- Further weakness in the US ISM Manufacturing PMI & Employment sub-component increases the risk of a hard landing scenario.

- A Fed interest rate cut that is implemented late in the US economic cycle where a downturn may be already in motion sees the evaporation of the earlier outperformance of the Dow Jones Industrial Average and Russell 2000.

- EUR/CHF faces further downside pressure reinforced by a medium-term global risk-off episode.

This is a follow-up analysis of our prior report, “S&P 500: Further weakness may trigger a medium-term global risk-off event” published on 25 July 2024. Click here for a recap.

Since the publication of our previous analysis, the S&P 500 has failed to break above its 20-day moving average which has acted as a near-term resistance at 5,540. In addition, its price actions staged a bearish reaction after a retest on the 20-day moving average on Thursday, 1 August, and declined by 1.37%.

Interestingly, all the major US stock indices ended with losses yesterday, even last month July’s outperformers, the Russell 2000 (+10%) and Dow Jones Industrial Average (+4.4%) were not spared of the bloodshed with daily declines of 3% and 1.2% respectively.

The sell-off seen in the US stock market coupled with Amazon (NASDAQ:AMZN), a mega-cap tech stock that reported a revenue miss for Q2 earnings and lackluster guidance triggered a global risk-off episode today, 2 August in the Asian session that inflicted the major European benchmark stock indices as well with intraday losses of 1.6% and 0.8% seen on Germany DAX and France CAC 40 at this time of the writing.

Major benchmark Asian stock indices from Japan, South Korea, Taiwan, Hong Kong, China, Singapore, and Australia all ended in the red, and the worst hit was Japan’s Nikkei 225 which recorded a horrendous decline of 5.8%, its worst intraday day performance in percentage terms since the Covid pandemic outburst on 13 March 2020.

Risk of a Hard Landing Scenario in the US has Increased

The catalyst that reinforced this potential medium-term risk-off phase has been the worst-than-expected US ISM Manufacturing PMI and its Employment sub-component data for July.

The headline Manufacturing PMI declined further to 46.8 in July from 48.5 in June, reflecting the sharpest contraction in US factory activities since November 2023. The Manufacturing Employment sub-component also decreased further to 43.40 in July, its steepest pace of contraction since June 2020, from a reading of 49.3 in June.

These weak data points in a leading US survey-based economic indicator have increased the risk of a further softening of the US labour market which suggests the US economy is likely to be on the brink of a hard landing or recession.

The hesitant US Federal Reserve in enacting its first interest rate cut at the late part of the US economic cycle where a downturn may have already materialized added fuel to the current risk-off episode.

Hence, the further bull steepening of the US Treasury yield curve with the US Fed being late gain on its monetary policy implementation is likely to see a synchronized downtrend in all the four major US stock indices with the earlier outperformance of the Dow Jones Industrial Average and Russell 2000 at risk of evaporation.

