“The case for somewhat more accommodative policy has strengthened,” Fed Chairman Jerome Powell

The Fed set the table last week for future rate cuts. They continue to voice the lack of inflation, and have increasingly seen the slowing economic and company data points, so now are feeling more pressure from the White House to cut or lose control of the scissors. The markets have moved to a 100% chance of a July Fed Funds rate cut, with over one-third believing the cut will be 50 basis points. Investors of most every asset class enjoyed the news that the Fed will continue to stoke the fire of higher prices. Stocks, Bonds and Commodities surged higher while only the U.S. dollar fell on the news.

So now we will embark on a round of ‘nowhere near a recession’ Fed rate cuts. The market has retaken its all-time highs, but really the gains are only a few percentage points over the last 16 months. For investors, it appears much easier to make money in Bonds and Commodities from here. Stock investors have a much more difficult lake to ski right now. Ripples include: an unlikely trade deal with China, a slowdown in global growth, and fairly priced stock valuations (17x 2020 estimated earnings). Don’t forget that we were 15 minutes away from going to war with a nuclear power in the middle east.

While our summer of fun moves along, this week will bring the now over-hyped G-20 meeting. Hopefully the decision and resolutions will be more exciting than the photographs, but we won’t be holding our breath. Companies will get a final look at their books before the quarter closes, but in most cases June is ending on a weaker note. Investors will likely be heading out early at the end of the week to enjoy the mid-week 4th of July holiday. So expect low volumes and maybe less volatility this week as the markets remain in a wait-and-see-and-where-are-my-flipflops mode. I know where mine are. Have a great 4th of July.

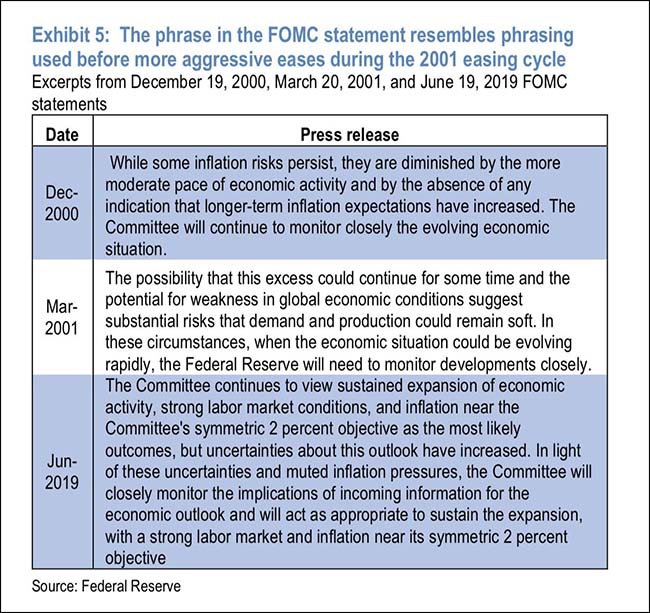

Goldman Sachs (NYSE:GS) notes a resemblance in the Fed Statements from 2000/01 to last week’s…

(@Copernicus2013)

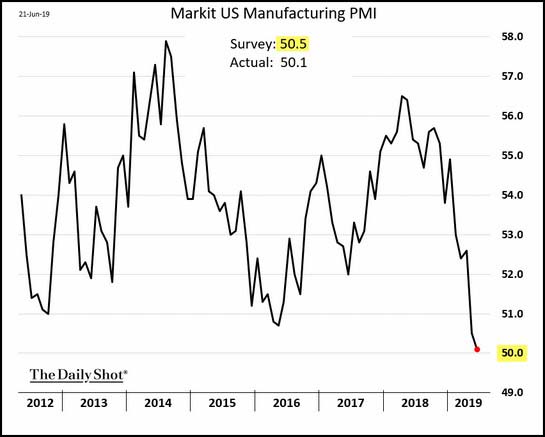

Meanwhile, the U.S. economic slowdown statistics are piling up…

(WSJ/DailyShot)

