Investing.com’s stocks of the week

Forex

USD

The dollar is hovering around a 10-month low as the US healthcare reform bill implodes. This is the worst defeat for Trump’s Republican party since they took charge of Washington.

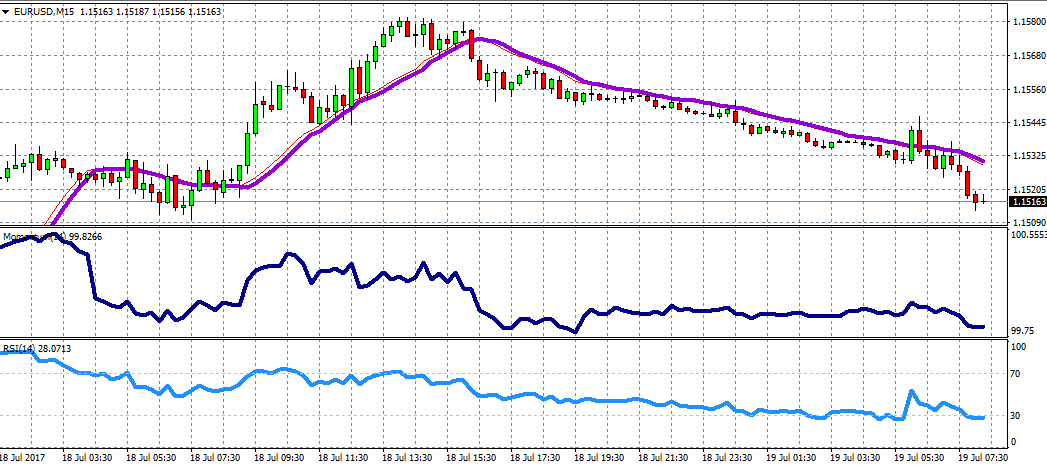

EUR

The euro slipped from a 14-month high just before the European Central Bank meeting.

EURUSD

Possible bullish movements towards 1.155 supported by the RSI curve dipping below 30.

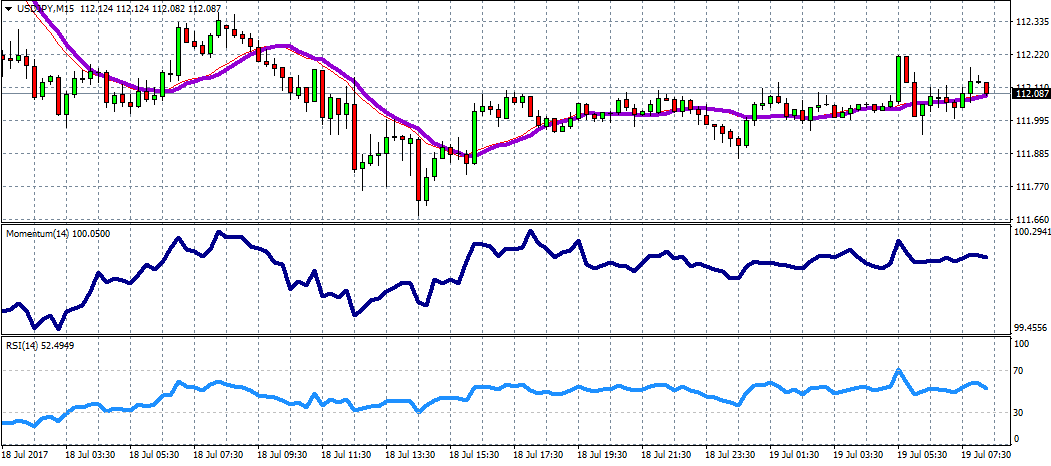

JPY

The Japanese yen was muted early Wednesday, almost touching a three-week high. Given the flurry of economic data and the drama deriving from Washington, the Japanese-yen could find support.

