EU shares rebounded on Monday, perhaps as investors were encouraged to increase their risk exposure due to more upbeat headlines with regards to a potential coronavirus vaccine. In the currency world, the British pound was the main loser among the G10s, coming under selling interest due to fresh EU-UK tensions. Today, a new round of Brexit negotiations is set to begin, but the latest developments suggest that a breakthrough is unlikely.

VACCINE HEADLINES LIFT SENTIMENT, GBP FALLS ON FRESH BREXIT TENSIONS

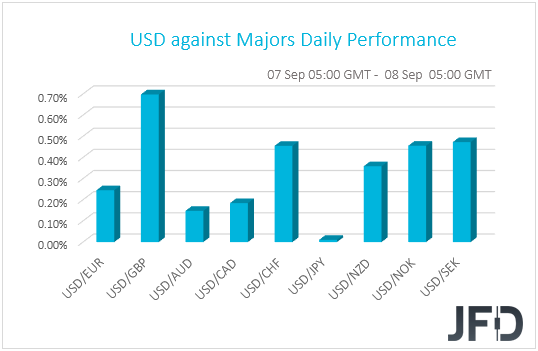

The US dollar traded higher against all but one of the other G10 currencies on Monday and during the Asian morning Tuesday. It gained the most versus GBP, SEK, CHF, and NOK in that order, while it gained the least versus CAD and AUD. The greenback was found virtually unchanged against JPY.

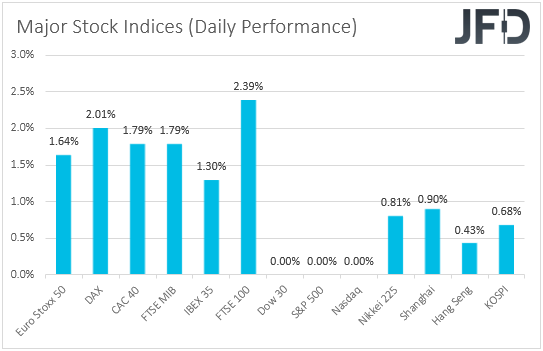

The strengthening of the US dollar and the Japanese yen suggests that markets traded in a risk-off fashion yesterday. Nonetheless, the weakening of the Swiss franc and the relative strength in AUD and CAD point otherwise. Thus, in order to get a clearer picture with regards to the broader market sentiment, we prefer to turn our gaze to the equity world. There, major EU indices were a sea of green, with the main gainer being the UK FTSE 100, perhaps aided by the tumble in the British pound. Remember that many companies of the index generate profits in other currencies, so in a weakening GBP environment, if those profits are converted to pounds, they worth more. Wall Street was closed yesterday due to the Labor Day Holiday, while today, in Asia, the optimism continued. Japan’s Nikkei 225 and China’s Shanghai Composite gained 0.81% and 0.90% respectively.

EU shares bounced from a Wall Street-led rout in technology stocks in the previous week, perhaps as investors were encouraged to increase their risk exposure due to more upbeat headlines with regards to a potential coronavirus vaccine. Yesterday, Australia’s PM Scott Morrison said that his nation will buy about 85mn doses of two potential vaccines if trials prove successful, reaching common ground with the biotech firm CSL (OTC:CSLLY). The agreement was for CSL to manufacture two vaccines, one developed by Astra Zeneca and Oxford University, and another one produced on CSL’s own labs with the University of Queensland.

All this adds to our view that the latest retreat in equities and other risk-linked assets may have been a corrective phase before another leg of buying. With headlines over a potential vaccine keep coming on the bright side, and expectations over fresh stimulus, especially by the ECB and the Fed, rising, we would see decent chances for investors to continue increasing their risk exposures and abandon safe havens.

Back to the currencies, the British pound was the main loser, coming under selling interest on fresh EU-UK tensions. On Sunday, reports hit the wires that UK is planning new legislation that will override key parts of the Brexit withdrawal agreement, with the EU warning that there would be no deal if that happened. Today, both sides are scheduled to return to the negotiating table, with both parties giving a self-imposed October deadline to find common ground. If they do, the deal will have to be ratified at an EU summit before the transition period expires. Remember that the transition period expires on December 31st.

We already have had negative news with regards to the Brexit saga, with the UK doubling its fishing quotas, something that was not likely to be agreed by the EU. The latest developments over the withdrawal agreement lessen even further the likelihood of any progress being made this week, and as a consequence, the chances for a no-deal Brexit in the end of this year are growing. In our view, this is likely to keep the pound under selling interest for a while more. Conditional upon a recovery in the broader investor morale, we would expect the British currency to lose the most ground against currencies which tend to get benefited during risk-on periods, the likes of the Aussie and the Kiwi.

