European stock markets are seeing green on Tuesday, and the DAX and CAC have both posted strong gains. The DAX is up 1.15%, while the CAC has gained 0.81%. There is just one event on the schedule. Eurozone Retail PMI improved to 52.3, pointing to slight expansion. On Wednesday, the eurozone releases revised GDP and France publishes trade balance.

The “tariff tussle” continues in the US, but investors could be treated to a tug-of-war between President Trump and Congress. Trump appears intent on applying stiff tariffs on steel imports, much to the consternation of the European Union and other US trading partners. Despite fears that that the tariffs could spark an all-out trade war, the markets have reacted positively to strong opposition to the tariff proposal from senior Republican lawmakers, including House Speaker Paul Ryan. If Trump doesn’t back down, the Republicans could even resort to legislation to limit Trump’s authority on tariffs. The announcement of the tariffs last week sent stock markets lower, and if Trump moves ahead with the tariffs, we can expect the stock markets to move sharply lower.

The ECB will be on center stage on Thursday, as the Bank will set the benchmark rate, followed by a press conference with Mario Draghi. The interest rate has been pegged at a flat 0.0% for the past two years, and no change is expected. The markets will be keeping a close eye on the language of the rate statement, in particular, whether the easing bias stance will be removed. If so, this would likely be interpreted as a plan to eventually tighten policy and would be bullish for the euro. Inflation remains weak, so there is little pressure on the ECB to tighten policy anytime soon. Recent indicators show that inflation in the eurozone is steady, but remains well below the ECB target of around 2 percent. Eurozone CPI dipped to 1.2% in February, down from 1.3% in January.

Tuesday (March 6)

- 4:10 Eurozone Retail PMI. Actual 52.3

Wednesday (March 7)

- 2:45 French Trade Balance. Estimate -3.7B

- 5:00 Eurozone Revised GDP. Estimate 0.6%

*All release times are EST

*Key events are in bold

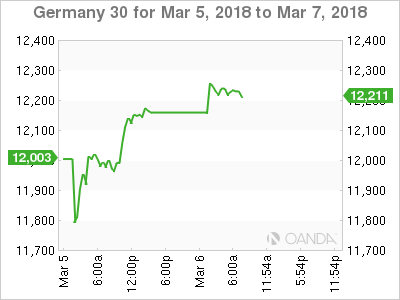

DAX, Tuesday, March 6 at 6:50 EDT

Previous Close: 12,090.87 Open: 12,240.00 High: 12,262.41 Low: 12,192.00 Close: 12,229.00