The weakness in the French PMI numbers is translating into a lower open for stocks over in Europe. In addition to this, there aren't any imminent signs of a trade deal between the US and China, especially after Beijing walked away from the recent conversations abruptly.

Fatigueness is prominent in the US equity markets and this is especially true if you look at the market reaction of the major benchmark indices, the S&P 500 index and the Dow Jones. Both closed lower on Friday. The failure of these indices breaking their previous record highs prompted concern among investors that weakness is brewing among bulls.

Expect Some Weakness For The Dollar Index

In terms of the FX market, we may see some weakness coming for the dollar index during this week as a number of fed officials are slated to speak. Majority of them are expected to have a dovish stance on the monetary policy. In terms of economic numbers, investors aren't going to be much concerned because the heavy hitters are scheduled for release during next week.

Gold Inflow At Highest Level Since 2013

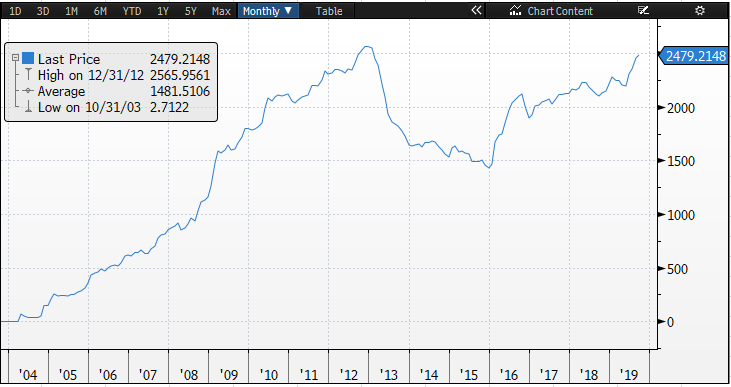

The shining metal, gold is the favorite choice among investors and it is highly expected that the gold may continue to rise this week. The below chart shows that the inflow in gold is very close to its record high, a level not seen since 2012. The worldwide total stands at 2479.2 tonnes, the highest level since 2013. Remember gold doesn't pay any dividend or interest, so this increase in position is based on the fact that investors are pricing higher uncertainty in the market. Overall, there is a little optimism on the trade war front ahead of a major holiday period over in China.

Supreme Court’s Decision and Johnson’s Performance at Climate Summit

As for Brexit, Boris Johnson the UK's Prime Minister is going to try his best to cultivate any support during the climate summit in New York. He's expected to have several meetings on the sidelines. His meeting with German Chancellor Angela Merkel is of significant importance given that the US president, Donald Trump isn’t going to be there.

The Supreme Court is also going to deliver its verdict about Johnson's decision to suspend the parliament on this may bring some whipsaws for the currency. Remember, Sterling touched its highest level on Friday since July and if the Supreme Court judges decide to deliver a verdict against the government decision, we may actually see an uptick in currency.

Oil Continues Its Climb

Saudi Arabia is struggling to revive its oil production back to its previous level. Armco’s executives are determined to do whatever it takes and this includes paying premium rates to workers and for the equipment for the repair work. The strength in the oil price is primarily due to the pessimism around Saudi oil production.