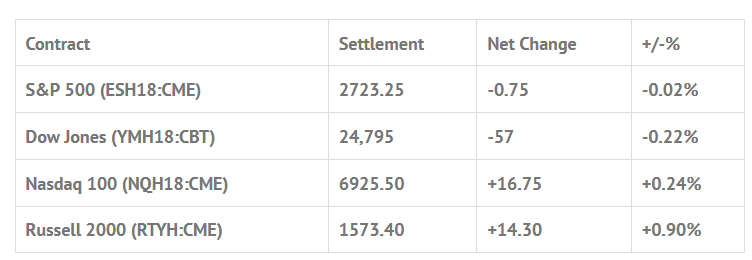

Index Futures Net Changes and Settlements:

Foreign Markets, Fair Value and Volume:

- In Asia 10 out of 11 markets closed higher: Shanghai Comp +0.54%, Hang Seng +1.52%, Nikkei +0.54%

- In Europe 11 out of 12 markets are trading higher: CAC +0.37%, DAX -0.17%, FTSE +0.09%

- Fair Value: S&P +2.20, NASDAQ +22.17, Dow +8.15

- Total Volume: 1.4mil ESH & 1.9k SPH traded in the pit

Today’s Economic Calendar:

The Weekly Bill Settlement, Chain Store Sales, Challenger Job-Cut Report 7:30 AM ET, Jobless Claims 8:30 AM ET, Bloomberg Consumer Comfort Index 9:45 AM ET, Quarterly Services Survey 10:00 AM ET, EIA Natural Gas Report 10:30 AM ET, Fed Balance Sheet 4:30 PM ET, and Money Supply 4:30 PM ET.

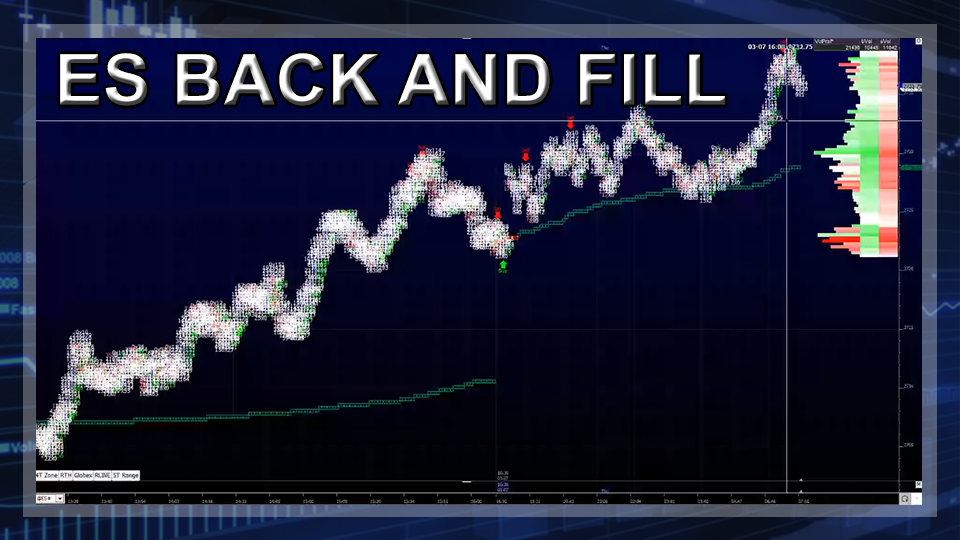

S&P 500 Futures: #ES Fills The Cohn 2724 Gap

After Trump’s top economic adviser Gary Cohn resigned, the S&P 500 Futures sold off down to 2681.25 early Tuesday night. After that, the futures rallied up to 2704.50, pulled back little, then ended up making its Globex high at 2709.75 after Wednesday morning ADP number came out stronger than expected at 245,000. A total of 410,000 ES futures traded during the overnight session. On the 8:30 CT futures open the ES traded 2701.00, and immedeatly shot up to 2715.25. The high Globex volume was a good indication that traders got too short after the news.

After a small pullback down to 2708.25, the ES traded all the way up to 2723.50, two ticks off the 2724.00 gap, just before 10:00 CT, and then sold off down to 2711.25 at 10:21 am, and then down to 2700.75 at 11:12. I figured the ES would fill the gap, and I also thought it would sell off again, and that’s exactly what happened. Once the low was in, the ES pushed back up to 2710.00, and then went back down and retested the lows. After the retest, the futures traded all the way up to 2725.00 before pulling back to the 2720 level, and then rallied up to 2729.75 as the MiM went from $233 million to sell to $2 million to buy. At 2:45 the cash imbalance came out FLAT, and the ES traded up to a new high at 2730.25. On the 3:00 cash close the futures traded 2726.00, and went on to settle at 2723.25, down 0.75 handles, or -0.03%, on the day.

What can I say? The bots jammed the longs, and then they jammed the shorts. There are still two possibly wild days ahead. The ECB and rollover are today, and the jobs report comes out tomorrow.

Disclaimer: Trading Futures, Options on Futures, and retail off-exchange foreign currency transactions involves substantial risk of loss and is not suitable for all investors. You should carefully consider whether trading is suitable for you in light of your circumstances, knowledge, and financial resources. Any decision to purchase or sell as a result of the opinions expressed in the forum will be the full responsibility of the person(s) authorizing such transaction(s). BE ADVISED TO ALWAYS USE PROTECTIVE STOP LOSSES AND ALLOW FOR SLIPPAGE TO MANAGE YOUR TRADE(S) AS AN INVESTOR COULD LOSE ALL OR MORE THAN THEIR INITIAL INVESTMENT. PAST PERFORMANCE IS NOT INDICATIVE OF FUTURE RESULTS.