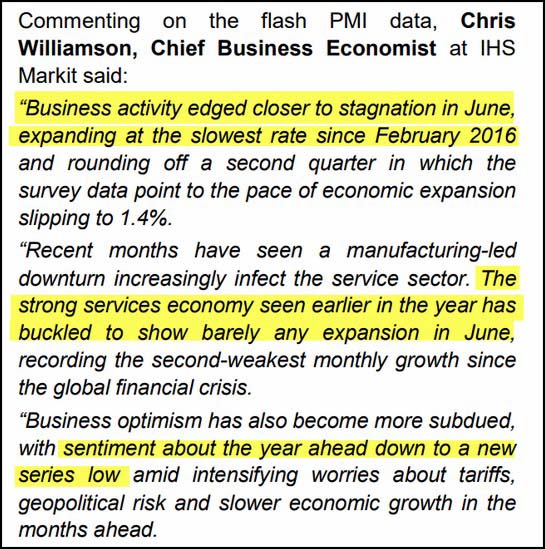

(IHSMarkit)

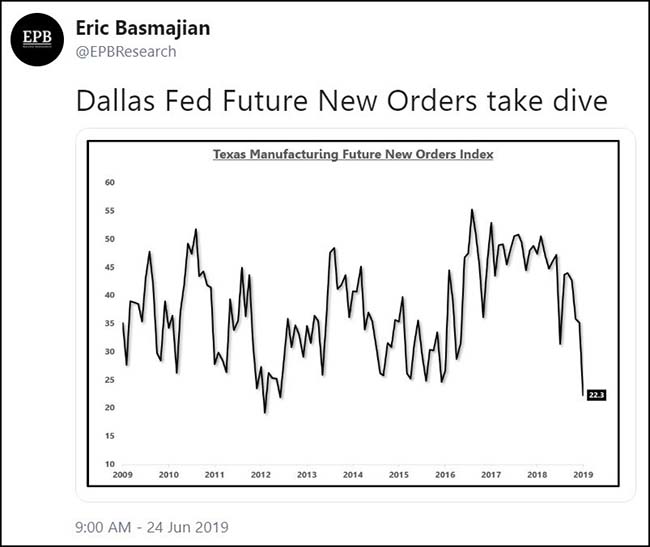

The Dallas Fed Manufacturing new order component fell to seven-year lows…

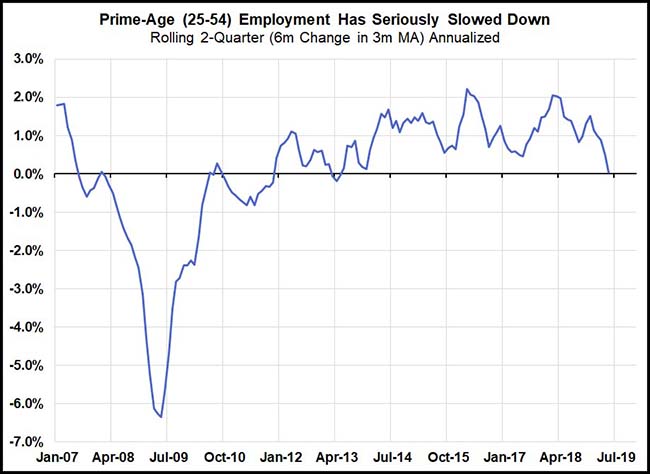

And further digging into the monthly employment data shows a clear negative turn in job trends…

Prime-age employment trends are signaling elevated slowdown and recession risk. The household survey (CPS) is more volatile than the establishment survey (CES) but is also a better real-time indicator, especially since there is no issue of revisions. What you see is what you get. What we got in April suggested that prime-age employment growth was slowing. The May report only confirmed that we’re now seeing near-contraction in employment for the key set of cohorts that drive labor supply and labor income growth.

