The eyes of the forex world shift across to the local scene here in Australia today, with the latest RBA rates decision the highlight on the economic calendar.

While today’s decision isn’t expected to deliver a cut, looking at the guidance for next meeting is where the price action will come from.

If we remember back a couple of weeks ago in this morning blog, we spoke about Australian Prime Minister Turnbull throwing a spanner into the works of the AUD/USD trading machine:

“What to expect from Glenn Stevens and the Aussie dollar changed dramatically yesterday, as Australian Prime Minister Malcolm Turnbull announced that parliament would be recalled early to try to push Australian Building and Construction Commission legislation through the senate ASAP.”

“If the bill doesn’t go through the Senate then an early federal election will be called. A Federal election campaign that the RBA will surely at all costs avoid cutting rates in the midst of.”

What I didn’t speak about however, was that the next RBA rate decision in May actually falls on the day the Australian Federal Budget is released.

My thinking would be that again, the RBA’s track record says that they are much more likely to sit on their hands come May, but the economist survey actually goes from a unanimous ‘hold’ decision today, to a 25% cut in May. Do you follow the smartest guys in the room, or do you avoid them…?

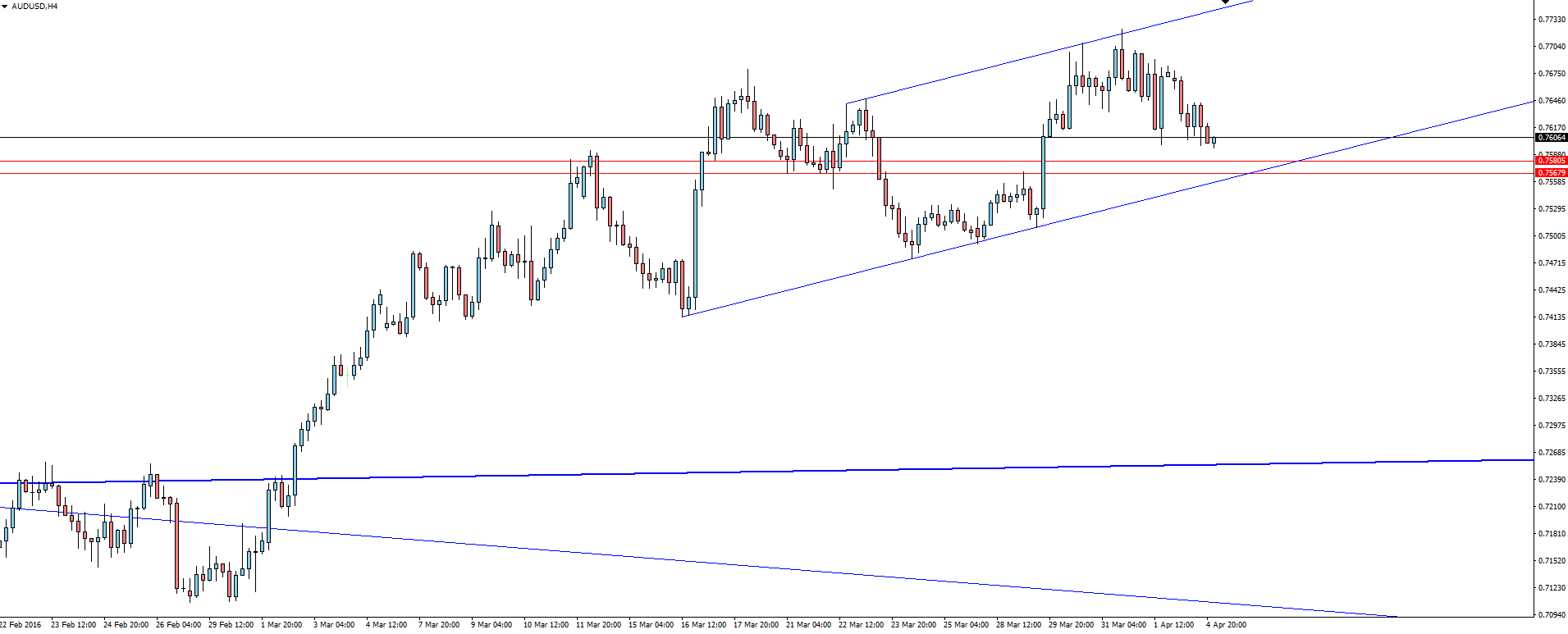

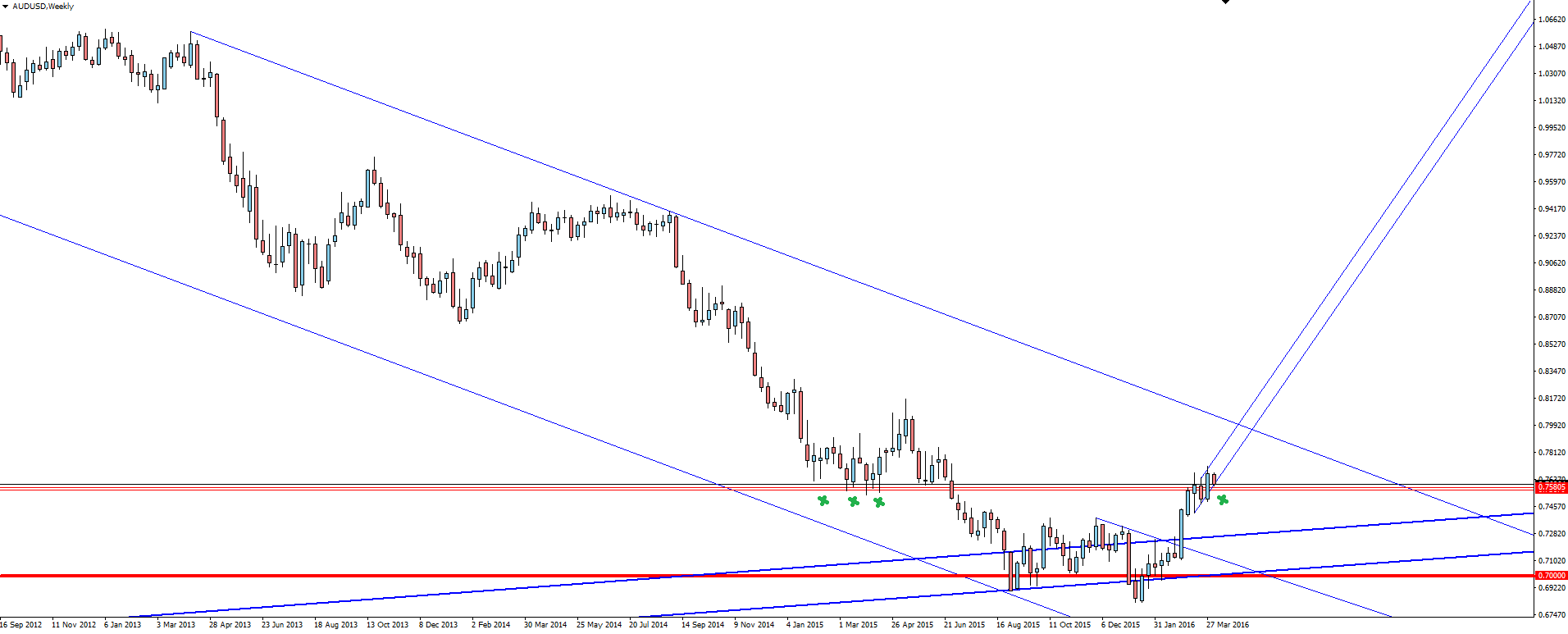

The 4 hourly is approaching the bottom of a lower time frame bullish channel. I like this because the red horizontal support/resistance level that just happens to line up with the bottom of the channel is a weekly level here:

AUD/USD Weekly:

Price has chopped through it both up and down recently on the lower time frame which weakens the level, but it is a noticeable level of confluence which could very well come into play today.

