discuss with you each week. The chart below shows the history of the model allocation adjustments going back to 2006 when we first started tracking changes to the model used in our 401k plan manager.

While there are certainly periods where the model under-performs the benchmark index, particularly an all-equity index, it is the reduction in drawdowns which leads to longer-term out-performance over a passive index. The obvious point here is simply “getting back to even” is not the same as “growing value.”

We have been and currently remain underweight equities. But, as I stated, being “underweight equity” is far different from assuming we are sitting entirely in cash. While we certainly do not advocate market timing, we certainly do adhere to the principals of risk management and capital preservation.

With valuations currently trading at the second highest level in history, the outlook for forward returns over the next decade are extremely low. In fact, it is highly probable that bonds will once again outperform stocks over the next 10-year period. However, when that over-valuation is reversed, we will certainly become “raging equity bulls” once again.

But that time is not now, and I agree with Doug’s comments this past week that risks continue to outweigh the rewards.

Kass: Concerns Remain Plentiful

I am still carrying a small net long exposure with a plan to short strength in the S&P area of 2750-2775.

But my forward looking concerns are plentiful – trade wars, the message of the bond market (as well as the message of the bank stock market), rising geopolitical risks (the immigration issue is dividing the EU and splintering some of the entrenched parties) and the possibility of policy mistakes at both the White House and the Federal Reserve as the latter pivots away from monetary largesse.

Importantly, the rising ambiguity of global economic growth (and the possible repudiation of the so called synchronized global economic recovery) will likely give investors some pause into the Summer:

The powerful symbol of the yield curve. An excerpt:

You can try to play down a trade war with China. You can brush off the impact of rising oil prices on corporate earnings.

But if you’re in the business of making economic predictions, it has become very difficult to disregard an important signal from the bond market.

The yield curve is perilously close to predicting a recession and so is the absolute level of interest rates – something it has done before with surprising accuracy…

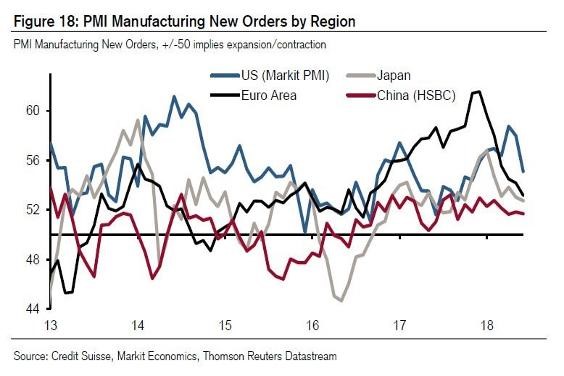

* PMI manufacturing new orders by region are turning lower:

And hastily crafted White House policy (conflated with politics), developed on the back of a napkin and delivered by tweet is dangerous in an interconnected world. Policy developed by hardliners like Navarro and by an inexperienced President that seems at its epicenter the faulty notion that US imports and US GDP are inversely related – when in fact deficits and growth are directly correlated – is likely also to prove dangerous. (President Trump is making economic uncertainty and market volatility great again. #MUVGA)

Finally, as expressed recently, I am constantly shocked how optimistic investors, strategists, analysts and biz news commentators apply first level thinking when considering the wide range of possible political, economic and market outcomes (many of them adverse). But, to me, we are in a vortex of uncertainty and in a new regime of volatility — at a time in which global monetary policy has pivoted from being expansionary to being contractionary and is no longer suppressing volatility. (We will soon see the end of ECB QE by year end, with it being cut in half in three months. That’s a really big deal as liquidity flow becomes a drain both here and over there).

Bottom Line

2017 was a year of hope, in which the S&P Index’s valuation experienced a three handle valuation increase. Wall Street triumphed over Main Street.

2018 is a year of reality, in which the S&P Index’s valuation has and will likely to continue to contract. Main Street is triumphing over Wall Street.

I will grow more cautious as stocks move higher in the near term — as downside risk increasingly dwarfs upside reward.