JPY and CHF are the Strongest Currencies So Far

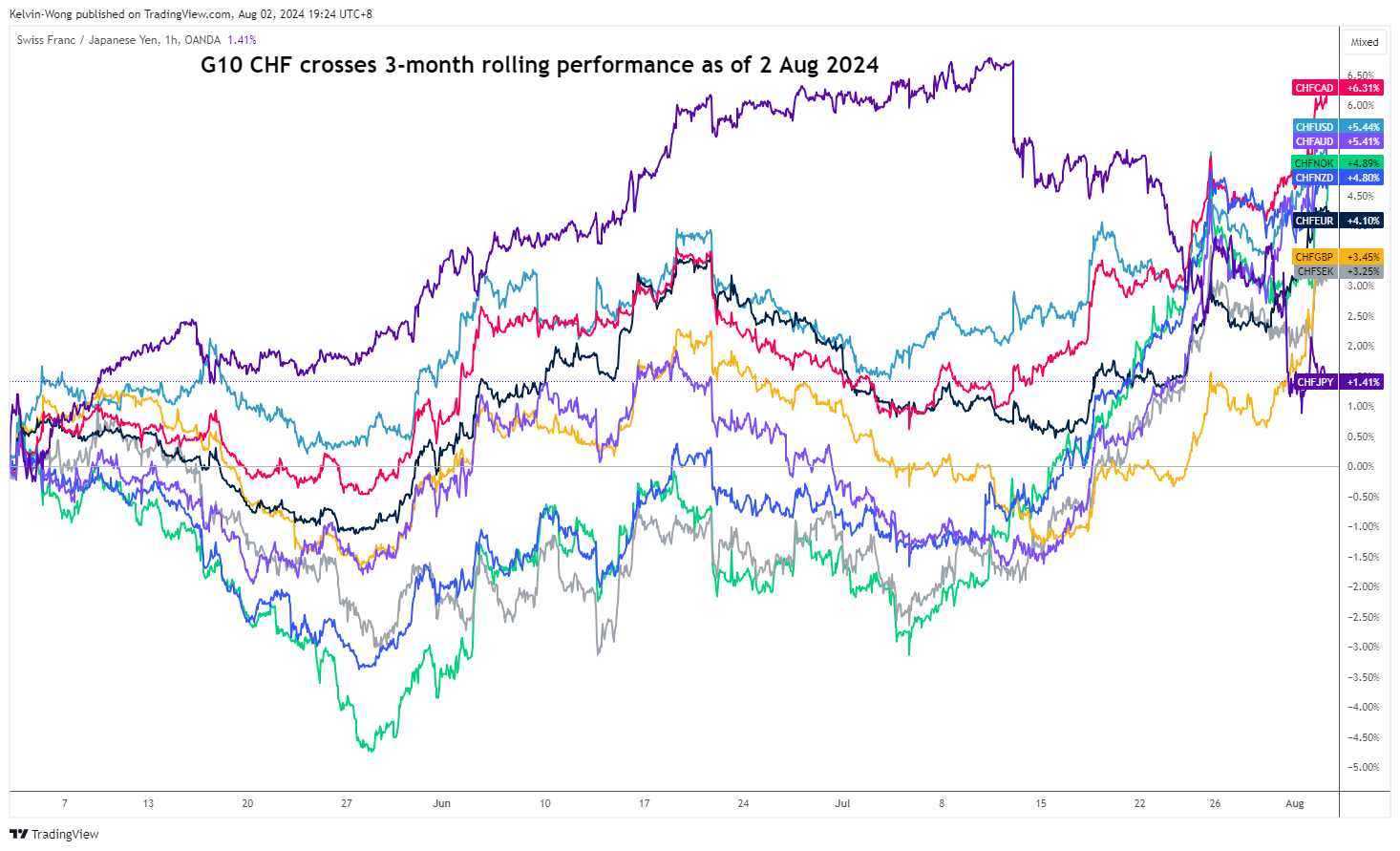

Fig 1: 3-month rolling performance G-10 CHF crosses as of 2 Aug 2024 (Source: TradingView)

In the FX market, the safe haven currencies; the Swiss franc and the Japanese yen are the outperformers at this juncture where the CHF rose against all G-10 currencies such as the EUR, GBP, AUD, and USD on a three-month rolling performance basis but not against the JPY due to a firmer Bank of Japan (BoJ) that is now on track to implement a quantitative tightening programme that is likely to see interest rates in Japan on a gradual path of moving higher from prior decade-plus of persistently negative interest rate levels (see Fig 1).

