A new phase in the markets began this month. The Federal Reserve ended its QE3+ purchases. The Bank of Japan unexpectedly and dramatically stepped up its asset purchases under its QQE operations. The government's largest pension fund announced aggressive portfolio diversification plan.

Contrary to some press reports, the ECB remained unanimous in favor of additional measures to arrest the deflationary headwinds, if needed. The staff was instructed to accelerate work on other assets that can be purchases to expand the ECB's balance sheet back toward the 2012 peak.

The softening of the flash PMI, and expectations that next week's flash HICP inflation estimate shows softer prices, underscored the likelihood that more measures will be needed, and before the weekend, Draghi expressed some urgency. This raises the prospects of more action at the ECB meeting in early December. Previously, it appeared more likely that the ECB would wait until next year, to see the participation in the next month's TLTRO and the beginning of the ABS purchase plan.

In the UK, official guidance, including the Quarterly Inflation Report, validated the investors deferring the first hike from next spring until the end of the year. An increasing number of economists are pushing it out until 2016. Whereas the BOJ and ECB are providing more monetary support, the BOE indicates it will not make conditions less accommodative for longer.

The People's Bank of China joined the party before the weekend. It announced the first cut in the benchmark one-year deposit rate in two years. The 25 bp cut took many by surprise, as the PBOC was seen continuing to target liquidity injections, in part, ostensibly to minimize stimulating shadow banking activities.

The divergence has driven the dollar higher. There are two notable exceptions among the major currencies. The New Zealand dollar has been the strongest this month, gaining 1.6% against the US dollar. This is most likely a function of favorable economic news, leaving aside the decline in milk prices, for the domestic economy. The other exception is the Canadian dollar. As we have noted, it is common for the Canadian dollar to do well on the crosses in a strong US dollar environment. In addition, firmer than expected inflation data ahead of the weekend helped spur a short-squeeze, helping lift the Loonie to its best level since October 31.

The yen has been the weakest of the majors this month, losing about 4.7% against the dollar. The swing in interest rate expectations for the BOE has seen sterling slip 2.0%, more than twice the euro's 0.9% decline, thus far, in November. The Australian dollar is still off about 1% this month, even after recovering about 0.8% in response to the Chinese rate cut.

The prospects of the ECB taking more action as early as December will likely continue to weigh on the euro. In the middle of last week, the euro rose to a 3-week high near $1.2600. This corresponds to a downtrend line drawn off three highs in the second half of October, beginning with the October 15 high near $1.2885. Being turned back from the trend likely signals the resumption of the downtrend, even though market positioning (in the futures market) and sentiment seem nearly as extreme as ever. A break of the $1.2360 area would target $1.2230, on the way to $1.20 in the coming weeks.

The dollar was trading below JPY110 before the October 31 surprise moves from Japan. There were very little official comments about the currency market until the dollar approached JPY119. Then Finance Minister Aso expressed concern about the pace of the move, spurring a modest pullback. However, economic adviser Hamada's comments suggest two things. One, if the pace is a bit troublesome, the direction is desirable. Two, official jawboning, as we anticipated, is likely to rise as the JPY120 level is approached. Dollar support is pegged around JPY117.30, which also corresponds to the 5-day moving average, which it has not closed below since October 16.

Sterling is trading sideways in a box. The $1.5600 area has repeatedly been tested in recent sessions. The $1.5740 area marks the top of the box. Above there is what may prove to be a more formidable resistance near $1.58. While we expect sterling to outperform the euro on a trend basis, it is still likely to decline against the dollar.

The dollar-bloc looks to be in a superior technical position compared with the euro, yen, and sterling. The RSI and MACDs are consistent with follow through gains in the Canadian dollar after the strong advance before the weekend.

There are some important caveats though. First, the Canadian dollar has had several short-lived bounces during this five-month downtrend. This one is already getting large in terms of the magnitude of past corrections. Second, the US dollar found bids near the 50-day moving average (~CAD1.1215), which has generally acted as support for the greenback in trek from around CAD1.06 in July to CAD1.1470 earlier this month. Below CAD1.1200 nearby support is seen around CAD1.1160 and then CAD1.11.

The Australian dollar bounced strongly in response to the surprise rate cut by the PBOC. It does look like it is trying to carve out a bottom. However, the key level is $0.8800, and the Aussie first needs to close above its 20-day moving average which comes just below $0.8710. The technical indicators are constructive, but it is a counter-trend move.

The dollar edged higher against the Mexican peso over the past week but showed little momentum as it approached the multi-month high set on November 4 near MXN13.68. It requires a break of MXN13.50 to signal something of interest. The political backlash against the government may endanger its larger reform efforts.

Turning to the U.S. 10-Year Treasury yield, technical indicators are not giving strong signals as to the direction of the breakout from the 2.30%-2.40% range. This coming week is holiday-shortened, and it very well may mean that the ranges are largely respected, perhaps until the run-up to the employment data.

The S&P 500 gapped higher before the weekend, arguably lifted by Draghi's sense of urgency and the PBOC's rate cut. That gap exists between 2053.84 (Thursday's high) and 2057.46 (Friday's low). This gap is technically significant, and short and medium-term traders will monitor it. Just as nature abhors a vacuum, so do prices, and if it is a "normal" gap it will be filled over the next few sessions. It could be a breakaway gap, suggesting an acceleration of the advance. It might turn out to be an exhaustion gap, typically at the end of an advance, a last hurrah, if you will, before a correction unfolds.

Another insight we'd like to share is about the relative performance. The S&P 500 has generally outperformed the European bourses, but this may be changing. Over the past week, the Dow Jones STOXX 600 advanced twice as much as the S&P 500, and this brought the month-to-date gain into equilibrium. Of course, one week a trend does not make, and the outlook of the exchange rate should be integrated into the decision process. All we are saying is that it may be worth monitoring. If the global liquidity conditions are still ample post-QE3+, and one expects the business cycle to bottom, European equities seem to be a good risk-reward way to expect that view.

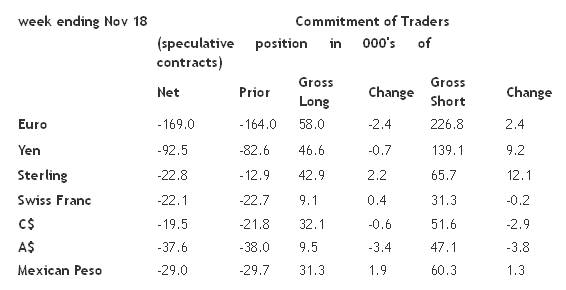

Observations based on the speculative positioning in the futures market:

1. Position adjustments were minor in the Commitment of Traders reporting week ending November 18. There were only two gross positions adjusted by more than 5k contracts. The gross short yen position grew 9.2k contracts to 139.1k. The gross short sterling position rose 12.1k contracts to 65.7k.

2. The net short position in the U.S. 10-year Treasury futures rose to 127k contracts from 112k. This was the result of a small add by the longs (8.3k contracts to 398.9k) and a larger sale by the shorts (+23.2k contracts to 526.2k).

3. Given how closely the capital markets are watching oil, we note that the speculative long position in the futures market eased 21.5k contract to stands to 255.3k. The gross longs were culled by nearly 38.5k contracts to 403.7k. Almost 17k gross short contracts were covered to leave 148.4k.