Market Brief

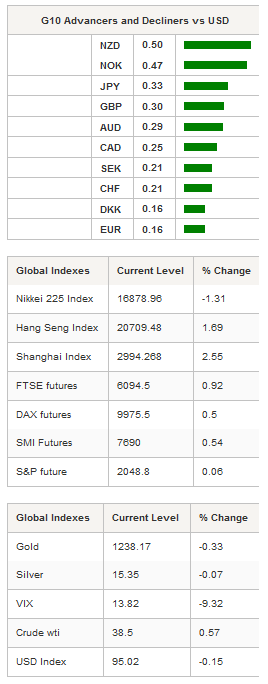

After last week’s bullish comments from St-Louis Fed’s Bullard (the market is getting used to it), traders were not expecting much from Janet Yellen’s speech yesterday in New York. However, given yesterday’s very light calendar, Yellen’s dovish comments have in fact had a strong effect on the US dollar. EUR/USD rose almost 1% in New York to around 1.13, GBP/USD surged 0.85% to 1.4975; while USD/JPY fell 0.90% to 112.60. The dollar index tumbled 0.85% and tested the 95 support level.

The reiterated calls for a more cautious and data dependent approach triggered a rally in US sovereign bonds, pushing front-end yields to a 1-month low. The monetary policy sensitive 2-year treasury yields fell more than 6bps to 0.7880%, while it tested the 1% threshold back in mid-March. The 5-year yield hit 1.2650% but quickly returned to around 1.29%. EUR/USD is on its way to test the nearest resistance that lies at 1.1342 (high from March 17th); the next resistance stands at 1.1376 (high from February 11th). We still expect the pair to continue moving higher as we believe that the market has been misled by the Fed’s hawks, while the Fed’s general tone has remained dovish since last December. However, one should also keep an eye on the ECB, which looks unfavourably on any EUR appreciation as it would prevent a return of inflation. Monetary easing is still very much on the table for the European Central Bank.

The prospect of low interest rates in the US helped precious metals: the yellow metal was up 1.35% to $1,243.10 before returning to $1,238 during the Asian session. Silver surged 1.60% to $15.37 and stabilised at around $15.34. In the equity market, with the exception of Japanese equities, which were sold off in Tokyo, Asian regional markets were all trading in positive territory. Mainland Chinese equities were leading the charge with the Shanghai and Shenzhen Composites up 2.55% and 3.21% respectively. Offshore, Hong Kong’s Hang Seng surged 1.69%, while in Taiwan the Taiex rose 1.39%. Finally, Australian shares completely erased the early session gains and ended up the day edging higher by 0.11%.

Commodity currencies stood amongst the biggest winners of the Asian session amid a recovery in crude oil prices and a weaker US dollar. USD/NOK continued to slide further, reaching 8.35 in the early European session. The Aussie also found a decent amount of buyers and is on its way to test the resistance lying at $0.7680. Finally, NZD/USD is about to break the strong resistance at 0.6897 (high from October 15th). We maintain our view that the kiwi is overbought and that a correction is looming.

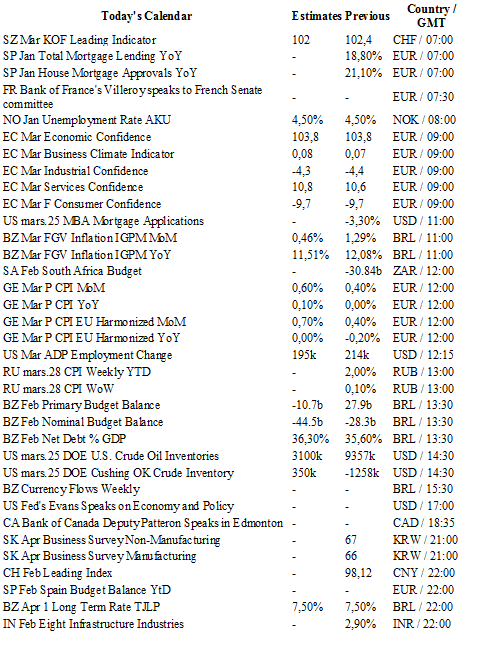

Today traders will be watching unemployment rate from Norway; consumer confidence from the euro zone; MBA mortgage application, ADP employment change, crude oil inventories and Fed’s Evans speech from the US; CPI report from Germany; mid-month inflation and primary budget balance from Brazil.

Currency Tech

EUR/USD

R 2: 1.1495

R 1: 1.1376

CURRENT: 1.1317

S 1: 1.1058

S 2: 1.0810

GBP/USD

R 2: 1.4668

R 1: 1.4591

CURRENT: 1.4437

S 1: 1.4195

S 2: 1.4033

USD/JPY

R 2: 117.53

R 1: 114.91

CURRENT: 112.24

S 1: 110.67

S 2: 107.61

USD/CHF

R 2: 1.0093

R 1: 0.9913

CURRENT: 0.9646

S 1: 0.9651

S 2: 0.9476