The simmering issue of the sustainability of the European banking system has all come to a head today, with Deutsche Bank’s solvency issues flooding the newswires.

The latest boiling point from the struggling Deutsche Bank (DE:DBKGn) has been their public battle to pay $14 billion in fines and settlements from the United States, post financial crisis. With today seeing numerous big hedge funds pulling their cash from the bank to ensure it is not tied up in legal proceedings if the bank does start to go under, the stock price has taken a beating:

Deutsche Bank Stock Price:

The question that keeps coming up is, will Deutsche Bank become the next Lehman Brothers? Short answer is no, thanks mainly to the post-GFC redrawing of banking regulations tightening up the position of the major US banks. But real concerns exist about a domino effect, especially across an already weakened Europe as we have touched upon in Italy if you click through the linked article in today’s first paragraph.

Just remember that back in June, the IMF did say that Deutsche may well be the biggest contributor to risk among global banks. Heavy.

But as forex traders, the question has been all focused around why the Euro has not had the same dive off of a cliff that it’s biggest bank has experienced? The argument that Deutsche is ‘too big to fail’ and that if called upon, the ECB will come to their rescue is hilariously ironic post GFC.

What I find even more hilariously ironic is calls for the US regulator to reduce Deutsche’s fines… Yes, fines for their reckless behaviour during the GFC… That put the entire system in danger! You honestly can’t make this stuff up and why anyone would read fiction when you have storylines like this playing out right in front of your eyes, I will never understand :).

This is why the Euro isn’t moving? Hmm…

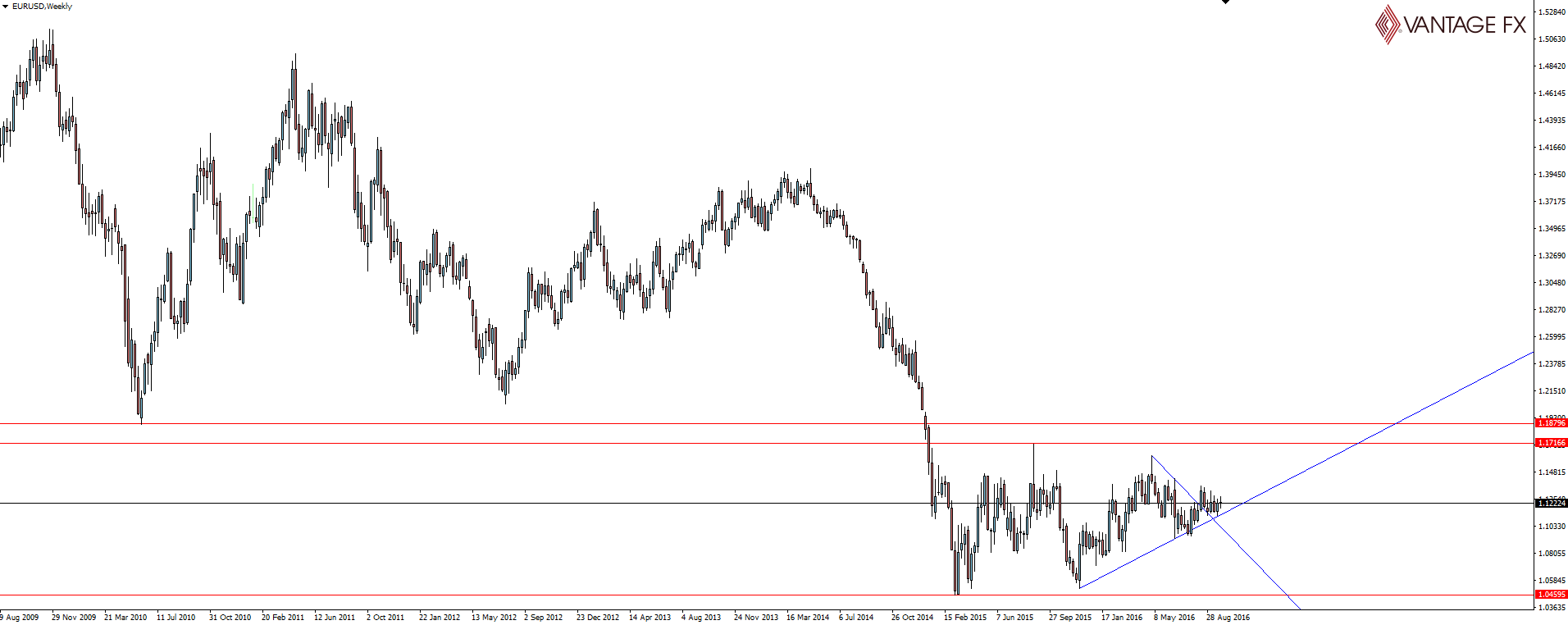

EUR/USD Weekly:

Moving onto the charts, and the important aspect of the weekly chart is the obvious 1300 pip zone that price has been bouncing between for basically 12 months now.