(@IrvingSwisher)

The Fed’s more accomodative stance and the worsening stats sent the 10-year Treasury yield below 2%…

It also sent the U.S. Dollar to its largest weekly decline in over a year…

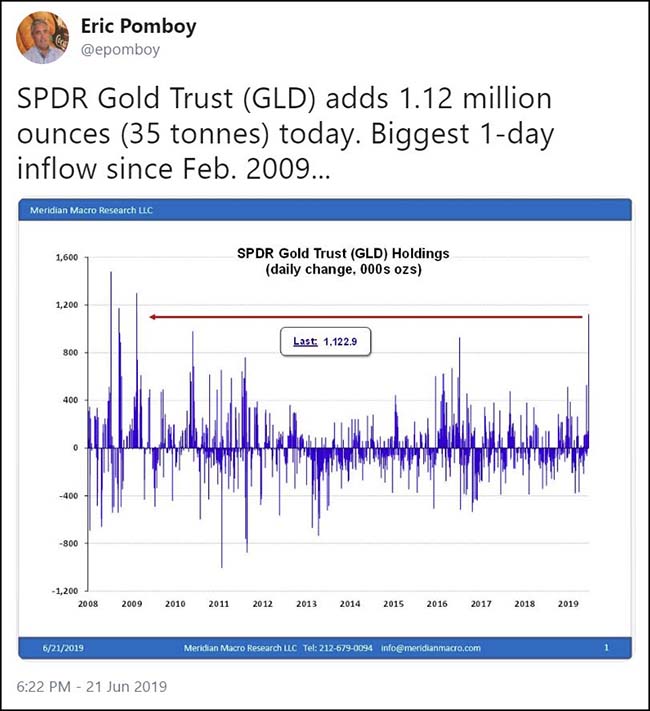

Meanwhile, a plunging Dollar, rising uncertainty, and the threat of war can only be good news for the breakout in Gold…

Increased interest in the yellow metal led to a ten-year record creation in $GLD ETF shares last week…

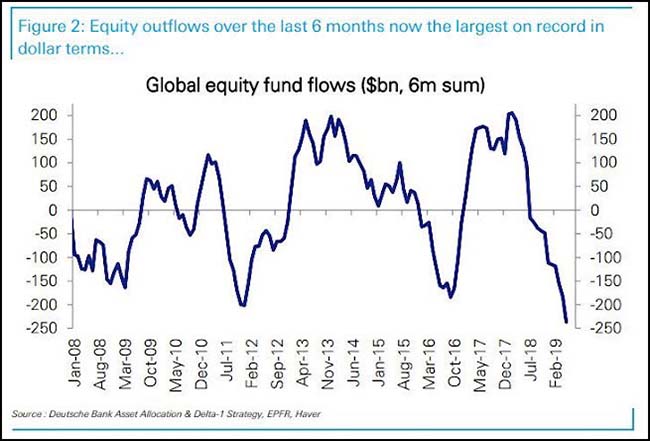

While some investors find their way into Gold, most continue to run from Global Equities…

(Fat-Pitch)

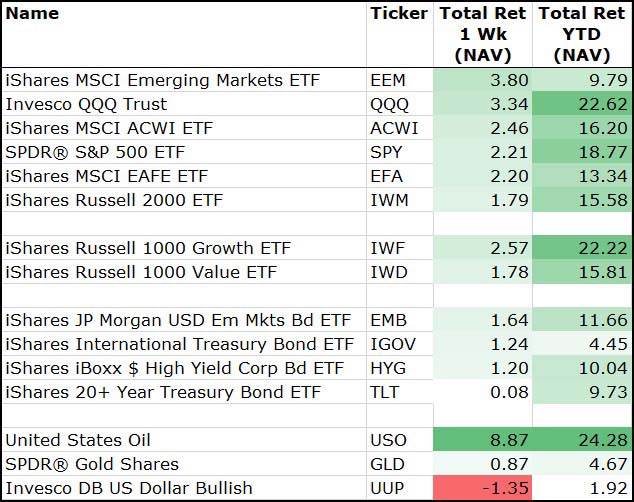

For the week, all major asset classes gained in value for U.S. investors…

(6/21/2019)

