The third quarter is coming to an end and world stock markets are at or near all-time highs. The lazy Russell 2000 has awoken to join the S&P 500 and NASDAQ 100 at all-time highs. If you have not been invested in this market you need to either find an advisor to get you involved or fire your advisor for not keeping you involved. But where should you look if you have not been involved? How about your bank.

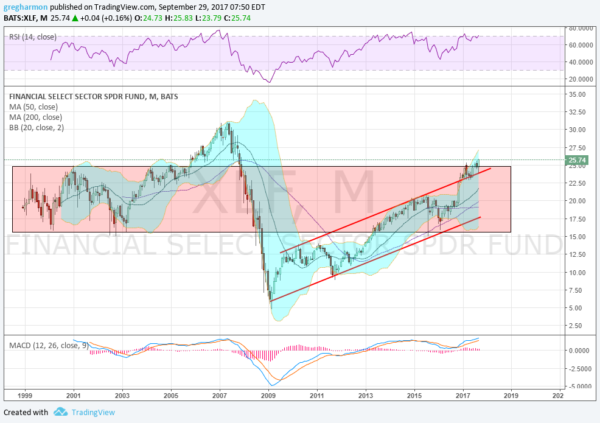

Financial stocks have had a great run since the November election. But the Financial ETF (NYSE:XLF) still remains 20% below its all-time high. With the move in September, the ETF is finally breaking out of a highly trafficked price range to the upside. This may be the perfect time to get in if you are not invested already.

The chart above shows the price action moving over the historical channel. It is also continuing higher above trending support. Momentum is favoring more upside as well. The RSI is strong and high in the bullish zone with the MACD rising and positive. Even the Bollinger Bands® are opened to the upside. What is left above is a lightly traveled road. Not much price history to slow it down. For a long term investor, using 22.50 as a stop loss area could be your key to a great run higher.

DISCLAIMER: The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog, please see my Disclaimer page for my full disclaimer.