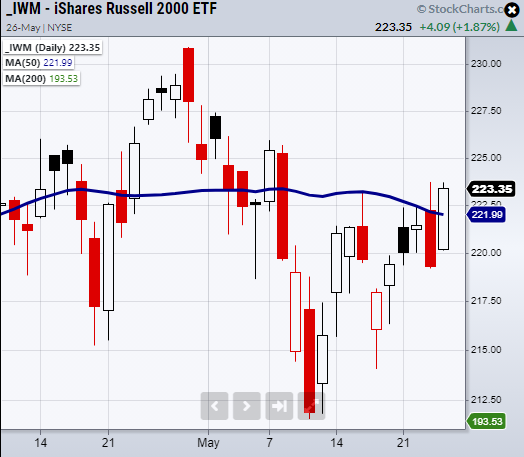

For the past couple of weeks, the Russell 2000 iShares Russell 2000 ETF (NYSE:IWM) has been a major focus for traders and investors that have been cautious given the struggle IWM has gone through in its current trading range.

As of yesterday, it has cleared its pivotal 50-day moving average at $221.96 and looks to confirm a bullish phase with a second close over the MA on Thursday.

Additionally, IWM has been a key indicator for bullish market sentiment even though the price action has been choppy.

If IWM confirms its phase change, each major index will be in a bullish phase. At that point, the market can gear up for new highs.

Thursday morning, two economic reports-Jobless Claims and Durable Goods, could set the stage for the rest of the week.

Durable Goods will give insight into the current U.S supply chain which has gone through issues including shortages of semiconductors, to building supplies as the housing market made leaps and bounds with cheap mortgage rates along with increasing demand as people spread out to new states throughout the pandemic.

Circling back, the economic reports could bring negative news based on increasing inflation and missed expectations.

With that said, the market has great potential to make a strong move higher if today's reports come out positive now that IWM's restraints have been cut by clearing the 50-DMA.

ETF Summary

- S&P 500 (SPY) Resistance at 422.82.

- Russell 2000 (IWM) Watching for a second close over the 50-DMA at 221.99.

- Dow (DIA) Needs to clear 345 and hold.

- NASDAQ (QQQ) Next resistance at 336.65.

- KRE (Regional Banks) 68.16 support.

- SMH (Semiconductors) 242.39 needs to hold as new support.

- IYT (Transportation) 267.44 support.

- {{6381|IBB} (Biotechnology) 147 support. Held the 10-DMA at 149.95.

- XRT (Retail) Filled the gap at 93.52.

- Volatility Index (VXX) Broke support.

- Junk Bonds (JNK) Resistance 109.17 108.67 support.

- XLU (Utilities) Doji day. 65.18 support the 50-DMA.

- SLV (Silver) 25.23 support.

- VBK (Small Cap Growth ETF) 276.75 resistance.

- UGA (US Gas Fund) 34.68 resistance area.

- TLT (iShares 20+ Year Treasuries) 140.60 resistance.

- USD (Dollar) Closed over the 10-DMA at 89.99.

- MJ (Alternative Harvest ETF) 21.40 resistance.

- LIT (Lithium) 64.25 resistance.

- XOP (Oil and Gas Exploration) Needs to hold over 85.69.

- DBA (Agriculture) 18.17 support.

- GLD (Gold Trust) Minor support the 10-DMA at 175.27.