EUR/CHF at Risk of Further Decline

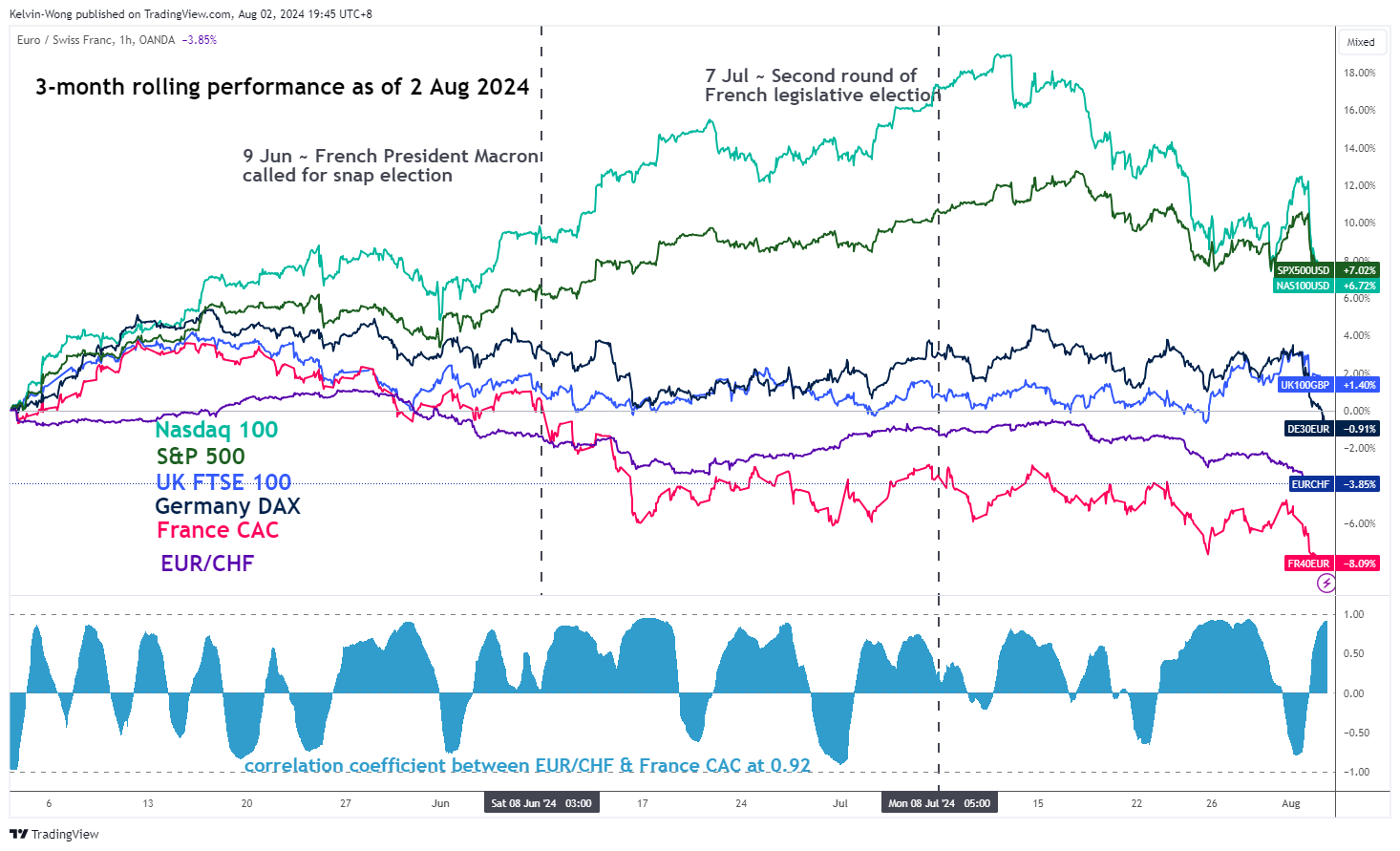

Fig 2: 3-month rolling performance CAC 40, EUR/CHF & other major stock indices (US, Germany, UK) as of 2 Aug 2024 (Source: TradingView)

Fig 3: EUR/CHF major trend as of 2 Aug 2024 (Source: TradingView)

Given the outperformance of the Swiss franc in the ongoing global risk-off episode, the EUR/CHF now faces the risk of a medium-term (multi-week) corrective decline scenario unfolding as it has a high direct correlation with major European benchmark stock indices such as the France CAC with a 60-period rolling correlation coefficient of 0.92 at this time of the writing (see Fig 2).

In the lens of technical analysis, the EUR/CHF cross pair is still oscillating within a long-term secular descending channel since April 2018.

In addition, the weekly MACD trend indicator has just broken below its centreline and it started trending lower since the week of 10 June 2024.

These observations reinforced a potential ongoing multi-week bearish trend that is still unfolding in the EUR/CHF with its price actions now firmly trading below its 200-day moving average (see Fig 3).

If the 0.9780 key medium-term pivotal resistance is not surpassed to the upside, further weakness may prevail on the EUR/CHF and a break below 0.9255 (29 December 2023 major swing low) exposes the next major support to come in at 0.8890 (also the lower boundary of the long-term secular descending channel).

On the other hand, a clearance above 0.9780 negates the bearish tone for a medium-term corrective rebound scenario to take shape for the major resistance zone to come in at 1.0040/1.1000 (also the upper boundary of the long-term secular descending channel).