Market and Sector Analysis

Data Analysis Of The Market and Sectors For Traders

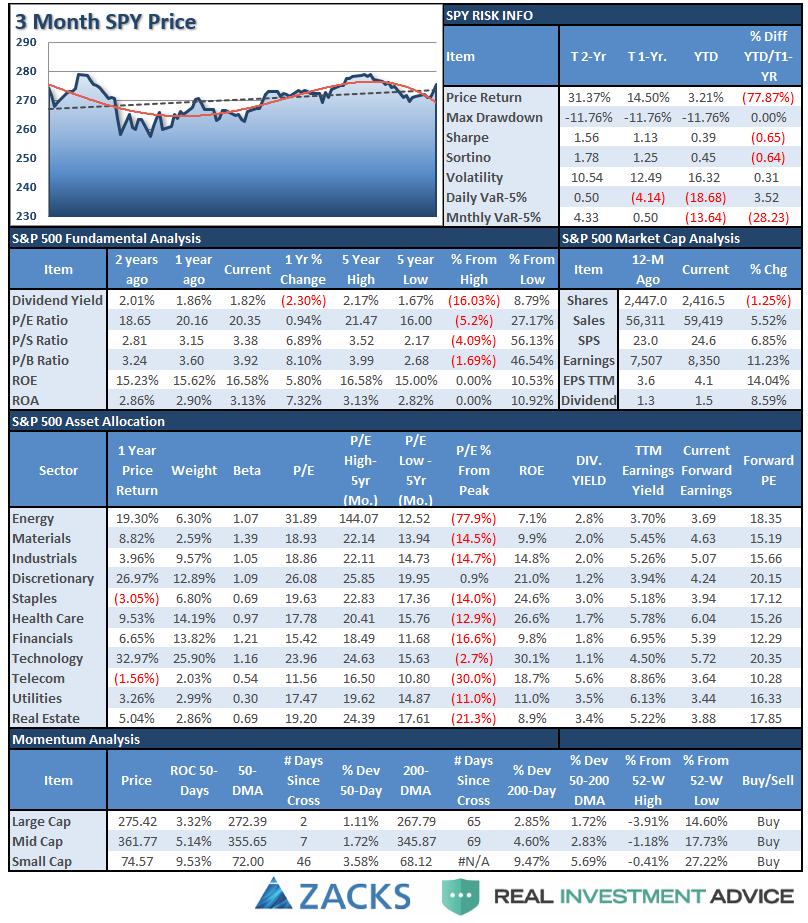

S&P 500 Tear Sheet

Performance Analysis

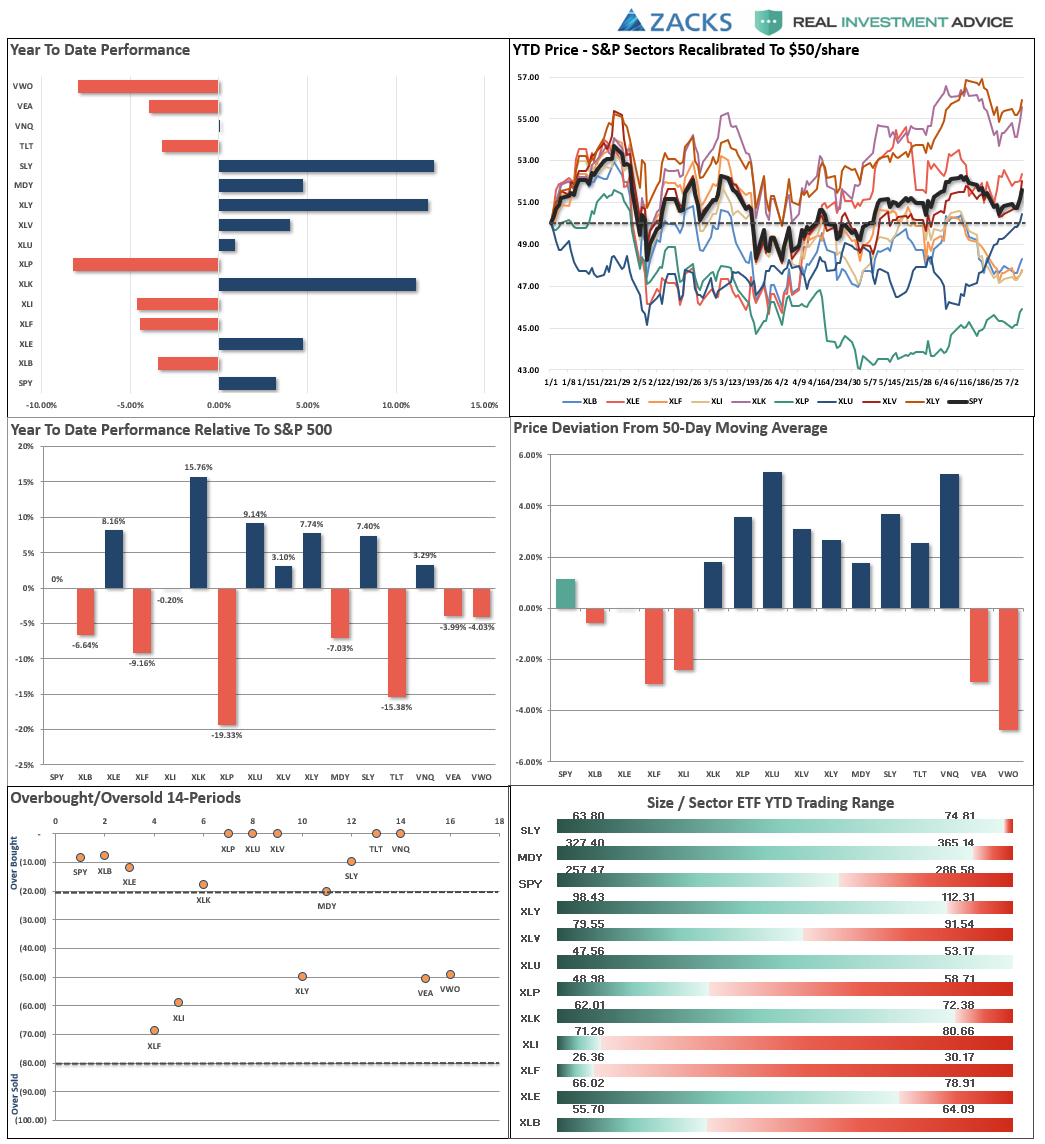

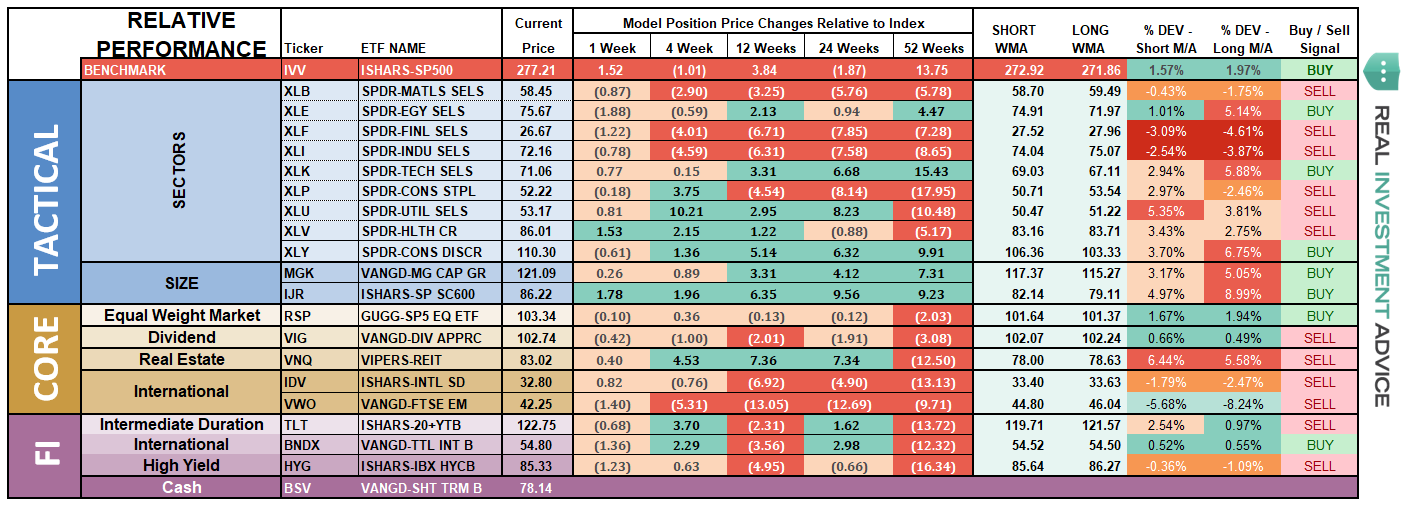

ETF Model Relative Performance Analysis

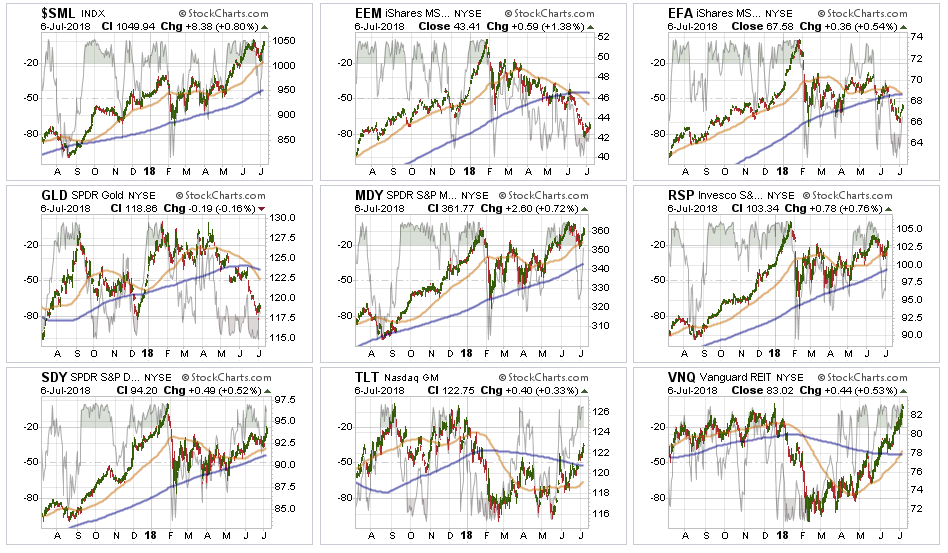

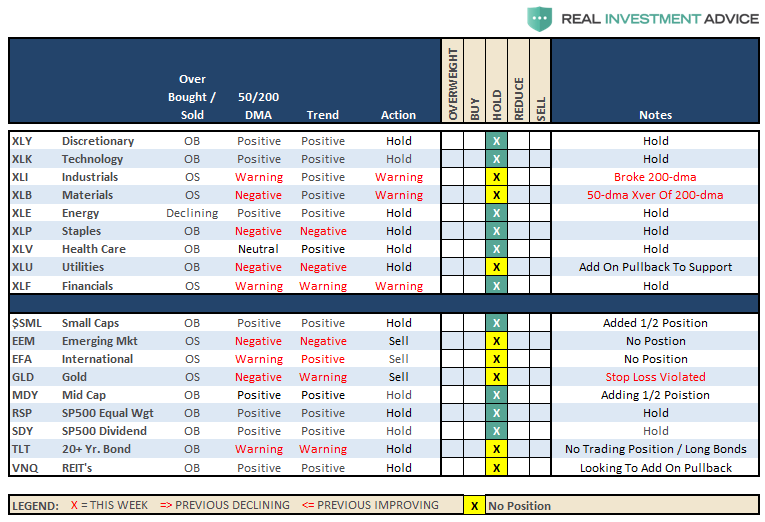

Sector and Market Analysis:

In last week’s holiday shortened week, the markets mustered a rally. However, with tariffs ramping up, the risk to sectors most exposed to the “trade war” remain vulnerable.

Discretionary stocks have been leaders previously, but as we stated three weeks ago, that sharp ramp higher was not sustainable. We recommended, with the sector extremely overbought, to take profits and reduce weights back to portfolio model weights for now. The recent correction pulled the sector back to support which held and turned back up keeping us allocated to the sector for now.

Technology, as noted two weeks ago, ran into a bit of trouble over trade war concerns. We suggested taking profits and reducing portfolios back to target model weights as well. With the sector holding support at the 50-dma, and turning higher, we continue to remain allocated to the sector for now.

