A slightly unusual Asian session ahead, with RBA Governor Glenn Stevens due to speak about ‘the global financial sector resilience, volatility, and connectedness’ at the Australian Securities and Investment Commission Annual Forum in Sydney this afternoon.

To satisfy your OCD (and come on, we’re all traders here which means we all have at least a mild case), we still have the usual 11.30am Sydney releases in the form of second tier Australian HPI as well as the RBA’s Assistant Governor Malcolm Edey, due to participate in a panel discussion about ‘risks related to central counterparties’ at the Australian Securities and Investment Commission Annual Forum in Sydney.

What to expect from Glenn Stevens and the Aussie Dollar changed dramatically yesterday, as Australian Prime Minister Malcolm Turnbull announced that parliament would be recalled early to try to push Australian Building and Construction Commission legislation through the senate ASAP. (For those playing at home, the bill is to restore this building industry watchdog as well as a second to set up a commission that will monitor unions.)

“Australian political jargon, blah blah blah who cares”, I can hear you saying already. Well it actually does have a major impact on Forex markets, so bear with me. If the bill doesn’t go through the senate then an early federal election will be called. A Federal election campaign that the RBA will surely at all costs avoid cutting rates in the midst of.

With ANZ one of the first to revise their calls for a further rate cut immediately on the back of the news, the Aussie dollar could be in for a bit of a re-pricing as the news is digested worldwide.

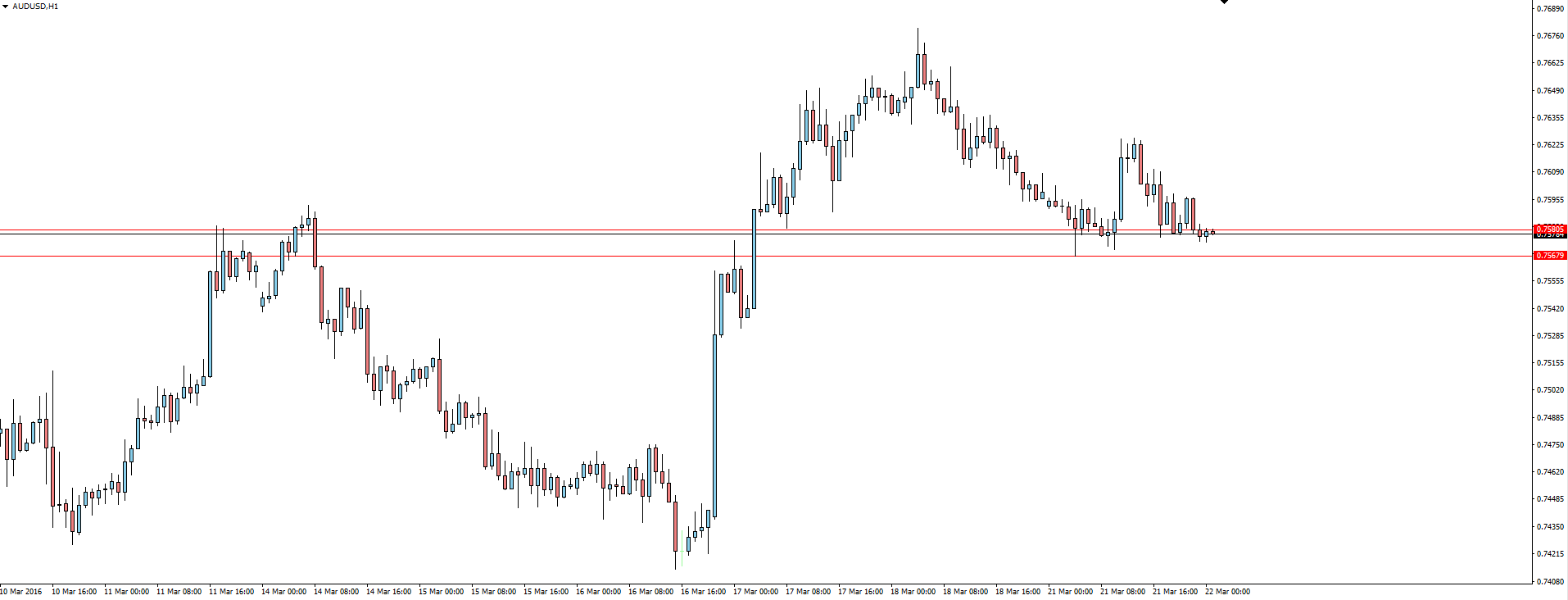

AUD/USD Hourly:

Click on chart to see a larger view.

Looking at the AUD/USD hourly chart, the red support/resistance zone that price is flirting with just happens to be a previous weekly swing low. As it’s a weekly resistance level, the hourly price action of a possible breakout then retest might not be as clean as the textbooks would lead you to believe, but the level is there to plan playing from the long side if you’re that way inclined.