USDJPY

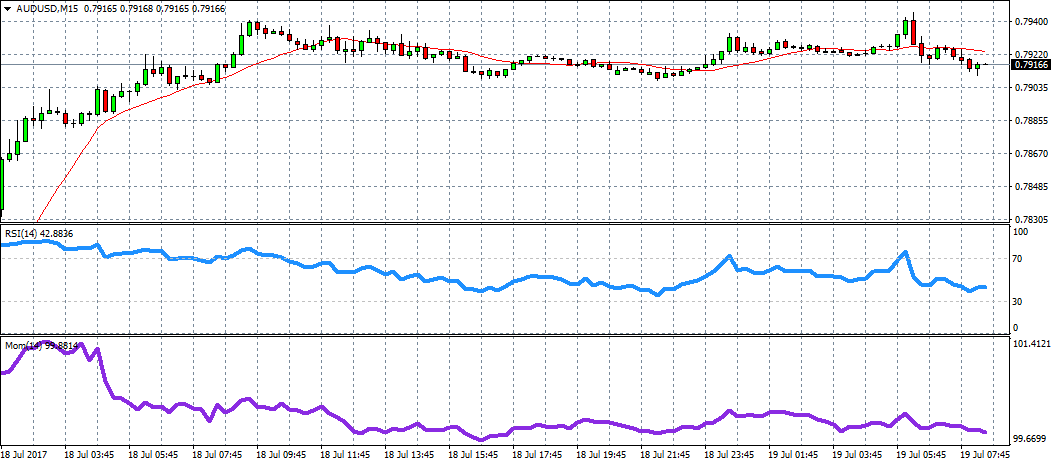

AUD

The Australian dollar climbed 0.2% against the dollar, its highest point in 26 months after rallying 1.5% following the Reserve Bank of Australia’s July meeting minutes.

AUDUSD

Possible more bullish movements to come, supported by a RSI curve near 40.

Global Stocks

European stocks slipped yesterday after disappointing earnings. Barclays (LON:BARC) and Deutsche Bank (DE:DBKGn) missed expectations drawing a negative sentiment over the region. The banking and technology sector have been the most favoured among investors.

Investors are concerned that the economy may not be able to withstand higher interest rates given the lack of inflationary pressures.

US equity markets returned to near all-time highs after the S&P 500 and Nasdaq 100 rose to record closing levels. Investor sentiment will be closely pinned to earnings reports in the coming weeks as the market looks for confirmation that the recent equity rally is justified.

Commodities

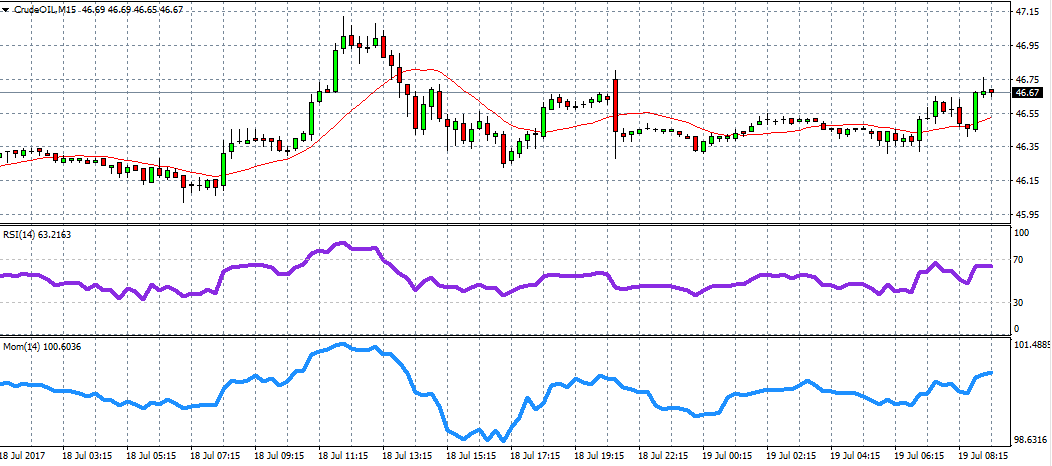

Brent crude, the international oil benchmark, climbed 0.69% higher this morning. Saudi Arabia stated that they would cut exports, underpinning the recent rally.

Crude oil has risen 0.58% since yesterday’s trading session before Libya’s meeting with OPEC to discuss production cuts this week.

Crude Oil