What if investors had a way to determine the extent of “stress” in the financial system? And what if those stress levels could tell investors whether or not riskier assets (e.g., stocks, higher-yielding debt, etc.) can succeed without definitive U.S. Federal Reserve intervention?

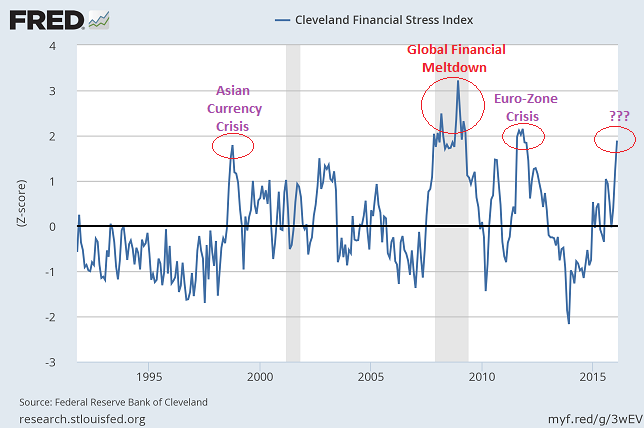

Consider the Cleveland Financial Stress Index (CFSI). The CFSI monitors the well-being of a wide range of financial markets, including credit, equity, foreign exchange, funding, real estate and securitization. According to the Cleveland Fed, a CFSI reading greater than 1.855 represents the highest threat level to the financial system. We’re sitting at 1.91.

Both the Asian Currency Crisis in 1998 and the Eurozone Debt Crisis in 2011 wreaked havoc on the typical U.S. stock. Small company shares, mid-sized company shares as well as shares of the average large company declined 20%-30%. On the other hand, when the popular market cap-weighted Dow and S&P 500 barometers approached the 20% bear market line in those crises, the U.S. Federal Reserve promptly stepped in. In 1998, the Fed orchestrated a bailout of the infamous hedge fund, Long-Term Capital Management, and sharply cut interest rates. In 2011, the Fed helped coordinate worldwide central bank stimulus as well as introduced “Operation Twist” – selling short-dated U.S. Treasuries to buy longer-dated U.S. Treasuries for the purpose of depressing borrowing costs.

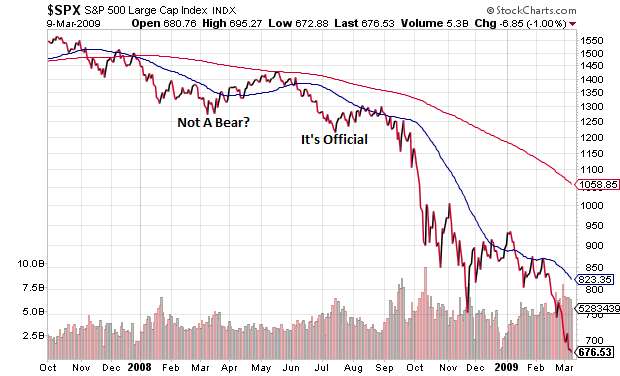

What about 2008? The U.S. Federal Reserve did slash interest rates dramatically in the first quarter. What’s more, the Fed organized the bailout of Bear Stearns in March of that year, sparking a relief rally that kept the S&P 500 well above the bear market demarcation line for three more months. But it wasn’t enough. Even cutting the Fed Funds overnight lending rate to 0% by December wasn’t enough. The Fed wasn’t able to inspire confidence again until quantitative easing (QE) began in 2009.