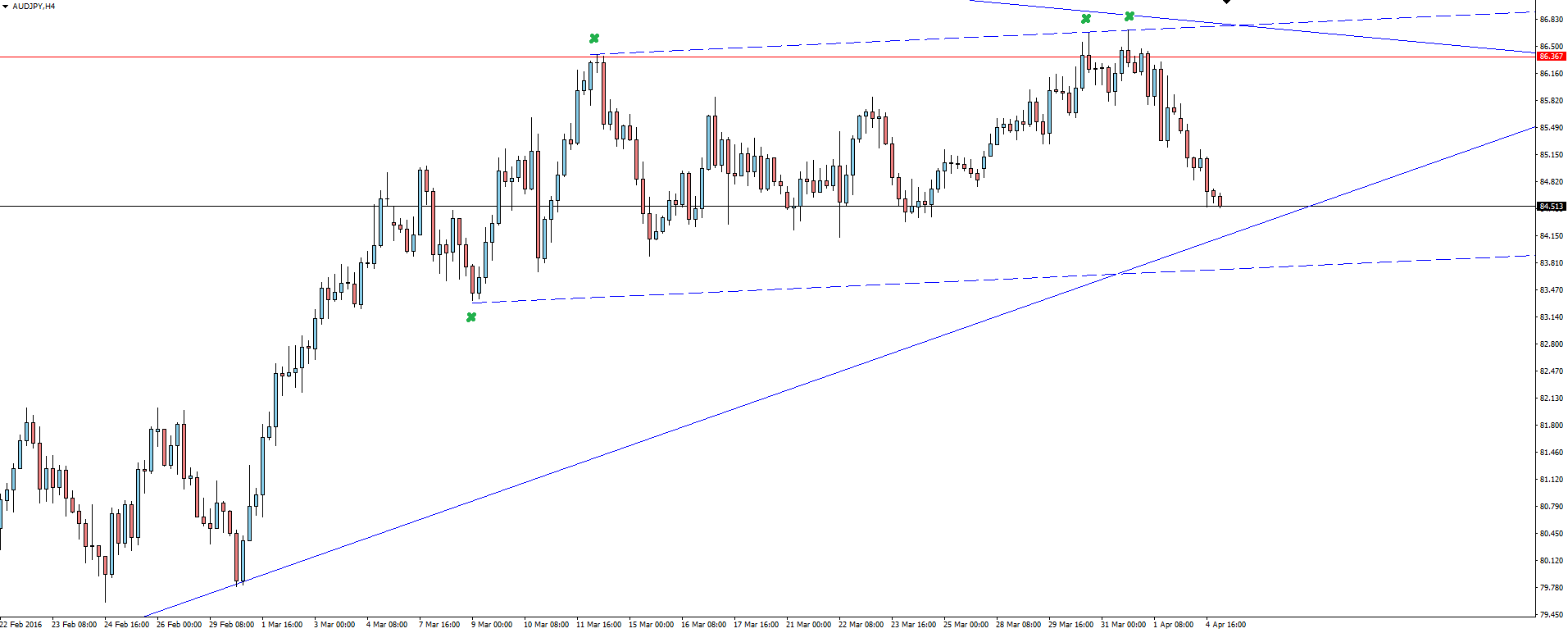

Chart of the Day:

These Aussie feature blogs seem to always have AUD/JPY as my go to ‘alternate’ currency pair and the trend continues today. The trend is your friend, as they do say!

