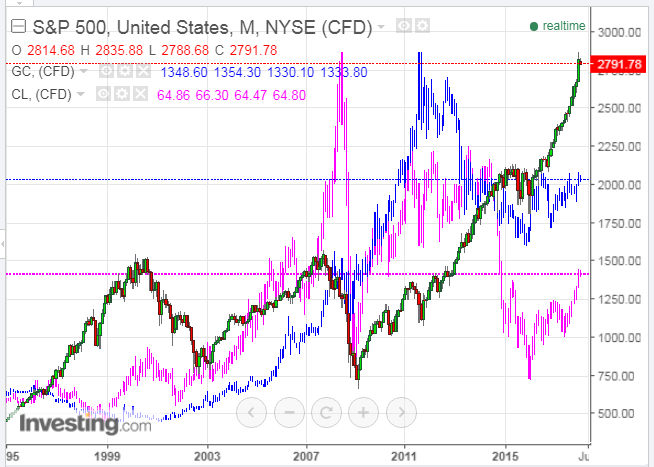

Looking back at a longer-term monthly view of the S&P 500 Index (SPX) compared with Gold (GC) (blue bars) and WTIC Crude Oil (CL) (pink bars), we saw a broad correlation among these regarding rallies and pullbacks...until 2011 when the bounce in GC and CL stalled and, ultimately, sank in mid-2014, especially CL when it plunged to (just below) post-financial-crisis levels in January of 2016.

As of 11:50am ET on Friday, we see that while the SPX is just below all-time highs, GC faces major resistance at 1350 and CL is swirling around 65.00 (major resistance/support).

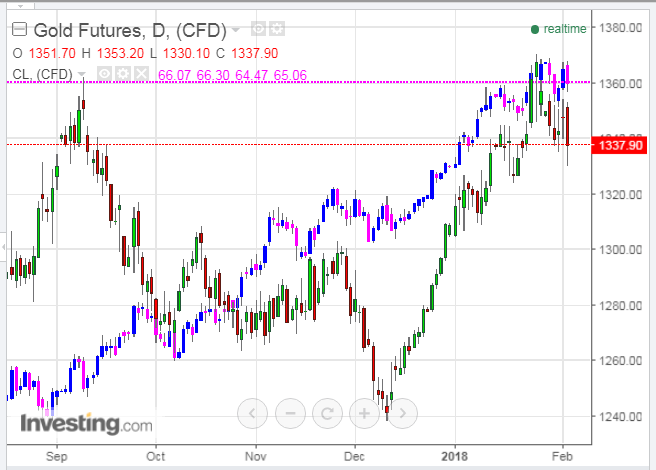

As shown on the following daily chart of GC (green & red) compared with CL (blue & pink), price in these two commodities has stalled during the past couple of weeks and is down again.

Given the "shock drop" that began in the SPX on Tuesday and continued on Friday, the daily SPX chart below (with the VIX overlayed), if GC and CL continue to decline next week and beyond, it could signal the beginning of a pullback in the SPX in particular and equities in general.

Keep an eye on the SPX:VIX ratio as one tool that can be used to gauge such a possibility/probability, as I described in my post on January 31.

As well, the details I outlined on January 27 regarding CL are worth monitoring.