Investing.com’s stocks of the week

Market Brief

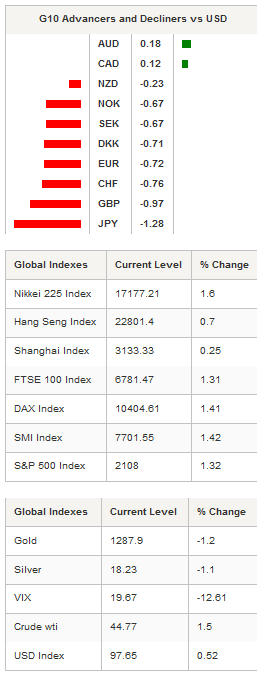

Risk appetite got a boost after the FBI told U.S. congress that it had found no new criminal charges against presidential nominee Hillary Clinton. Risky assets have broadly rallied in response, indicated just how correlated financial assets have become to the US election outcome. Asia regional equity indices were high across the board with the Nikkei climb 1.61%, Hang Seng 0.82% and Shanghai Composite 0.26%.

The USD was higher against G10 and EM currencies. In New Zealand the statistics department of NZ made an unexpected revision to its 3Q CPU data shifting from 0.2% q/q to 0.3% q/q. A manual processing for car registration was believed to have forced the needed to revision. NZD/USD was the big mover in the FX markets first gained in 0.60% on the FBI news, but quickly was overcome by selling pressure falling 0.80% to 0.7300. Gold fell from 1295 to 1286 as risk sentiment improved.

In Japan, the BoJ policy board minutes indicated that policy makers would allow inflation expectations to firm suggesting that uncertainty over the direction of monetary policy stimulus will remain ambiguous for the near term.

USD/JPY rallied to 104.58 from 103.13 on the FBI announcement following the widening of US/JP yields spread. The short-end US yields continued to be highly sensitive to shift in US election outlook. US 2-yr yields declined to 0.81% after hitting 0.83% this AM.

Oil prices rose marginally as statement from OPEC insisted that members remained committed to output cut agreed in September. However, we remain highly skeptical of any production agreement and would see the current rally as an opportunely to reload shorts. In addition, there are indications that Saudi Arabia could actually increase oil production again to help halt budget deficit.

Political tensions between China and Hong Kong intensified as China's legislation ruled that two pro – independence lawmakers from Hong Kong would be unable to join legal body. The move increases the probability that the summer pro-independence demonstrations could start up again. Finally, the US department of Commerce is expected to start a formal investigation into Chinese steel companies regarding moving steel through Vietnam in order to evade US import taxes. Should the investigation get formal approval this will not bode well for Chinese/US trade relations and broader deceleration of global trade.

Moving forward, trading will be limited by expectations on the US presidential elections and light economic calendar. Despite the media hype we see the probability of a Hillary Clinton victory to be dominate. In anticipation we would buy US equities and sell USD/MXN.

Currency Tech

EUR/USD

R 2: 1.1352

R 1: 1.1210

CURRENT: 1.1096

S 1: 1.0822

S 2: 1.0711

GBP/USD

R 2: 1.2857

R 1: 1.2477

CURRENT: 1.2267

S 1: 1.2083

S 2: 1.1841

USD/JPY

R 2: 111.45

R 1: 107.49

CURRENT: 103.56

S 1: 102.80

S 2: 100.09

USD/CHF

R 2: 1.0093

R 1: 0.9999

CURRENT: 0.9707

S 1: 0.9843

S 2: 0.9632