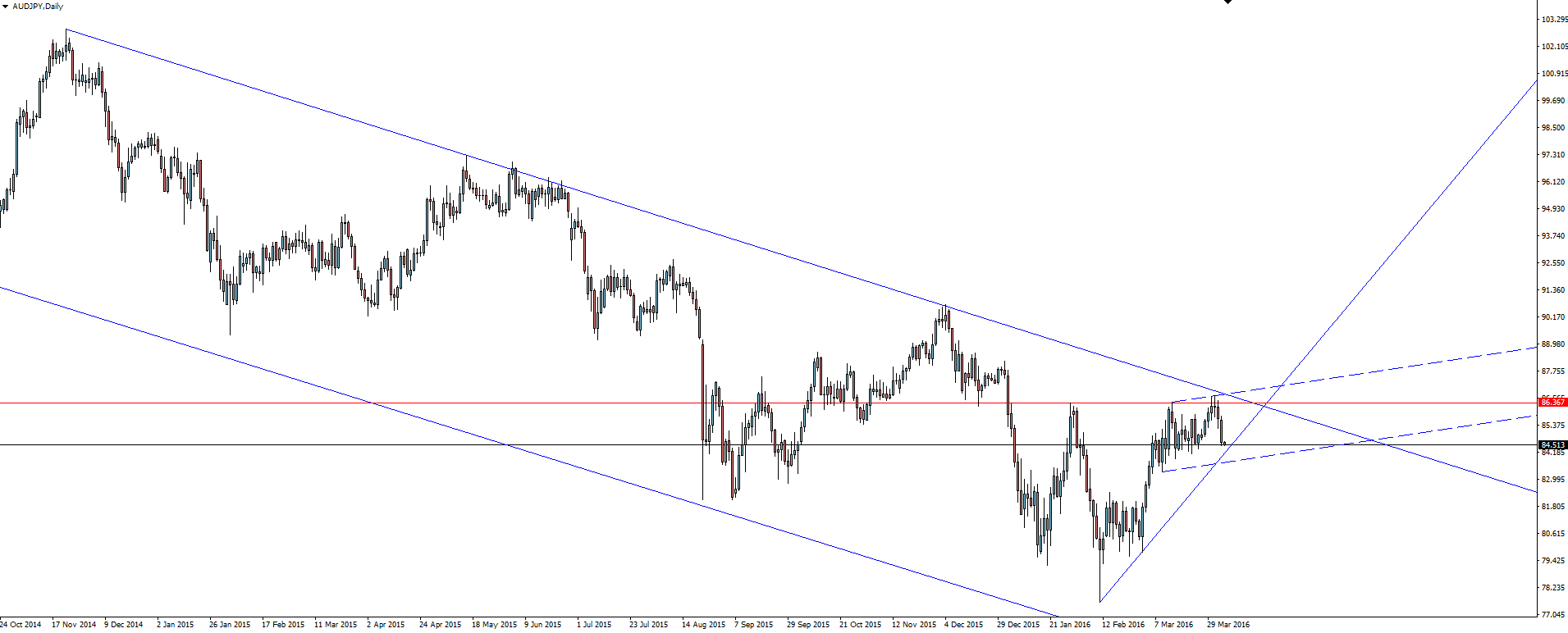

AUD/JPY Daily:

The daily shows a huge bearish channel which is pretty self explanatory.

Within that channel we have a couple of lower time frame, bullish levels to manage our risk around. This is where you need to make a trading decision. Do you fade into the short term level, or do you play for an early breakout lower, banking that the higher time frame resistance level that price has come out of on the daily chart above is the main one.

On the Calendar Tuesday:

AUD Trade Balance

AUD Cash Rate

AUD RBA Rate Statement

GBP Services PMI

CAD Trade Balance

USD ISM Non-Manufacturing PMI

NZD GDT Price Index

Risk Disclosure: In addition to the website disclaimer below, the material on this page prepared by Forex broker Pty Ltd does not contain a record of our prices or solicitation to trade. All opinions, news, research, prices or other information is provided as general news and marketing communication – not as investment advice. Consequently any person acting on it does so entirely at their own risk. The experts writers express their personal opinions and will not assume any responsibility whatsoever for the actions of the reader. We always aim for maximum accuracy and timeliness, and Australian Forex Broker Vantage FX on the MT4 platform, shall not be liable for any loss or damage, consequential or otherwise, which may arise from the use or reliance on this service and its content, inaccurate information or typos. No representation is being made that any results discussed within the report will be achieved, and past performance is not indicative of future performance.