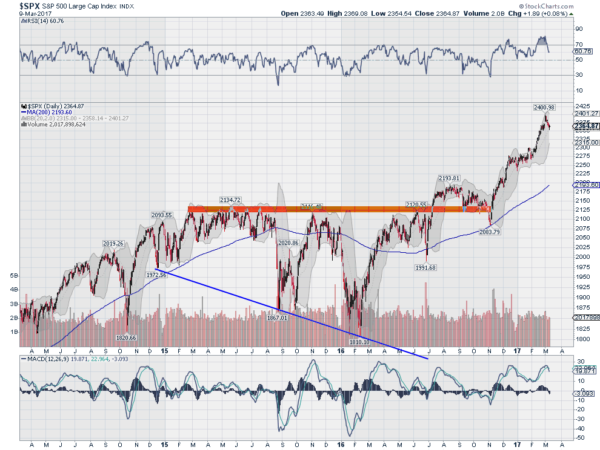

The worst sell-off of the year has brought the S&P 500 all the way back to its 20-day SMA. It has retraced a mere 36 points of its move out of the election low. Yet sentiment readings like the AAII are reaching high bearish levels. Traders are circulating charts of the Nasdaq from 1999 trying to paint a parallel to the period when a 75% sell-off followed. Some things never change. Many call it the wall of worry. Fear is what makes our brains take notice -- and what drives page views.

But should you be worried that the market is about to crash? I have no crystal ball that tells me that the markets will continue their march higher. Yes, it is my opinion that the easier path is to the upside based on the price action. But that does not mean it will happen. After all, who knew that a drop to 666 in the S&P 500 was about to happen in 2008? No one. But what has happened so far does not even qualify as a pull-back. That's the good news.

So what are you supposed to do with your portfolio when the Nasdaq looks like the first half of the 1999, Janet Yellen is going to give us another rate hike next week and everything you read says you'll be penniless in a week? Sell everything? No, just relax. Why? Because you had a plan before you put any money into the market. You do have a plan right?

It is said that risk management is more important than any other aspect of trading or investing. What does risk management mean to you? To me it means assessing the broad environment, measuring what loss I am willing to accept as a portion of my portfolio on each position, determining an exit level, translating those to a position size, and then trading. With the markets in a strong place if you do not have a plan this is a great time to create one. Do it now.