Last month, we spoke about BoE forecasts being revised up (and the prospect of further interest rate cuts going out the window with them), as a reason for possible GBP/USD strength:

…the BoE effectively signaled to the market that the bank now has a neutral bias in terms of interest rates, while also revising their growth forecasts for the coming two years to the upside.

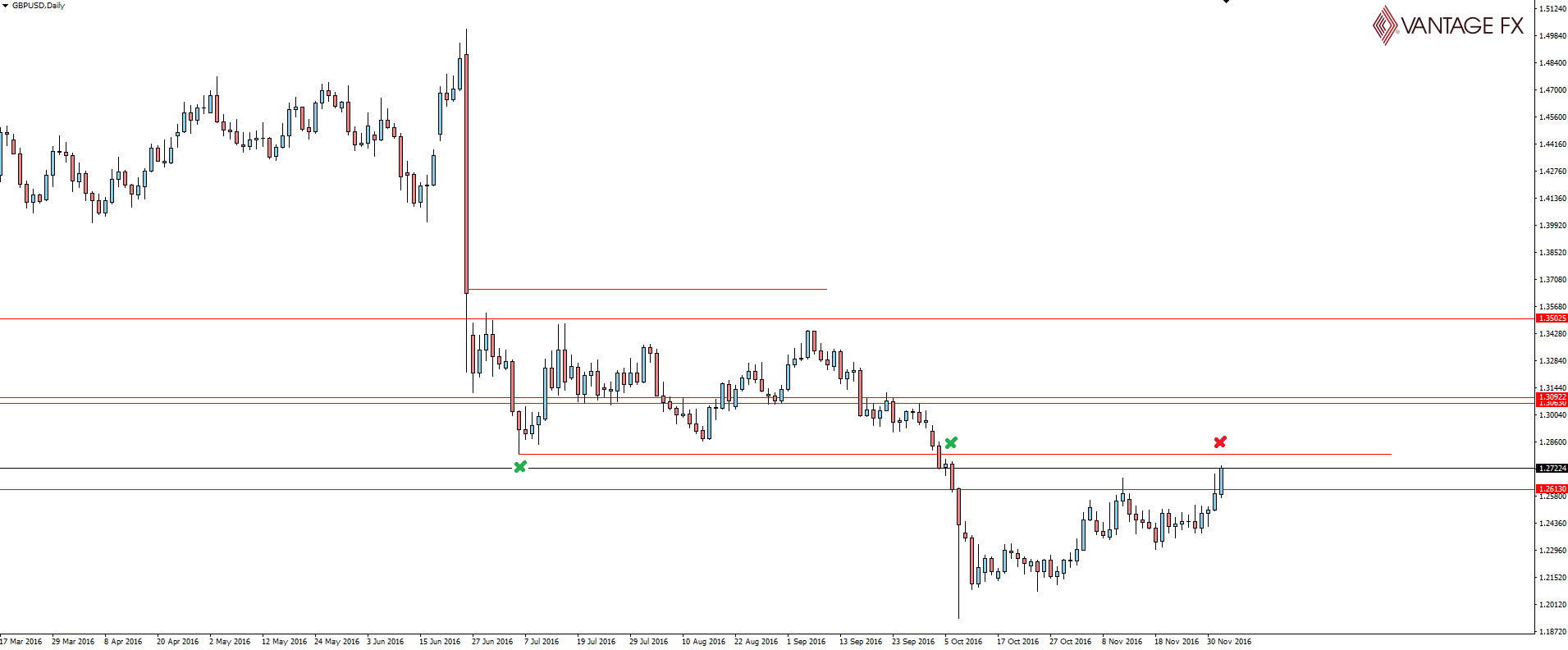

From here we’ve steadily seen Cable rise through the first previous level of weekly support turned resistance, from all the way back in 2009, and has now come to the next major level marked on our charts.

The level was the first swing low after the initial surge of Brexit momentum ran out of steam.

Being still front of mind for traders, we should see some sort of reaction as price heads into the level this week.