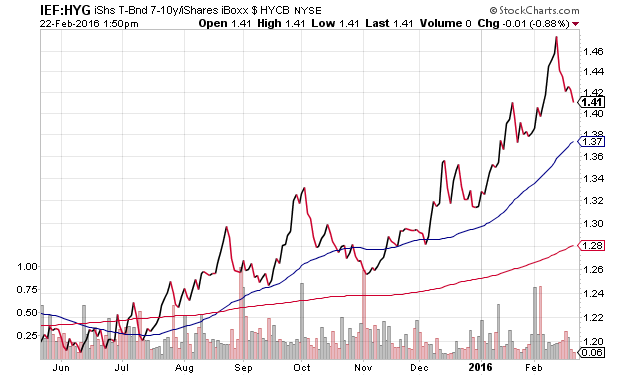

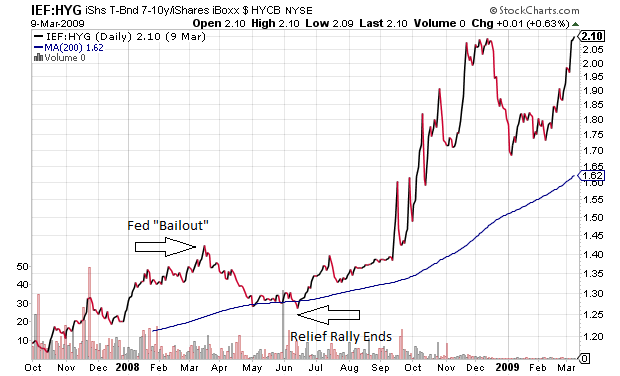

The recent rally for riskier assets here in 2016 is similar to relief rallies in the past; that is, shorter-term gains often overshadow longer-term financial distress as well as deteriorating market internals. For instance, a rising price ratio for iShares 7-10 Year Treasury Bond (N:IEF):iShares iBoxx $ High Yield Corporate Bond (N:HYG) is indicative of a preference for risk-off investment grade credit over speculative higher yielding credit. Is there anything in the present IEF:HYG price ratio to suggest that the longer-term trend is abating?

Now step back in time to the 10/2007-3/2009 bear. The IEF:HYG price ratio steadily marched higher until March of 2008. The Fed bailout of beleaguered financial firm Bear Stearns temporarily provided relief for risk assets, but the relief rally ended three months later. Once more, the IEF:HYG price ratio ascended like a mountain climbing enthusiast.

History teaches us that the Fed is unlikely to ride to the rescue unless the Dow and the S&P 500 challenge bear market territory. Even then, the rescue endeavor would require sufficient firepower. These historical precedents, then, make the current relief rally particularly troubling. For the Fed to wait until the major benchmarks buckle means that the financial system may grow increasingly unstable. And by then, cutting rates back to the zero bound or twisting shorter-term maturities to purchase longer-dated ones may be insufficient. Again, the Fed’s own assessment tool places the financial system at the highest level of instability, Grade 4 “Significant Stress.”

Recall that the iShares MSCI ACWI ex US (O:ACWX) has already depreciated 25%-plus from the top. Small caps in the iShares Russell 2000 (N:IWM)? Ditto. Transportation stocks in the iShares Transportation Average (N:IYT)? Nearly 30% erosion. Bear market descents have occurred in virtually every stock arena. It follows that when a wide range of stock types are fading, and when a wide range of debt types of different credit quality relative to U.S. treasuries are faltering, popular benchmarks like the Dow and S&P 500 eventually follow suit. The SPDR S&P 500 ETF (N:SPY) Trust (AX:SPY) will not be a lone exception.

A hold-n-hope advocate may not wish to change any aspect of his/her portfolio holdings, regardless of financial stress levels, historical probability, technical trends or fundamental overvaluation concerns. On the flip side, an investor who wishes to reduce exposure to downside risk can use a bear market rally to his/her advantage. Jettison a lower quality junk bond ETF for a higher quality investment grade corporate bond ETF like iShares Intermediate Credit Bond (N:CIU). Trade in a lower quality stock ETF for a higher quality stock ETF like iShares MSCI USA Quality Factor (N:QUAL). And disregard those who boldly declare that “cash is trash.” My moderate growth and income clients have witnessed less volatility and have experienced better risk-adjusted returns with roughly 20%-30% cash/cash equivalents since last summer. (And that’s before the levee broke.)

Disclosure: Gary Gordon, MS, CFP is the president of Pacific Park Financial, Inc., a Registered Investment Adviser with the SEC. Gary Gordon, Pacific Park Financial, Inc, and/or its clients may hold positions in the ETFs, mutual funds, and/or any investment asset mentioned above. The commentary does not constitute individualized investment advice. The opinions offered herein are not personalized recommendations to buy, sell or hold securities. At times, issuers of exchange-traded products compensate Pacific Park Financial, Inc. or its subsidiaries for advertising at the ETF Expert web site. ETF Expert content is created independently of any advertising relationships.