I can’t find reference to where I’ve spoken about it on the blog in the past, but I know I’ve been cautious of the fact that price is sitting in the dead middle of this range and just going nowhere. Such indecisive price action.

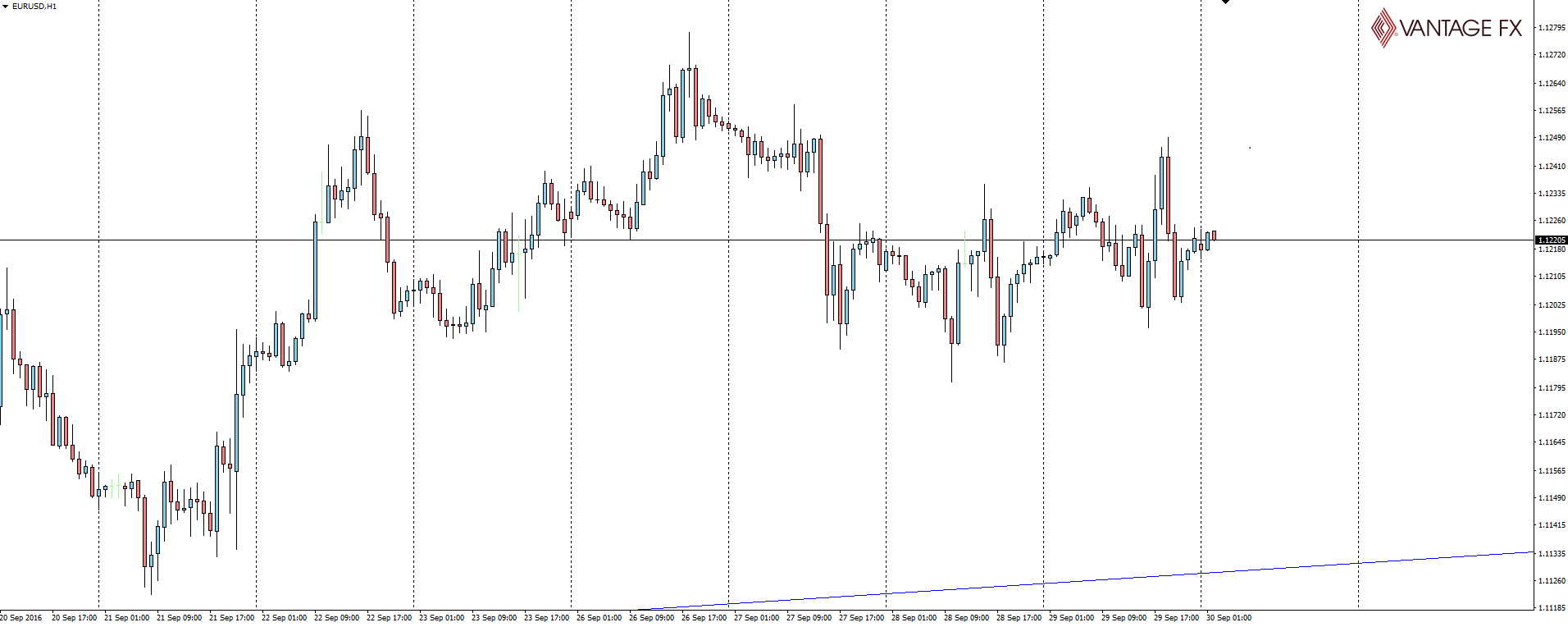

EUR/USD Hourly:

The hourly just highlights this indecision in the euro and with this Deutsche issue just lingering over not just the EU, but the entire interconnected global banking system, I do find it a little strange myself that there hasn’t been anything. There has been absolutely zero movement in the currency pair for 6 days. Zero!

Too big to fail?

No problems for EUR?

Forex is a baffling beast sometimes, but there is never an opportunity that isn’t present for you to take advantage of. This is just the beginning.

On the Calendar Friday

JPY: BOJ Gov Kuroda Speaks

CNY: Caixin Manufacturing PMI

GBP: Current Account

CAD: GDP m/m

Risk Disclosure: In addition to the website disclaimer below, the material on this page prepared by Forex broker Vantage FX Pty Ltd does not contain a record of our prices or solicitation to trade. All opinions, forex news, research, tools, prices or other information is provided as general market commentary and marketing communication – not as investment advice. Consequently, any person acting on it does so entirely at their own risk. The expert writers express their personal opinions and will not assume any responsibility whatsoever for the Forex account of the reader. We always aim for maximum accuracy and timeliness, and FX broker Vantage FX shall not be liable for any loss or damage, consequential or otherwise, which may arise from the use or reliance on this service and its content, inaccurate information or typos. No representation is being made that any results discussed within the report will be achieved, and past performance is not indicative of future performance.