Covered call writing and put-selling can be used in most market conditions including bear markets. In my books and DVDs, I detail the use of in-the-money call options (strikes lower than current market value), out-of-the-money put options (also lower than current market value) and securities with low-implied volatility like exchange-traded funds (ETFs). In this article we will use all three of these criteria and demonstrate the process of establishing our defensive positions using a popular ETF, PowerShares QQQ Trust Series 1 (NASDAQ:QQQ).

What is QQQ?

This is the ticker symbol for the Nasdaq 100 Trust, an ETF that offers exposure to the 100 largest non-financial stocks that trade on the Nasdaq exchange. It is a popular ETF with more-than-adequate trading volume and option liquidity.

How do we establish our defensive positions with QQQ or other ETFs?

First and foremost, we must establish our initial time value return goals (we do not include intrinsic value in our return calculations). If our goal for individual stocks is 2% – 4% per month, let’s use 2% for this ETF with the understanding that this target can be adjusted based on our personal risk tolerance. ETFs, in general, generate lower option returns than individual stocks. Next, we view the options chain and select strikes that meet our 2% criteria and also offer downside protection of our call and put positions…in-the-money calls and out-of-the-money puts. We will be using the multiple tab of the Ellman Calculator for call calculations and the BCI Put Calculator for put computations.

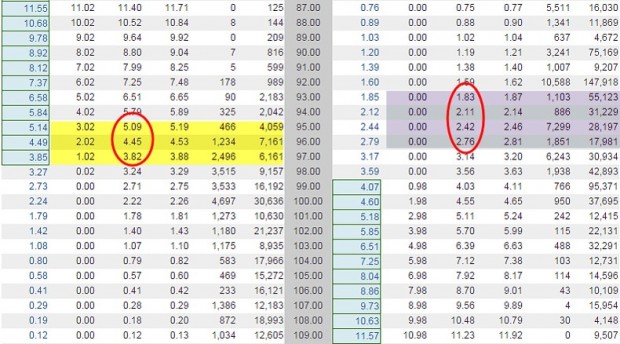

QQQ (trading at $98.02) options chain for 1-month March 18, 2016 expirations

Highlighted in the yellow field on the left side of the screenshot are call strikes we will evaluate and in the purple field on the right are put strikes to be evaluated.

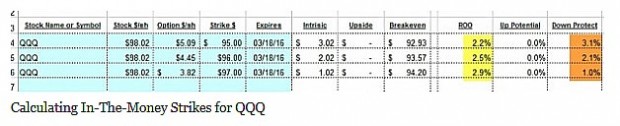

Covered call writing calculations using the multiple tab of the Ellman Calculator

All three in-the-money call strikes meet our 2% criteria. The higher the time value returns (ROO), the lower the downside protection (profit protection, not breakeven). The column to the left of ROO shows the breakeven points. All three choices represent reasonable defensive positions to consider.

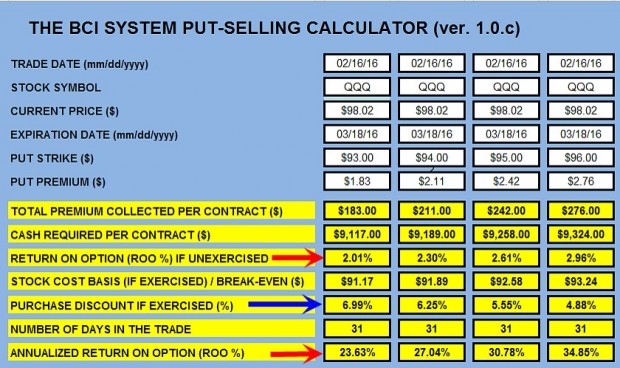

Put-selling calculations using the BCI Put Calculator

All four out-of-the-money put strikes meet our initial (unexercised) return goals as highlighted by the red arrows. The row adjacent to the blue arrow calculates the percent a stock must decline to reach the breakeven point. As an example, the $93.00 out-of-the-money put strike guarantees a 1-month return of 2.01% as long as share value does not decline by more than 6.99% by expiration. All four strikes offer reasonable defensive put-selling positions to establish in a bear market environment.

Discussion

Option-selling can be crafted to most market conditions. In bear markets we take defensive positions by selling in-the-money call options and out-of-the-money put options. Consideration should also be given to exchange-traded funds which generally (there are exceptions) have lower implied volatility than individual stocks.

Next live event- Workshop

July 16, 2016

American Association of Individual Investors

Washington DC Chapter

Northern Virginia Community College

9 AM – 12:30 PM

Market tone

Global declined this week after an initial boost on dovish commentary from US Federal Reserve Chair Janet Yellen. Crude oil prices rose to $49.31 from $48.11 last week, and global Brent crude prices dipped to $49.62 from $49.72 a week ago. The Chicago Board Options Exchange Volatility Index (VIX) rose to 17.03 from 14.48 last week. This week’s reports and international news of interest:

- Concerns about the economic outlook have been raised by recent labor data, Fed chair Yellen said in a speech on Monday, just days after a disappointing employment report. Markets give a June rate hike extremely low odds, and a July hike is now also seen as unlikely

- Record low 10-year bond yields were recorded this week in Germany, Japan and the United Kingdom as the Fed backed away from an expected summer rate hike

- The average yield on European investment-grade corporate bonds is now below 1% while some issues trade with negative yields

- Switzerland held a referendum on a universal basic income last weekend. The notion of sending each adult 2,500 Swiss francs a month and each child 625 — with no strings attached — was soundly defeated at the polls

- The World Bank downgraded its global GDP forecast which now sees a 2016 growth rate of just 2.4%, down from its 2.9% January forecast. Its 2017 growth outlook was trimmed to 2.8% from 3.1%

- Economic growth in the eurozone was revised higher in the first quarter, coming in at 0.6%, up from the prior 0.5% reading. On an annualized basis, growth grew by 1.7%. That’s the fastest rate in 12 months. Inflation, however, remains far below the ECB’s target of near 2%

THE WEEK AHEAD

- China reports direct foreign investment, retail sales and industrial production figures on Monday, June 13th

- The eurozone reports industrial production data on Tuesday, June 14th

- The United States reports retail sales data on Tuesday, June 14th

- The Swiss National Bank holds a quarterly monetary policy meeting on Thursday, June 16th

- Eurogroup finance ministers meet on Thursday, June 16th

- The Philadelphia Fed’s manufacturing index is released on Thursday, June 16th

For the week, the S&P 500 was unchanged for a year-to-date return of +2.70%.

Summary

IBD: Market in confirmed uptrend

GMI: 6/6- Buy signal since market close of May 25th

BCI: Cautiously bullish favoring out-of-the-money strikes 3-to-2

WHAT THE BROAD MARKET INDICATORS (S&P 500 AND VIX) ARE TELLING US

The charts are demonstrating signs of modestly bullish market movement. In the past six months the S&P 500 has been moved up 2.0% and the VIX has moved down by 11% to 17.03. The short-term trend is slightly bullish.