EU and US stock indices rebounded yesterday, perhaps as some investors saw Monday’s tumble as an opportunity to buy again. However, Asian shares fell today, probably after the Reserve Bank of New Zealand (RBNZ) gave them a reality check.

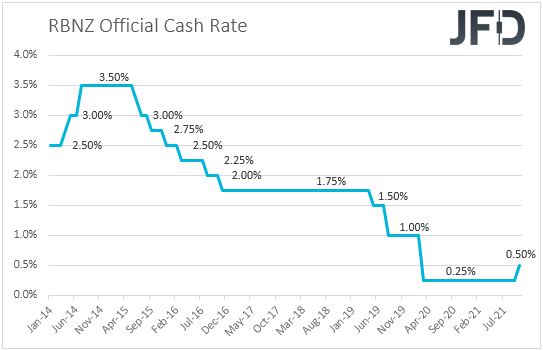

The bank hiked rates by 25 bps and signaled that more would follow, raising concerns about other central banks following suit.

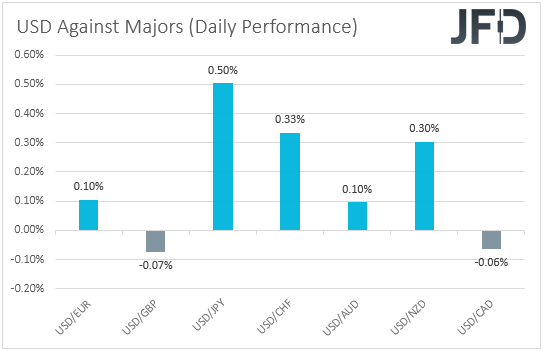

The US dollar traded higher against most of the other major currencies on Tuesday and during the Asian session Wednesday. It gained the most compared to JPY, CHF, and NZD, while it underperformed slightly against GBP and CAD.

The weakening of the Japanese yen and the Swiss franc suggests that market sentiment may have improved somehow yesterday and today in Asia. However, the decline of the risk-linked Kiwi points otherwise.

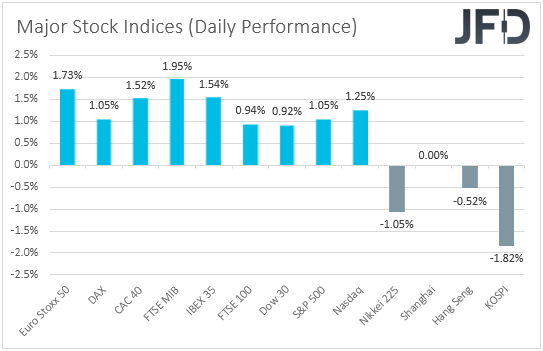

Therefore, to clear things up, we prefer to turn our gaze to the equity world. We see that major EU and US indices were a sea of green, rising on average 1.3% each.

However, the optimism disappeared during the Asian session. Japan’s Nikkei 225, Hong Kong’s Hang Seng, and South Korea’s KOSPI traded in negative territories.

Tech Stocks Rebound But Still Remain Under Pressure

EU and US indices were driven higher by a rebound in beaten-down technology companies, perhaps as some market participants saw Monday’s selloff as an opportunity to buy the dip.

That said, in our view, this is far from a positive reversal, especially in growth stocks, as concerns over persistently high inflation and central bank tightening remain elevated.

In our view, this is evident by the strength in the US dollar and the pullback in equities during the Asian session today.

RBNZ Decision Triggers Inflation and Central Bank Tightening Fears

RBNZ raised interest rates by 25 bps as expected. While some may have anticipated a slightly more cautious language in the accompanying statement, officials appeared somewhat optimistic, noting that tightening of monetary policy stimulus is expected over time.

Economic activity will recover quickly as alert level restrictions ease. The fact that policymakers confidently signaled more hikes in the foreseeable future encouraged some Kiwi buying.

However, the currency was quick to reverse the gains and trade even lower. Without anything of dovish nature in the RBNZ statement, we believe that the bank’s language may have raised concerns that other major central banks may also dismiss the economic slowdown as temporary and proceed with faster tightening.

The latest central bank commentary suggests that officials are now more concerned over high inflation. Remember that, among others, Fed Chair Powell recently said that inflation remains elevated for longer than they have estimated.

As a risk-linked currency, that’s why the Kiwi may have quickly reversed south, and that’s perhaps why equities fell today.