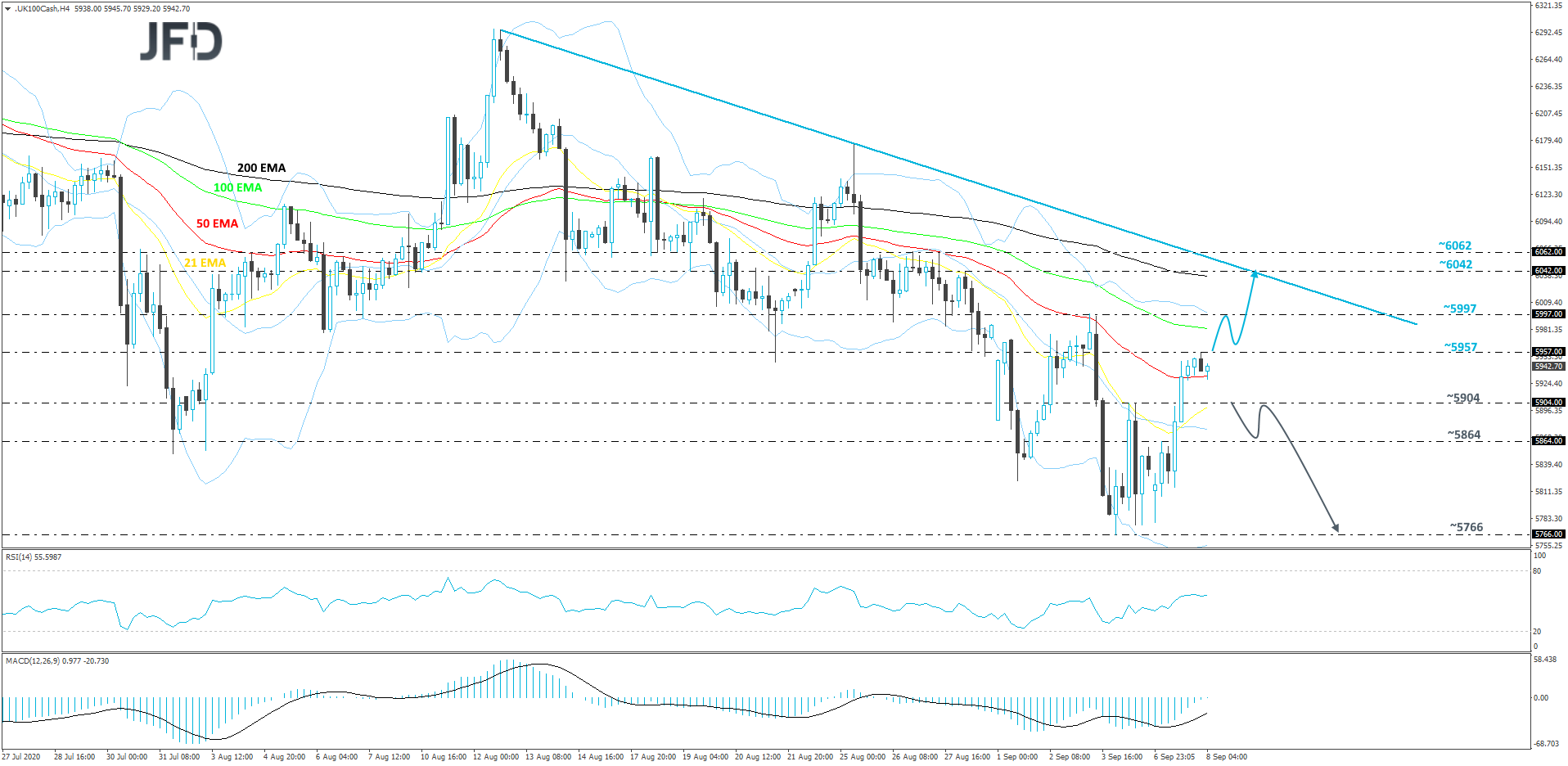

FTSE 100 – TECHNICAL OUTLOOK

After finding support near the 5766 hurdle last week, the FTSE 100 index rebounded and continues to show the willingness of moving further north. From the short-term perspective, the price may rise a bit more, but overall, let’s not forget that the index is still running below a short-term tentative downside resistance line drawn from the high of August 12th, which might halt the acceleration.

Looking at the FTSE 100 cash index on our 4-hour chart, we can see that this morning the price got held near the 5957 barrier. If that barrier fails to keep the index lower, its break may open the way towards the high of last week, at 5997. The price could stall there for a bit, but if the buyers are still feeling comfortable, a break of the 5997 hurdle might send FTSE 100 to the 6042 level, marked by the high of August 28th. Around there the index could also test the aforementioned downside line, which could provide additional resistance.

On the downside, if the price suddenly falls back below the 5904 hurdle, marked by the high of September 4th, that could clear the way to the 5864 obstacle, a break of which may send FTSE 100 further south. This is when we will consider a possible move back to the 5766 level, marked by the low of last week.