The other risk to AUD/USD longs is the risk of Stevens jaw-boning the currency down during his afternoon speech. This is one that I’m not too sure about though, and with the headline expectation of some sort of artificial downward pressure on the Aussie, actually see the greater risk being a miss in expectations and spike to the upside if nothing comes.

Really, we don’t know what Stevens or the RBA thinks about the election situation yet. This is where both the risk and opportunity lies in playing the Aussie from the long side.

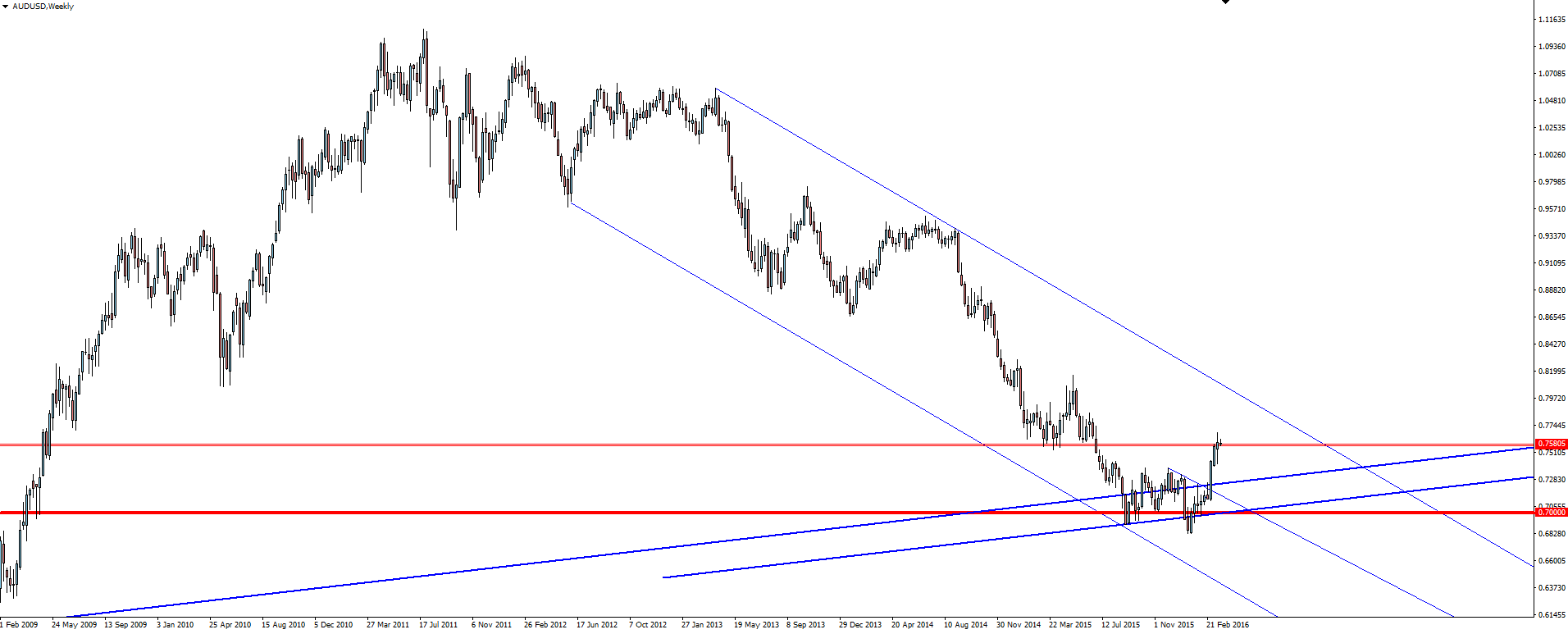

Chart of the Day:

I know that the AUD/USD weekly chart doesn’t change much and I include it in my blogs a lot, but I couldn’t publish the above hourly chart without the higher time frame context that the weekly provides.

AUD/USD Weekly:

This is where you can see the weekly swing low I’m referring to on the hourly chart above. That little red line is actually the hourly zone on that chart.

Yes, context indeed!

On the Calendar Tuesday:

AUD RBA Gov Stevens Speaks

EUR German Ifo Business Climate

GBP CPI y/y

EUR German ZEW Economic Sentiment

Risk Disclosure: In addition to the website disclaimer below, the material on this page prepared by ASIC regulated Forex broker Vantage FX Pty Ltd does not contain a record of our ECN Forex broker prices or solicitation to trade. All opinions, news, research, prices or other information is provided as general news and marketing communication – not as investment advice. Consequently any person acting on it does so entirely at their own risk. The experts writers express their personal opinions and will not assume any responsibility whatsoever for the actions of the reader. We always aim for maximum accuracy and timeliness, and Vantage FX on the MT4 platform, shall not be liable for any loss or damage, consequential or otherwise, which may arise from the use or reliance on this service and its content, inaccurate information or typos. No representation is being made that any results discussed within the report will be achieved, and past performance is not indicative of future performance.