I last wrote about the S&P 500:VIX ratio in my post here.

The SPX continued its plunge (that began on January 30) and closed near its low on Friday (spiking the VIX to a new daily swing high), as noted in this post.

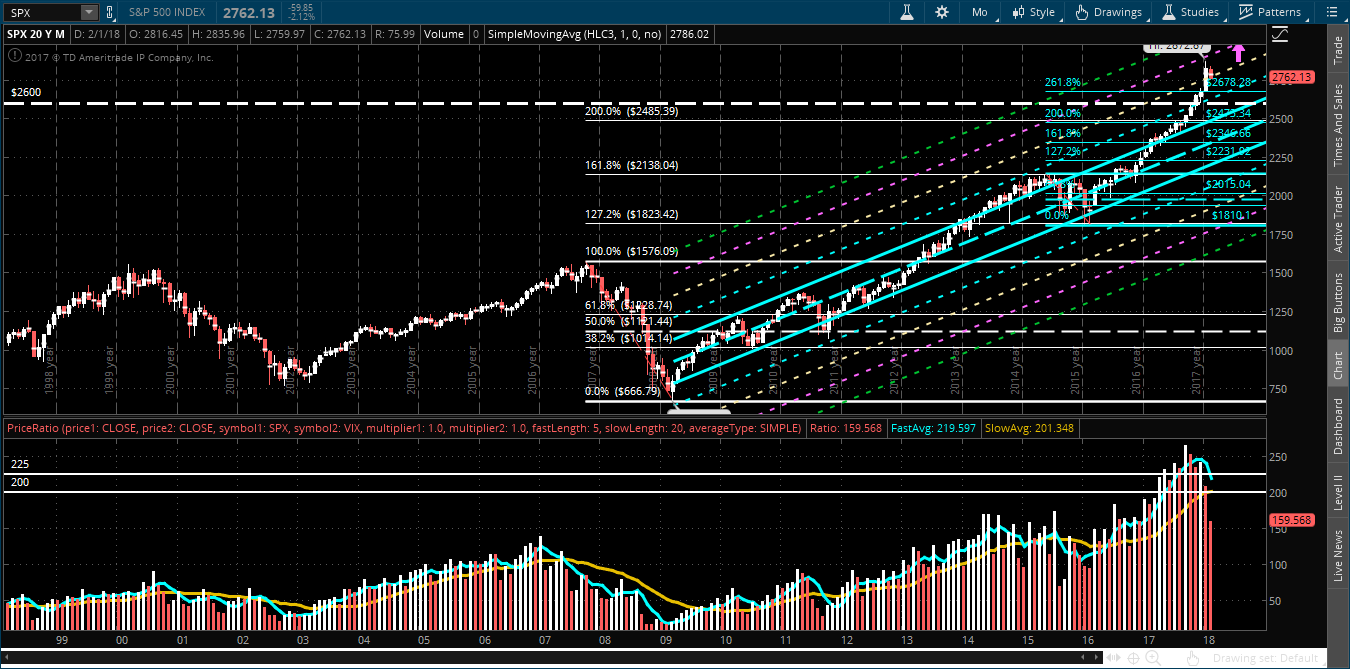

The following monthly chart of the SPX:VIX ratio shows that price closed well below, what was, major support of 200 and is hovering just above the 150 Bull/Bear Line-in-the-Sand or "critical mass."

Furthermore, the momentum indicator has fallen below the zero level, hinting of further equity weakness to come in the longer term.

If this ratio drops and holds below 150, no doubt we'll see an acceleration of equity selling and much higher spikes in volatility. In any event, we'll continue to see some wild swings as long as this ratio stays below 200.

As well, watch for a bearish moving average crossover of the ratio 5MA and 20MA on the following monthly chart -- which shows the SPX in the upper half and the SPX:VIX ratio (in histogram format with these 2 moving averages) in the lower half—if the ratio were to drop and hold below 150, to confirm continued (and, potentially, panic) selling in the SPX.