Healthcare, Staples, and Utilities have had a terrific pickup in performance recently as money has chased very beaten up sectors in a sector rotation move. After adding Staples to our portfolios previously, we are now looking for pullbacks to support that hold to further add to these holdings.

Financial, Energy, Industrial, and Material stocks, after a brief spurt of excitement, have all slipped backward. While the trend for Energy remain in place, for now, we remain underweight holdings. We currently have no weighting in Industrial or Materials as the “trade war” continues to negatively impact the companies in the sectors. The decline of the “yield curve” is hurting major banks, while we are underweight the sector as well.

Small-Cap and S&P Midcap 400 continue to lead performance overall. We noted last week, that after small and mid-caps broke out of a multi-top trading range, we needed a pull-back to add further exposure. We recently added small-cap exposure to portfolios and are maintaining stops at the 50-dma. Any further weakness in the markets that hold supports and we will likely increase exposure further.

Emerging and International Markets were removed in January from portfolios on the basis that “trade wars” and “rising rates” were not good for these groups. Furthermore, we noted that global economic growth was slowing which provided substantial risk. That recommendation to focus on domestic holdings in allocations has paid off well in recent months. With emerging markets and international markets continuing to languish, there is no reason to ad exposure at this time. Remain domestically focused to reduce the drag on overall portfolio performance.

Dividends and Equal Weight continue to hold their own and we continue to hold our allocations to these “core holdings.”

Gold – we haven’t owned gold since early 2013. However, as we stated several weeks ago:

“…we previously suggested to ‘Take profits on positions, and lower your stop to last week’s bottom at $122.’ Again, we see no reason currently to own gold in your portfolio, however, if you do, the $122 stop was violated and all precious metals positions should be closed out for now.”

With the 50-dma now back below the 200-dma there is still no reason to own gold currently. If you are long in the metal currently, gold is extremely oversold and a bounce is likely. Use that bounce to reduce holdings for now. There will come a time to own gold, and when there is, we will add it to portfolios. Now is not the time.

Bonds and REITs – Bonds have continued to improve performance despite a continued bullish backdrop to equities. These two things do not generally coincide for long periods, so either, the “bulls” are wrong on stocks or the “bears” are wrong on bonds. I would bet on the latter.

We remain out of trading positions currently, but remain long “core” bond holdings mostly in floating rate and shorter duration exposure. REIT’s are much more interesting now with a break back above their 200-dma and now the 50-dma crossing back above the 200-dma. The sector is extremely overbought, so on a pullback that does violate support, we will add REIT’s back into our portfolios.

The table below shows thoughts on specific actions related to the current market environment.

(These are not recommendations or solicitations to take any action. This is for informational purposes only related to market extremes and contrarian positioning within portfolios. Use at your own risk and peril.)

Portfolio/Client Update:

With last week being a holiday trading week, we kept our portfolio additions on hold. We are looking for some follow through on Monday for some confirmation the markets have set aside some of the “trade war” rhetoric for now. The cluster of support at the 50- and 100-dma remains in place and we are currently evaluating market conditions for small step ups in equity exposure to add to current holdings. Depending on how the market behaves next week, we are still looking to take the following actions across our portfolio models.

- New clients: Will will look to buy 50% of target equity allocations for new clients.

- Equity Model: We previously added 50% of target allocations. Those positions will be “dollar cost averaged” and 1/2 weight of new holdings will be added opportunistically.

- Equity/ETF blended models will be brought closer to target allocations. We will add to “core holdings” and add 1/2 weight to new holdings and bring existing holdings up to target model weights.

- Option-Wrapped Equity Model will be brought closer to target allocations and collars implemented.

Again, we are moving cautiously, and opportunistically, as we continue to work toward minimizing risk as much as possible. While market action has improved on a short-term basis, we remain very aware of the long-term risks associated with rising rates, excessive valuations and extended cycles.

It is important to understand that when we add to our equity allocations, ALL purchases are initially “trades” that can, and will, be closed out quickly if they fail to work as anticipated. This is why we “step” into positions initially. Once a “trade” begins to work as anticipated, it is then brought to the appropriate portfolio weight and becomes a long-term investment. We will unwind these action either by reducing, selling, or hedging, if the market environment changes for the worse.