As I am beginning this post on Monday evening, the net change in the ES is +0.00, and I suspect things will be ungodly boring until the FOMC’s big event on Wednesday, at which time they do their usual schtick and also discuss details of slowly unwinding their gargantuan $4.5 trillion of assets they acquired for the noble purpose of making the Rich even Richer.

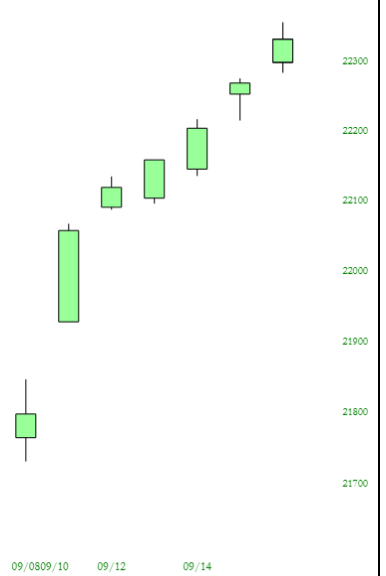

Of course, looking at the Dow 30, it sure doesn’t seem like anyone is worried about equities……..

Solid green, day after day, to record highs, day after day. All while what little is left of volatility gets smothered completely:

It seems like an eternity ago (although it was just a month) when the “fire and fury” of North Korea was all anyone could think about. Those dips in the Korean equity market are long gone, as shown here via the KOSPI index.

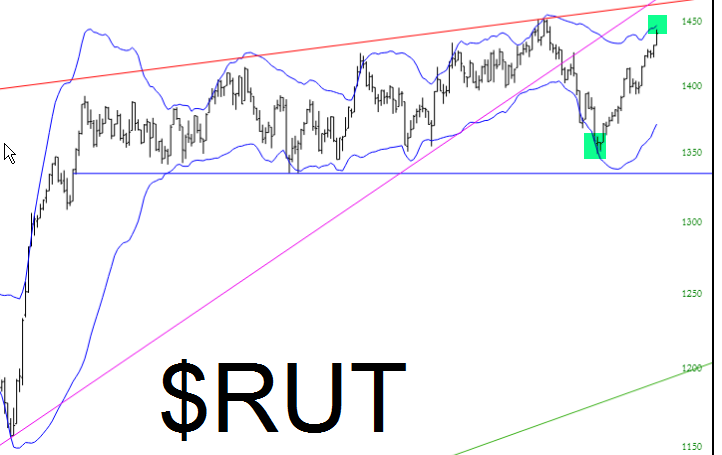

For myself, my principal focus remains the small cap index, which has traversed the entire width of the Bollinger Bands (see green highlights).

I’ve got puts on the RUT (dated November 17th, so I’ve got plenty of time), as well as a few ETFs, including the consumer discretionary (which, even on a day like Monday, went down with a bearish reversal pattern):

…..as well as retail, which has been rejected twice by the red horizontal:

See you in the morning.