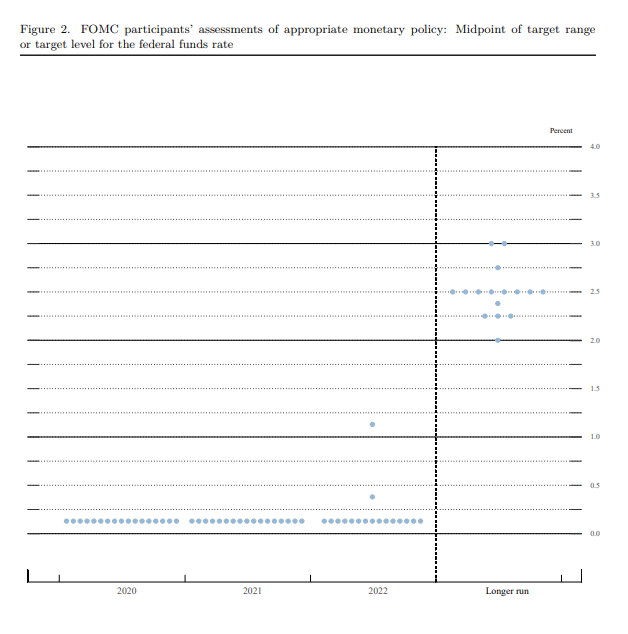

Federal Reserve policymakers took forward guidance up a couple of notches Wednesday, as they almost unanimously forecast benchmark policy rates remaining at their current level, near zero, through 2022.

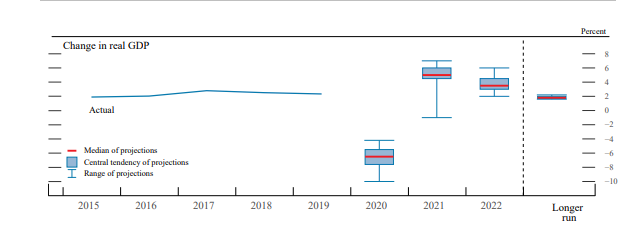

GDP will contract by 6.5 percent this year, according to the median projection of the 17 members of the Federal Open Market Committee in their first forecasting effort since December.

But the FOMC believes it will rebound with 5 percent growth next year and 3.5 percent in 2022.

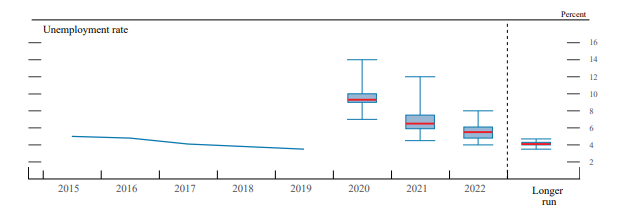

Unemployment will fall to 9.3 percent by the fourth quarter, sinking to 6.5 percent next year and 5.5 percent in 2022. Inflation will remain well short of the Fed’s 2 percent target for the foreseeable future.

The Fed’s crystal ball dims after 2022. Longer run economic projections are almost unchanged from December, with a growth rate of 1.8 percent, unemployment of 4.1 percent and inflation, optimistically, at 2 percent.

Fed Chair Jerome Powell was at pains to stress in the virtual press conference yesterday, following the two-day FOMC meeting, how uncertain any forecast is given the imponderables of the coronavirus pandemic and the measures to contain it. The surprise gain in employment registered in May was welcome, he said, but the Fed is not going to change its views on the basis of one data point.

While reiterating the Fed is ready to do whatever it takes for as long as it takes, Powell did not have a lot of news. Yes, the committee members discussed capping the yield curve and looked at historic instances of yield curve control, but it is a discussion they will continue at later meetings.

The steepening of the yield curve on U.S. Treasuries has become a hot topic, raising the issue of whether the Fed would take action to keep long-term yields from getting too far above shorter term yields.

The Fed policymakers are cautious, and Powell says they think recovery will come only over time as people begin to get comfortable again with being in close quarters at work, but also in restaurants and entertainment venues.

All 17 members of the panel projected the overnight Fed funds rate at 0.125 percent this year and next, with just one looking for a quarter-point hike in 2022 and another for a full percentage point raise.

For now, however, “we’re not even thinking about thinking about raising rates,” Powell said.

The Fed chair would not speculate on recommendations for further fiscal action, but he categorized those undertaken so far as forceful, and above all very quick. There could well be a scenario, depending on the progress in overcoming the virus, where Congress might deem further fiscal action to be necessary, he ventured.

The Fed, for its part, intends to stand pat on monetary policy while maintaining asset purchases with a view to keeping credit flowing and using the full range of its emergency lending tools to ease the impact on companies. Though the Fed had been reducing the rate of purchases, it will now keep them at least at the current rate of $80 billion in additional Treasuries each month and $40 billion in mortgage securities—another welcome piece of forward guidance.

Powell became downright mournful when contrasting the record low unemployment before the pandemic with the record high jobless rate just two months later. “It’s really heartbreaking,” he said. “We want to get it back.”

Stock market investors agreed. The S&P 500 cut short yesterday's rally to close down 0.5 percent despite the Fed’s dovish tone. Nevertheless, they pushed the NASDAQ to a record close of 10,020.35 as tech stocks surged.