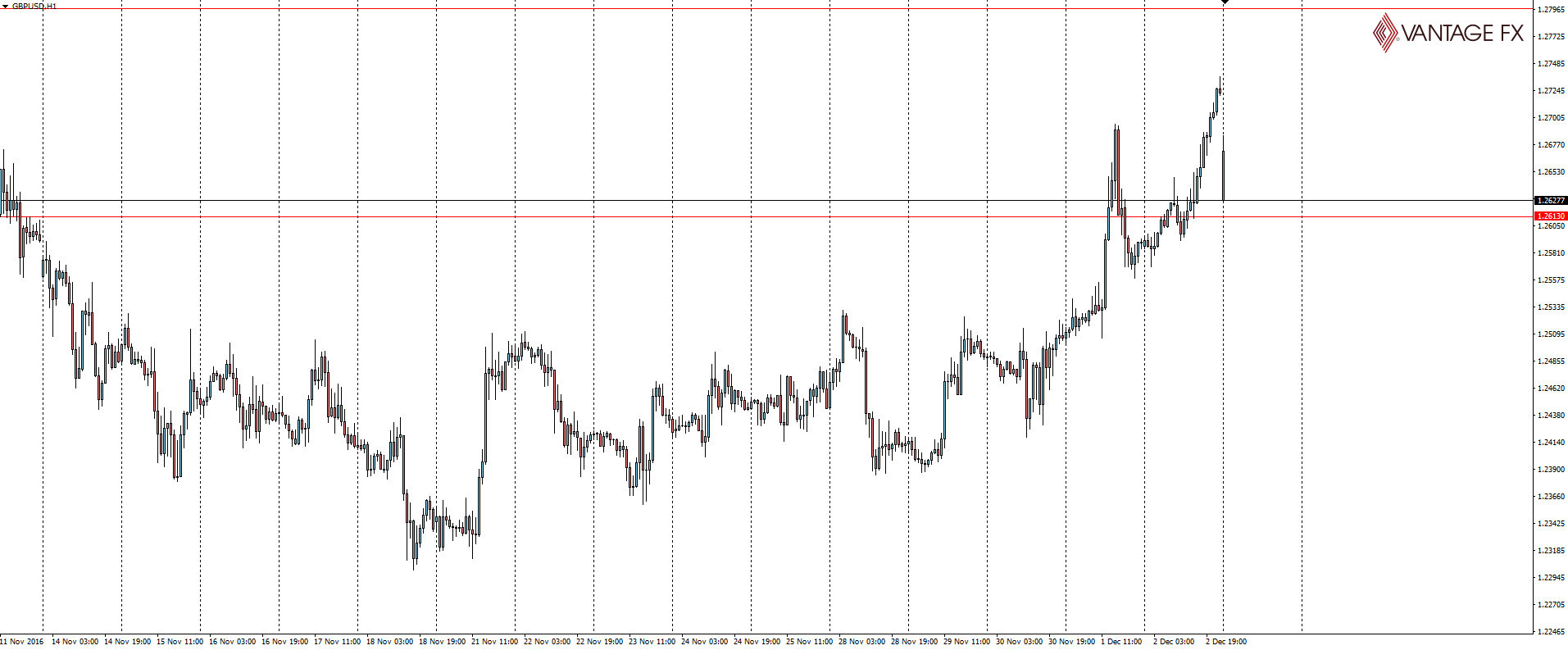

As you can see zooming into the hourly chart, GBP/USD closed about 70 pips from the level on Friday night.

The ‘middle x’ I’ve marked is also quite a significant zone because of the single indecision candle right near the level. That is the sort of area that you expect some sort of reaction out of when price heads back to it and when combined with a higher time frame level like this, it will be hugely significant.

Risk Disclosure: In addition to the website disclaimer below, the material on this page prepared by Forex broker Vantage FX Pty Ltd does not contain a record of our prices or solicitation to trade. All opinions, forex news, research, tools, prices or other information is provided as general market commentary and marketing communication – not as investment advice. Consequently, any person acting on it does so entirely at their own risk. The expert writers express their personal opinions and will not assume any responsibility whatsoever for the Forex account of the reader. We always aim for maximum accuracy and timeliness, and FX broker Vantage FX shall not be liable for any loss or damage, consequential or otherwise, which may arise from the use or reliance on this service and its content, inaccurate information or typos. No representation is being made that any results discussed within the report will be achieved, and past performance is not indicative of future performance.