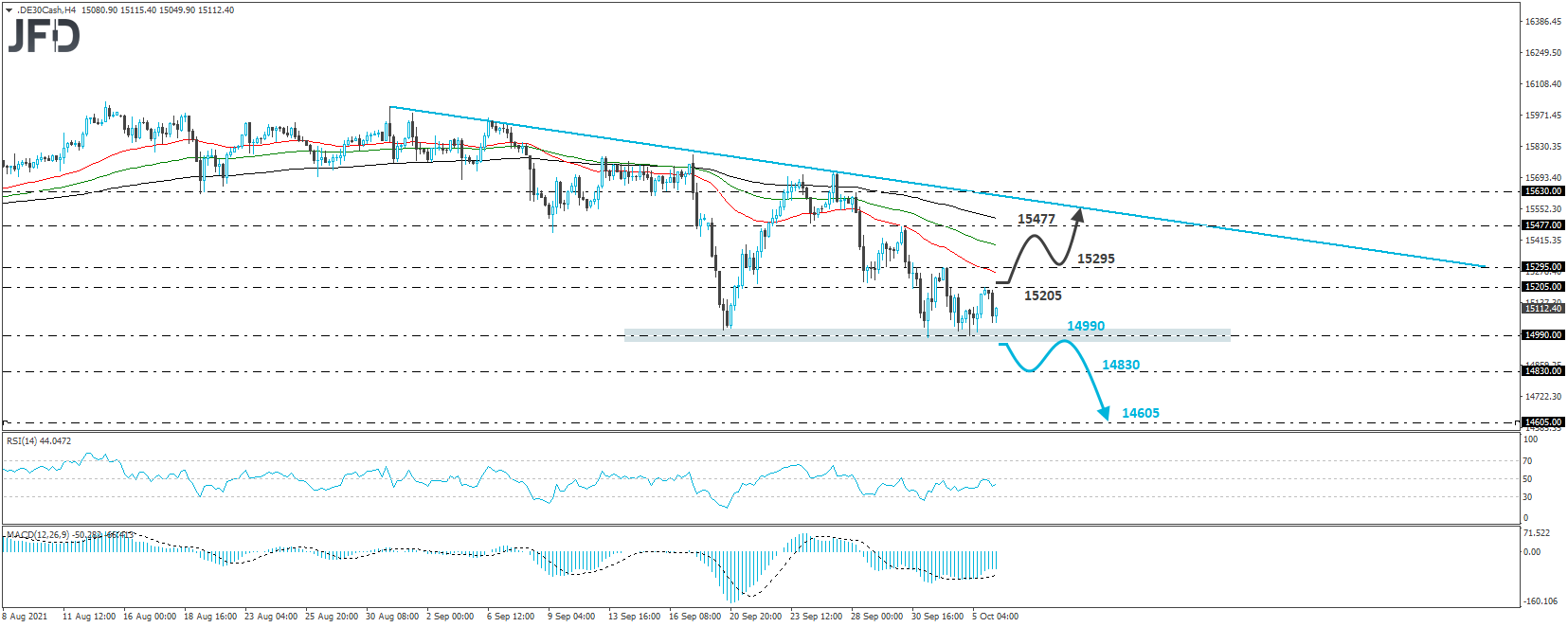

DAX – Technical Outlook

The German DAX cash index traded higher yesterday but hit resistance at 15205 and pulled back later. Overall, the index remains below the downside resistance line taken from the high of Aug. 31, which keeps the near-term outlook somewhat bearish.

However, to get confident in more significant declines, we would like to see a dip below the critical support zone of 14990, marked by Friday’s and yesterday’s lows.

Such a move will confirm a forthcoming lower low and initially target the 14830 zone, which supported the index on May 4 and 15. If market participants are unwilling to jump back into the action near that zone, a lower break could extend the fall towards the 14605 territories, defined as a support by the inside swing high of March 25.

We will start examining the case of a decent corrective recovery only if we see a break back above 15205. This may initially target the 15295 territories, marked by Monday’s high, the break of which could encourage more buying, perhaps towards the peak of Sept. 30, at 15477, or the downside resistance line taken from the high of Aug. 31.

EUR/USD – Technical Outlook

Since Monday, EUR/USD has been sliding after hitting resistance at 1.1640. Overall, the pair continues to make lower lows and lower highs below the downside resistance line taken from the high of Sept. 3 and below the downside line drawn from Sept. 14. In our view, this keeps the short-term outlook negative.

A dip below Friday's low of 1.1563 will confirm a forthcoming lower low and may see scope for declines towards the low of July 22, 2020, near the psychological round figure of 1.1500. If the bears are unwilling to stop there either, we could see the fall extending towards the inside swing high of July 20, 2020, at around 1.1465.

On the upside, a break above the downside line taken from the high of Sept. 3 could be a sign of trend reversal. The bulls may feel free to take action up to the 1.1749 zone, which provided strong resistance between Sept. 21 and 23, the break of which could allow extensions towards the high of Sept. 17, at around 1.1790.

Elsewhere

Today, we have Eurozone's retail sales for August and the US ADP report for September. Eurozone's retail sales are expected to rebound 0.8% MoM after sliding 2.3%. While in the US, the ADP report is expected to show that the private sector has gained 430,000 jobs, less than August's 374,000.

Although the ADP is far from a reliable predictor of NFPs, it is the only major gauge for the official statistic. Thus, it could raise speculation that the NFPs could also come in slightly better than in August.

Regarding the energy market, the EIA (Energy Information Administration) report on crude oil inventories for last week is coming out, and expectations are for a 0.418mn barrels slide after a 4.578mn barrels increase the week before.

However, bearing in mind that the API reported a 0.951mn inventory build yesterday, we would consider the risks surrounding the EIA forecast as tilted to the upside.

On the political front, the US Senate will vote on a plan proposed by Democrats to suspend the US debt ceiling, according to yesterday's remarks by a key lawmaker.

As for the speakers, we will hear from Atlanta Fed President Raphael Bostic and ECB Supervisory Board member Elizabeth McCaul.