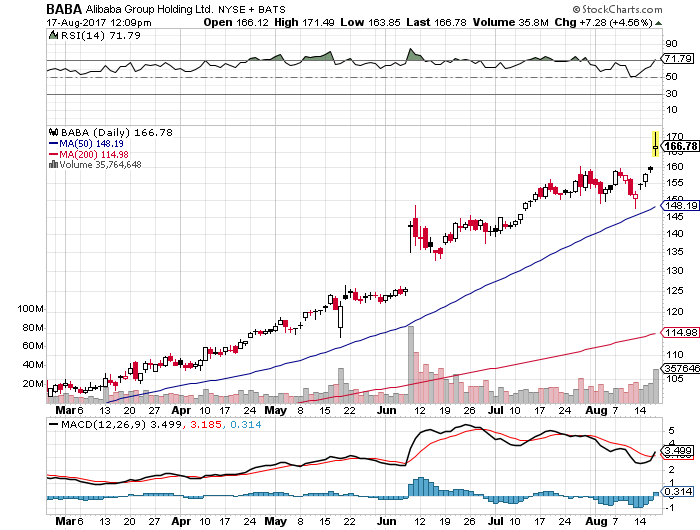

On a weak equity tape today one stock that is popping after their quarterly earnings release is China based Alibaba Group Holdings Ltd. (NYSE:BABA).

The company, which was founded in 1999 debuted on the New York Stock Exchange nearly three years ago in September of 2014, has since then has achieved several feats such as growing into the world’s largest retailer (WMT was formerly the leader as of April of 2016).

Just last month, BABA became the first Asian based company to rise above the $400 billion mark in terms of its market capitalization, and with today’s lift in the stock clearly that value continues to rise. Today we see the stock trading at yet another all-time high following a warm reception to their quarterly earnings report, and this once again causes us to visit ETFs that are benefiting from their exposure to the stock.

ETFs that have a sizable allocation in BABA are as one might expect funds that are either China or Emerging-Markets based for the most part. BLDRS Emerging Markets 50 ADR (NASDAQ:ADRE) (Expense Ratio 0.30%) has the highest weighting to BABA with a notable 15.20% allocation, while there are several other funds with more than 10% slices dedicated to the stock.

In order of percentage allocations these ETFs are iShares MSCI China (NASDAQ:MCHI) (Expense Ratio 0.64%, 12.38% weighting), BLDRS Asia 50 ADR (NASDAQ:ADRA) (Expense Ratio 0.30%, 10.90%), Guggenheim Invest BRIC (NYSE:EEB) (Expense Ratio 0.64%, 10.86%), Guggenheim Invest China Technology (NYSE:CQQQ) (Expense Ratio 0.70%, 10.78%), First Trust International IPO (NASDAQ:FPXI) (Expense Ratio 0.70%, 10.68%) and SPDR S&P China (MX:GXC) (NYSE:GXC) (Expense Ratio 0.59%, 10.44%).

Being an ADR, BABA will not qualify as a holding in some ETFs, depending on how they are structured in terms of how they were initially set up, i.e. in spite of its rising market capitalization and prominence not only as a player in China but an international force, ETFs based on indices that do not incorporate ADRs will always miss out on exposure to the stock.

Significantly, when BABA debuted for trading back in 2014 S&P Dow Jones Indices assigned BABA a “China” domicile, making it ineligible for inclusion in well-known indices such as the S&P 500, the S&P MidCap 400 and the S&P SmallCap 600 indices since the investment criteria mandates a “U.S.” domicile.

Alibaba Group Holding was trading at $167.83 per share on Thursday morning, up $8.33 (+5.22%). Year-to-date, BABA has gained 91.13%, versus a 10.76% rise in the benchmark S&P 500 index during the same period.