As Bespoke notes, even with the strong YTD gains, the market has done very little over the last 12-18 months…

(@bespokeinvest)

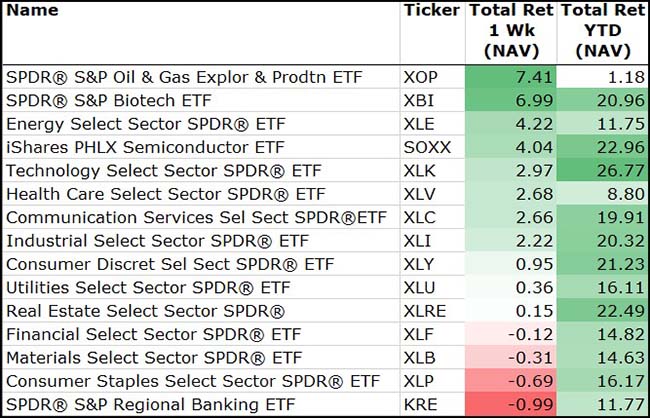

Among U.S. Sectors, it was more of a risk-on week as Energy, Biotech and Semis led the gains…

Banks lagged as analysts attempted to factor zero percent interest rates through the loan books.

(6/21/2019)

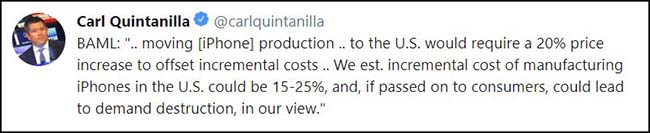

As the U.S./China trade war widens, Apple (NASDAQ:AAPL) is looking into shifting its China manufacturing into other countries…

Apple has asked its major suppliers to evaluate the cost implications of shifting 15% to 30% of their production capacity from China to Southeast Asia as it prepares for a fundamental restructuring of its supply chain, Nikkei Asian Review has learned.

The California-based tech giant’s request was triggered by the protracted trade tensions between Washington and Beijing, but multiple sources say that even if the spat is resolved there will be no turning back. Apple has decided the risks of relying so heavily on manufacturing in China, as it has done for decades, are too great and even rising, several people told Nikkei.

“A lower birthrate, higher labor costs and the risk of overly centralizing its production in one country. These adverse factors are not going anywhere,” said one executive with knowledge of the situation. “With or without the final round of the $300 billion tariff, Apple is following the big trend [to diversify production],” giving itself more flexibility, the person added.

(NikkeiAsianReview)

But there are few winners in this shuffling of iPhone production…

The early earnings or pre-announcements leading into the end of the Q2 are not very positive…

Jabil comments on supply chains during the Tues night conf. call – “Today, very few customers are moving existing production out of China. I believe this decision made by those customers is based on three factors; one, the deep-rooted mature supply chain that’s foundational to China; two, many of our customers don’t see a reasonable payback associated with such a move; and three, a decent percentage of our China revenue is for final consumption in geographies other than the United States”.

IQE PLC (LON:IQE) – “IQE is operating in an increasingly cautious marketplace and has very recently received a reduction in forecasts from a number of chip customers, in Wireless and also in Photonics, impacting anticipated revenues for the second half of FY2019”.

Siltronic AG (DE:WAFGn) – negative semiconductor data point as Siltronic cuts guidance. “Siltronic AG currently sees a continuing slowdown of the semiconductor industry, which is driven by geopolitical uncertainties, and the negative impact of export restrictions by the US government against Chinese technology companies. These developments indirectly affect important customers of Siltronic AG, which have therefore significantly reduced orders for the second half of 2019”.

