Effective on December 4th Bemis (NYSE:BMS) was moved to the S&P Midcap 400 Index from the S&P 500 Index. BMS was replaced by Royal Caribbean Cruises (NYSE:RCL). RCL was formally a member of the S&P 400 Midcap Index. On an ongoing basis S&P Dow Jones Indices evaluates the companies that comprise their various indices. A number of factors are required for a particular company to be included in an index and for that matter to be removed. Importantly, S&P notes, "...an index constituent that appears to violate criteria for addition to that index is not deleted unless ongoing conditions warrant an index change."

Keeping in mind the factors used by S&P as detailed in the above link, Bemis had a market capitalization of approximately $4.1 billion and Royal Caribbean's market cap was $17.4 billion at the time of their index changes. From an unadjusted market capitalization perspective, S&P currently uses the following guidelines for each respective index.

- S&P 500 Index: $5.3 billion or more.

- S&P Midcap 400 Index $1.4 billion to $5.9 billion.

- S&P SmallCap 600 Index $400 million to $1.8 billion

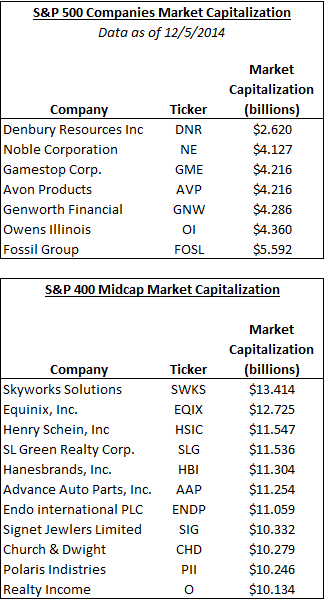

Below is a list of those companies in the S&P 500 Index that have the smallest market caps and those companies in the S&P Midcap 400 Index that have the largest market caps.

Not surprisingly I suppose, conclusions are mixed as to whether it is a positive or negative to be added or deleted from the Index (here, here and here). Many reasons can result in a company being added/removed from the index. For example, removal can occur because a company's business prospects are declining and in that case future stock performance may be weak. On the other hand, a company may have sold portions of their business resulting in a smaller capitalized company that may actually perform well going into the future. One of the white papers at a link noted earlier in this paragraph concludes stocks added to the S&P 500 Index underperform due to the application of a larger discount rate because of potentially higher stock price volatility. For investors, understanding why a firm is added or deleted from an index is important. Evaluating a company's long term business prospect is more important than whether or not it is in a particular index.