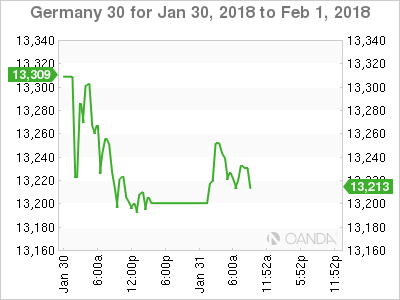

The DAX and CAC indices have posted slight gains in the Tuesday session. The DAX is trading at 13,217.50, up 0.15% since the close on Tuesday. The CAC is following a similar trend, trading at 5484.90, for a 0.20% gain since the Tuesday close. The Eurozone CPI Flash Estimate ticked lower to 1.3%, its lowest level since July 2017. However, investors focused on the fact that the reading matched the forecast.

German releases continue to be sluggish this week. Retail Sales slipped 1.9%, well short of the estimate of -0.3%. It was the sharpest decline since June 2015. Preliminary CPI declined 0.7%, the weakest reading since January 2016. There was some good news, as unemployment claims dropped by 25 thousand, beating the estimate of 16 thousand. Eurozone numbers for fourth quarter 2016 remain solid, the unemployment rate has been steadily dropping, and remained at 8.7% in December, matching the forecast. On Tuesday, Preliminary Flash GDP for the fourth quarter remained unchanged at 0.6%, matching the forecast.

With eurozone inflation well under the ECB target of 2 percent, the ECB has some breathing room regarding its stimulus program (QE), which is scheduled to terminate in September. A stronger eurozone economy has raised speculation that the ECB could wind up QE and shift to normative policy, and perhaps even raise interest rates. However, ECB members have been cautious, trying to keep in check any market enthusiasm about a major change in policy. Last week, ECB President Mario Draghi went as far as saying that QE could be extended or increased if necessary.

Economic Calendar

Wednesday (January 31)

- 2:00 German Retail Sales. Estimate -0.3%. Actual -1.9%

- 2:45 French Preliminary CPI. Estimate -0.3%. Actual -0.1%

- 3:00 Spanish Flash CPI. Estimate 0.9%. Actual 0.5%

- 3:55 German Unemployment Change. Estimate -16K. Actual -25K

- 4:00 Italian Monthly Unemployment Rate. Estimate 10.9%. Actual 10.8%

- 5:00 Eurozone CPI Flash Estimate. Estimate 1.3%. Actual 1.3%

- 5:00 Eurozone Core CPI Flash Estimate. Estimate 1.0%. Actual 1.0%

- 5:00 Eurozone Unemployment Rate. Estimate 8.7%. Actual 8.7%

- 14:00 US FOMC Statement

- 14:00 US Federal Funds Rate. Estimate

Thursday (February 1)

- 3:55 German Final Manufacturing PMI. Estimate 61.2

- 4:00 Eurozone Final Manufacturing PMI. Estimate 59.6

*All release times are GMT

*Key events are in bold

DAX, Wednesday, January 31 at 7:05 EDT

Open: 13,216.50 High: 13,270.50 Low: 13,211.00 Close: 13,217.50