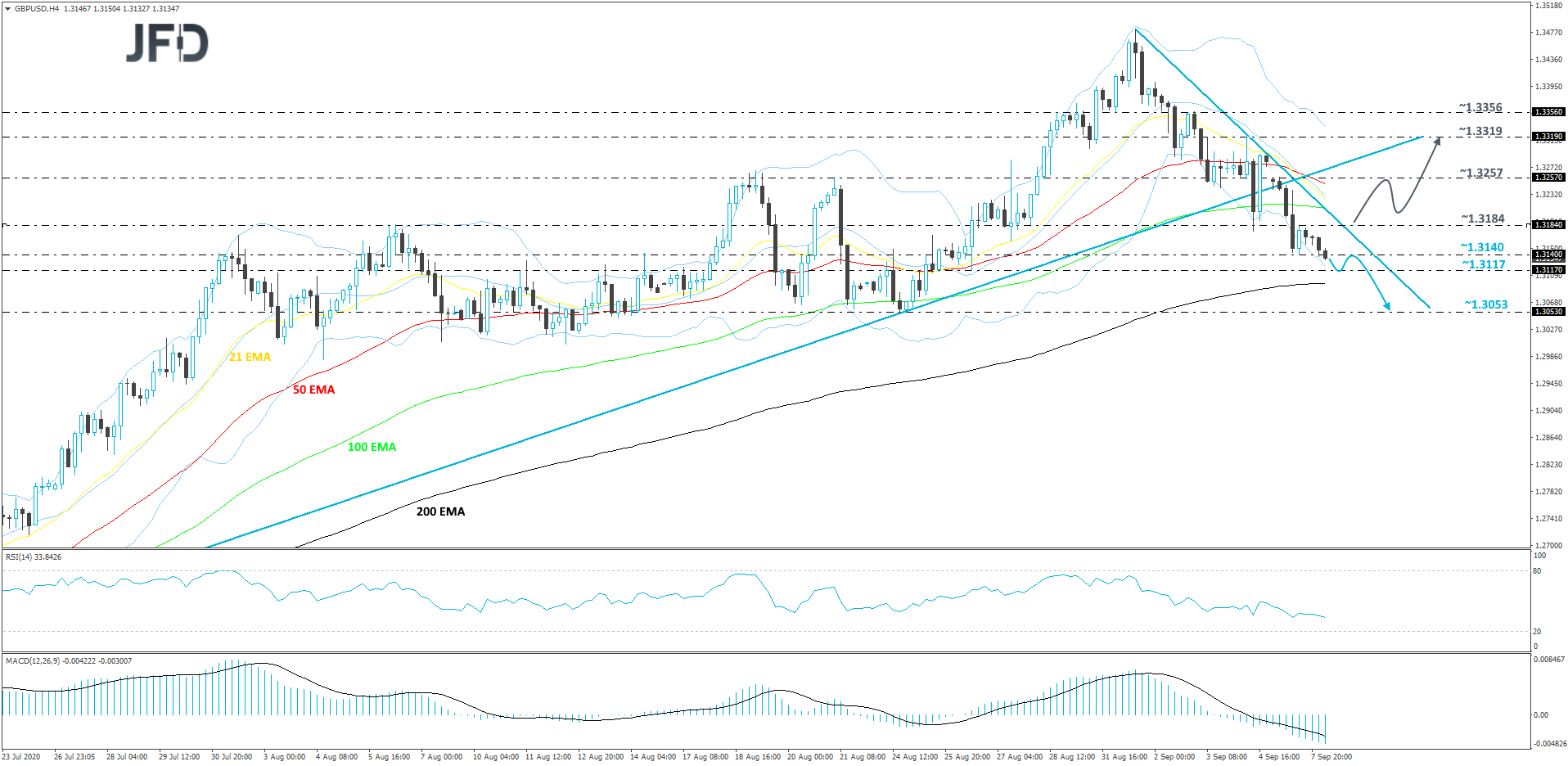

GBP/USD – TECHNICAL OUTLOOKLast week, GBP/USD ended up breaking its medium-term tentative upside support line drawn from the low of July 20th. The pair continues to drift south, while trading below a short-term tentative downside resistance line taken from the high of September 1st. If that downside line remains intact, we will stay bearish with the near-term outlook.

A further pushdown, away from the 1.3140 hurdle, may help the bears to drag the rate to the 1.3117 support area, marked by the low of August 26th. GBP/USD might stall there for a bit, or even correct back up. That said, if the pair remains below the aforementioned downside line, another round of selling may be possible, as the bears could take advantage of the higher rate. That’s when we will once again aim for the 1.3117 obstacle, a break of which might set the stage for a drop to the 1.3053 level, marked by the low of August 24th.

On the upside, if GBP/USD is able to move back above the previously discussed downside line and also above the 1.3184 zone, marked by yesterday’s intraday swing high, that may convince more bulls to join in. The pair might then travel to the 1.3257 obstacle, a break of which could open the door for a push to the 1.3319 level, marked by the high of September 4th.

AS FOR TODAY’S EVENTS

During the EU trading, Germany’s trade balance for July and Eurozone’s final GDP for Q2 are coming out. Germany’s trade surplus is expected to have increased somewhat, while the euro area final GDP is anticipated to confirm its 2nd estimate of -12.1% qoq.

As for tonight, during the Asian session Wednesday, China’s CPI and PPI for August are coming out. The CPI is forecast to have slowed to +2.4% yoy from +2.7%, while the PPI is anticipated to have fallen at a slower pace than in July. Specifically, it is expected to have slid 2.0% yoy after falling 2.4%.