Cautious demand for risky assets is returning to global markets after reassurances from Fed members, dampening inflation fears. Key indices in the US and beyond are clinging to a bullish trend. Last night we saw rising demand near important support levels, which remains in place on Friday morning.

In turn, the dollar's recovery has stalled, and it is losing slightly this morning. Assurances of continued soft monetary policy and tolerance of higher inflation piles pressure on the dollar as markets will look for ways to preserve capital from depreciation due to inflation.

As one would expect, Fed member Christopher Waller explained to markets that the surge was due to transitionary factors, tolerating recent price rises above the Fed's 2% target. This fits in very nicely with the updated strategy formalising the tolerance of higher inflation after crises.

We previously talked about the temporary nature of inflation, pointing out that its driver was a surge in used car prices and transport services. While overall inflation figures may have spooked retail investors, funds and professional players used the drop to buy.

The DXY, the dollar index to a basket of the world's six most popular currencies, is losing 0.2% to 90.50 on Friday but remains 0.5% above the lows of the week when the latest sell-off in equity markets kicked off.

On the technical analysis side, traders should look out for a retest of the 89-90 area in the coming days, this year's low. A drop below would be the prologue for the next chapter of the dollar's decline in the global trend that started in 2020, after the correction pullback in January-March.

The technical picture in the stocks is bullish and in favour of a further dollar decline. Since September, the NASDAQ 100 has received support from the Fed and buyers in the markets on the downside, supporting the uptrend channel in place.

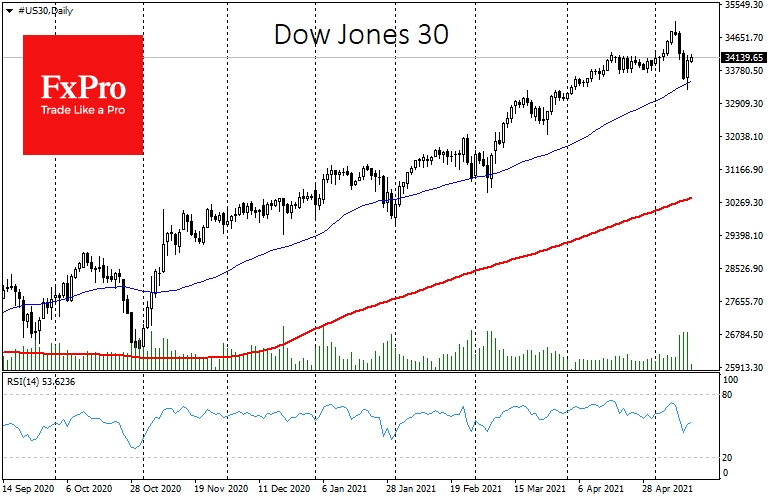

The Dow Jones bounced back after touching the 50-day moving average intraday, as it did earlier in January and March. The S&P 500 also got support from buyers on a pullback to the 50-day moving average for the fourth time this year. We witnessed the same bounce from the 50-day average in the DAX and FTSE100 on Thursday with an impressive intraday reversal.

The bullish sentiment of the markets is also indicated by the markedly increased trading volumes in equities yesterday. They were the highest since March, exceeding volumes during the sell-off earlier in the week.

In commodities, gold and silver are worth looking at. Overcoming recent local highs at $1840 and $27.60 could further encourage bulls to buy.

The FxPro Analyst Team

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Fed Backs Stock Buyers And Returns Pressure On The Dollar

Published 05/14/2021, 07:12 AM

Fed Backs Stock Buyers And Returns Pressure On The Dollar

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.