Carnival (NYSE:CCL) Cruise Lines – reported earnings and cut guidance. “Recent booking trends have been impacted by ongoing geopolitical and macroeconomic headwinds affecting our Continental European brands. We continue to expect higher yields in our North America and Australia brands offset by lower yields in our Europe and Asia brands for the remainder of the year.”

Minerals Technologies in the US (“The strong demand we saw in March and April changed rapidly in May and further in June, primarily in U.S. automotive, heavy truck and agricultural equipment, leading to lower volumes in our U.S. metalcasting business. We are also experiencing weaker demand across our China and European markets”

U.S. Steel – provided Q2 EPS guidance below expectations and announced plans to take some production offline. “In response to current market conditions, we are taking actions aligned with our strategy by adjusting our global blast furnace footprint. We are idling two blast furnaces in the United States and one blast furnace in Europe to better align our global production with our order book”.

(J.P. Morgan)

As for the closely watched Ag community, Purdue’s monthly survey of 400 farmers continues to deteriorate…

Torrential flooding in the Midwest, lowered prices, surpluses of products like dairy, and, above all, the ongoing trade war with China have hit farmer sentiment like a heat-seeking missile. One year ago, 35 percent of respondents said they believed their equity will decline in the next year; in May 2019, that number leapt to 55 percent.

Farmers also increasingly believe their farmland to be less valuable; a year ago, 52 percent of farmers believed their farmland would increase in value, while in May, that number dropped to 39 percent.

Much has been made of farmer support for Donald Trump and his presidency. But payouts to help farmers through the trade war have been inadequate, slow, and unbalanced; New Food Economy reports that some farms are receiving millions of dollars, far above the allowed limit. China, the largest international buyer of American soybeans, is looking to other suppliers, like Brazil, potentially setting up a situation where even after the trade war theoretically ends, American farmers will have lost their buyer. Farmers still, despite this, mostly support the trade war, but support is waning. In March, 77 percent of farmers said they thought the trade war would ultimately benefit American agriculture; in May, that was down to 65 percent.

(ModernFarmer)

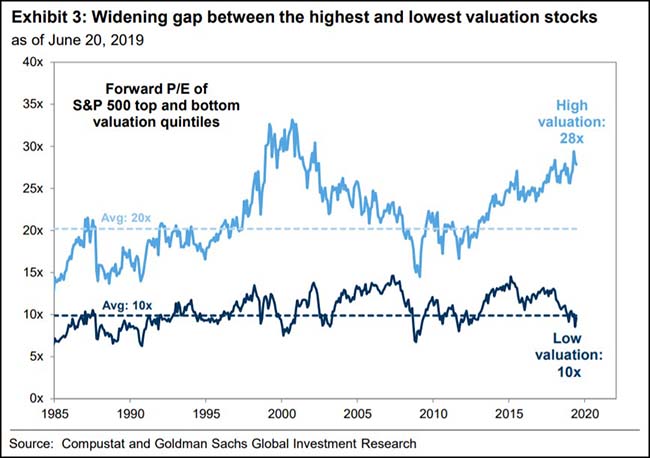

While investors shy away from owning problem stocks, they are paying up for the top performers…

This Goldman Sachs chart shows that the distribution of P/E multiples is growing increasingly wide. The last time it was this wide was an interesting time in the markets.

The stock market also appears to be outperforming the recent trends in high yield credit…

This chart shows a tight correlation between stocks and junk credit which has recently split a bit. Maybe the very sharp move in U.S. Treasuries accounts for the move. Or maybe investors are done paying up for the riskiest of corporate credits.

(@HumbleStudent)

Michaels Stores found out the hard way last week when it went to refinance some of its credit…

Michaels Stores Inc. was forced to pay up to refinance existing debt Friday, the latest unintended victim in the ongoing U.S. trade war with China.

