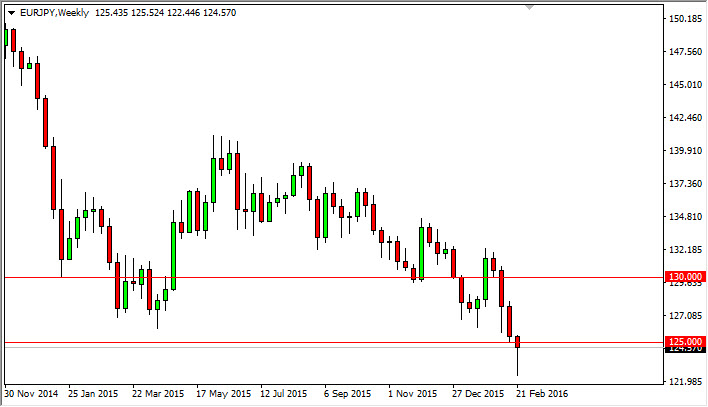

After a very volatile week, the EUR/JPY pair decided to form a hammer on the weekly chart. This of course suggests that the pair very well could bounce from here. The hammer could lead the market to the 130 level above, as it was once important. The pair formed a hammer right at the 125 level, which of course is a large, round number. The market tends to see a lot of order flow in these areas, especially when it is every 500 pips like we see in the pair at the moment.

The market is currently sitting in an area that has been relatively important in the past, as it has been very supportive previously. The hammer sitting right there has certainly caught our interest as a result. However, there is something that you must keep in mind when it comes to the EUR/JPY pair.

EUR/JPY and risk appetite

The pair does tend to reflect that it will generally follow what the risk appetite of the market is currently. The pair will often reflect what we see in the S&P 500 index, the DAX, the FTSE, and of course the Nikkei. In general, this pair will follow stock traders, but also keep in mind that commodity markets could be influential as well. The pair could go to the 130 level, and then turn around. This would make sense as it would simply be a pullback in a longer downtrend. At this point, we are hesitant to try to hold onto a long position for any real length of time, as the trend is strong, and is strong for a reason.

If we break the bottom of the hammer, this would be very negative, and we should continue to see a sell off in the near future. The market would really fall apart at this point, and we would more than likely see a selling of risk in general around the world. This pair will continue to be a bit of a “canary in the coalmine” in the big scheme of things.

As soon as we get above the top of the weekly hammer – we are going long and aiming for 130.