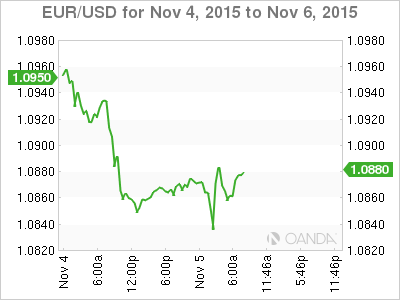

This week’s euro slide continues, as the pair trades at 1.0860 line in Thursday’s European session. In economic news, it’s a busy day in the Eurozone and the US, highlighted by US Unemployment Claims. On Friday, we’ll get a look at one of the most important market-movers, US Nonfarm Payrolls.

Eurozone indicators disappointed on Thursday. German Factory Orders posted a sharp decline of 1.7%, well off the estimate of a gain of 1.1%. Eurozone Retail PMI softened, with a reading of 51.3 points. Eurozone Retail Sales, the primary gauge of consumer sales, posted a decline of -0.1%. This was shy of the estimate of +0.2%. In the US, today’s key release is Unemployment Claims, with an estimate of 263 thousand. We’ll also hear from three FOMC members, and the markets will be listening closely for any hints about a December rate hike.

Thursday’s readings out of Germany and the Eurozone are exactly what the ECB does not want to hear, as they underscore a weak Eurozone economy and add to the pressure on the central bank to increase stimulus, a step which ECB head Mario Draghi has hinted that the ECB is prepared to take. Market expectations that the ECB could act in December will continue to weigh on the euro. The currency continues to struggle, and has slipped below the 1.09 line, as it flirts with lows last seen in July. The continental currency has not recovered since last week’s Fed statement a rate hike was still on the table in 2015. With the Eurozone suffering from weak growth and a lack of inflation, unless Eurozone releases show marked improvement, the euro will have trouble holding its own against the US dollar.

The US continues to release key job numbers on Thursday and Friday, and these indicators could have a sharp impact on the movement of EUR/USD. On Wednesday, ADP Nonfarm Payrolls slipped to 182 thousand, close to the estimate of 183 thousand. Still, the indicator slipped badly in comparison to the previous release of 200 thousand. Unemployment Claims are expected to stay rise slightly, and the real test is on Friday, with the release of the unemployment rate and Nonfarm payrolls. NFP is expected to rise sharply to 173 thousand, so the dollar could be a big winner as we wrap up the trading week. Aside from employment numbers acting as an important gauge of the US economy, this week’s releases have added significance, since strong numbers will increase the likelihood of a rate cut in December. Conversely, a poor performance will damper expectations of a move by the Fed before 2016.

EUR/USD Fundamentals

Thursday (Nov. 5)

- 7:00 German Factory Orders. Estimate +1.1%. Actual -1.7%

- 9:00 ECB Economic Bulletin

- 9:10 Eurozone Retail PMI. Actual 51.3 points

- 10:00 EU Economic Forecasts

- 10:00 Eurozone Retail Sales. Estimate 0.2%. Actual -0.1%.

- Tentative – Spanish 10-year Bond Auction. Actual 1.75%

- Tentative – French 10-year Bond Auction. Actual 0.95%

- 11:45 ECB President Mario Draghi Speaks

- 12:30 US Challenger Job Cuts

- 13:30 US Unemployment Claims. Estimate 263K

- 13:30 FOMC Member William Dudley Speaks

- 13:30 US Preliminary Nonfarm Productivity. Estimate 0.1%

- 13:30 US Preliminary Unit Labor Costs. Estimate 2.2%

- 14:10 FOMC Member Stanley Fischer Speaks

- 15:30 US Natural Gas Storage. Estimate 60B

- 18:30 FOMC Member Dennis Lockhart Speaks

Upcoming Key Events

Thursday (Nov. 5)

- 13:30 US Average Hourly Earnings. Estimate 0.2%

- 13:30 US Nonfarm Employment Charge. Estimate 179K

- 13:30 US Unemployment Rate. Estimate 5.0%

*Key releases are highlighted in bold

*All release times are GMT

EUR/USD for Thursday, November 5, 2015

EUR/USD November 5 at 11:40 GMT

EUR/USD 1.0858 H: 1.0892 L: 1.0833

EUR/USD Technical

| S1 | S2 | S1 | R1 | R2 | R3 |

| 1.0659 | 1.0732 | 1.0847 | 1.0941 | 1.1017 | 1.1105 |

- EUR/USD was uneventful in the Asian session. The pair has showed some volatility in the European session but this has not resulted in any net movement.

- 1.0847 was tested in support and remains under strong pressure.

- 1.0941 is an immediate resistance line.

- Current range: 1.0847 to 1.041

Further levels in both directions:

- Below: 1.0847, 1.0732, 1.0659 and 1.05

- Above: 1.0941, 1.1017, 1.1105, 1.1214 and 1.1296

OANDA’s Open Positions Ratio

EUR/USD ratio is showing little change, consistent with the lack of movement shown by the pair on Thursday. The ratio has a slight majority of long positions (53:46), indicating slight trader bias towards the pair moving upwards.