Credit investors were concerned about disappointing financial results from earlier this month, as well as the potential for Michaels to be hurt by tariffs the U.S. is set to impose on Chinese imports. That had them asking for better terms.

The yield on the company’s $500 million offering came in at 8%, higher than the original price discussions of around 7% when the deal was first marketed earlier this week, according to people familiar with the matter who aren’t authorized to speak publicly.

Some investor protections — such as restrictions on dividend payments and asset sales — were also strengthened, the people said.

(Bloomberg)

Speaking of which, if you have a TOMS Shoes gift card, use it soon…

Low rates help zombie companies keep moving. But unfortunately even TOMS’ global goodwill may not help it survive the current retail apocalypse.

The H2O mess recalls some memories for me of the Bear Stearns’ High Grade Structured Credit Strategies Enhanced Leverage Fund…

Earlier this week the Financial Times detailed how H2O, a European asset manager owned by Natixis, had loaded up on illiquid debts connected to the flamboyant German financier Lars Windhorst. Morningstar promptly suspended its rating of one H2O fund, which in turn “raises concern about the quality of oversight by Natixis”, KBW said, sending the French financial group’s shares tumbling.

Setting aside some of the various allegations flying around, it is clear that the central challenge is that the H2O bond funds have a lot of hard-to-trade securities that can become problematic if investors suddenly want to yank their money out. A similar crisis enveloped Swiss asset manager GAM last year, when investors fled a $11bn “absolute return” fund range that had also dipped into esoteric, illiquid assets.

The problem is that this could be a wider, under-appreciated issue across the broader fixed income mutual fund universe, where customers are promised the ability to withdraw all their money at the drop of a hat but fund managers have been forced to take greater risks to make the returns that investors demand. In fact, the H2O and GAM affairs might eventually be seen to be the tip of a nasty iceberg for investors…

Bonds are typically the ballast investors use to protect their broader portfolios against downturns. When stock markets are choppy, fixed income tends to perform well. But with even stolid bond funds juicing their returns with riskier debt, investors may discover — to their horror — that the supposedly-safe part of their portfolios is nothing of the sort.

(FinancialTimes)

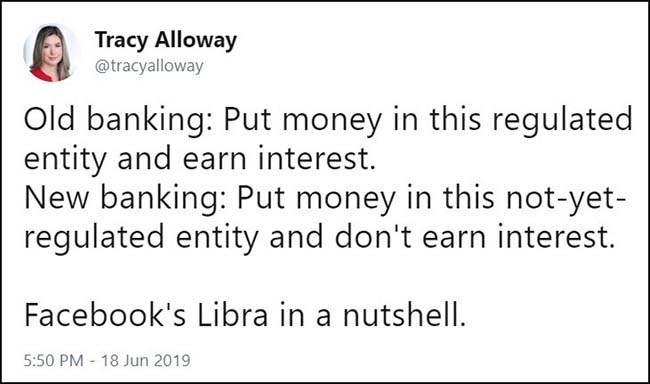

Very True… Low interest rates helped create Libra.

Nouriel Roubini has some thoughts on Libra…

• They claim it is not a security but rather a utility token by having the Libra Association and various legal fudges to avoid being labeled as a non compliant security. But it is either a security, and thus to be regulated by security regulators, or it is a bank that will need a bank license and needs to be regulated accordingly.

• All the members get a large cut of the seignorage from paying zero per cent on the float on customer balances and earning market rates on the assets they invest in. So they either rip-off customers or rip off traditional banks or central banks.

(FTalphaville)

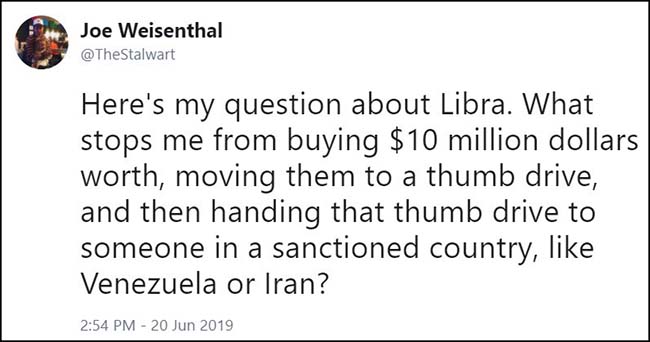

And Joe has a good question…

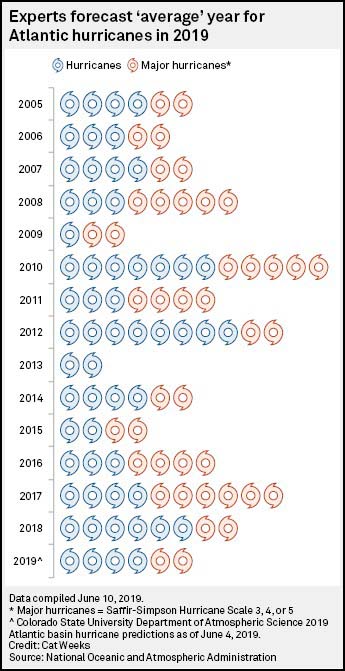

Given the very volatile Spring and Summer weather, I will take the ‘over’ bet for the number of Hurricanes this year…

@SPGMI_Insurance: Chartwatch: Leading experts at @ColoradoStateU predict 6 hurricanes in total including 2 major storms Category 3 or higher to originate from Atlantic basin in 2019.

(SPGlobal)

If you are long GE, this is a must watch…

I thought this video was a joke. But it is not. So great news for GE investors, because you now know that it can’t get any worse for the company if they have a product with reset instructions like this. Five bucks that Larry Culp uses this video as an example at the next meeting of top GE managers.

(SupportCbyGE)

If HBO or Netflix (NASDAQ:NFLX) is looking for a new mini-series, this unsolved puzzle would be an interesting one to watch…

The mystery surrounding MH370 has been a focus of continued investigation and a source of sometimes feverish public speculation. The loss devastated families on four continents. The idea that a sophisticated machine, with its modern instruments and redundant communications, could simply vanish seems beyond the realm of possibility. It is hard to permanently delete an email, and living off the grid is nearly unachievable even when the attempt is deliberate. A Boeing (NYSE:BA) 777 is meant to be electronically accessible at all times. The disappearance of the airplane has provoked a host of theories. Many are preposterous. All are given life by the fact that, in this age, commercial airplanes don’t just vanish.

This one did, and more than five years later its precise whereabouts remain unknown. Even so, a great deal about the disappearance of MH370 has come into clearer view, and reconstructing much of what happened that night is possible. The cockpit voice recorder and the flight-data recorder may never be recovered, but what we still need to know is unlikely to come from the black boxes. Instead, it will have to come from Malaysia.

(TheAtlantic)

And finally, this story went viral around many of the investment circles last week. It is worth everyone’s time…

This is going to be an uncharacteristic departure for me. This story is deeply personal, for our family, and for our oldest son in particular. But it is a story he’s letting me tell, because it is a story he wants people to hear.My son Max was born in Detroit in 1997, he spent the next summer in Hong Kong when I was interning at Fidelity Investments, and moved to London before he was two when I accepted an offer to work for Fido there full-time.

He was an amazing child, and became an amazing young man. But he had his demons. And just before he turned 16 years old, those demons arrived with a vengeance. I will spare you the details, but for the next three years, he went through a personal hell. Imagine all the things you don’t want to have happen to your teenager. They happened to him. For three years my wife and I would wait on our front stoop until 5:00 am, in the shadow of the Albert Bridge, hoping that he would come home. On those nights that he didn’t, we would call the hospitals, and call the police. And sometimes the police would call us.

(AlbertBridgeCapital)