We saw a fairly benign lead from Wall Street, but when all was quiet, we saw an FT article showing the Chinese and US are close to a final trade deal hit the market. Clearly, Asia has liked this news, with S&P 500 futures +0.4% and leading the ASX 200 +0.7% higher (currently 6285), with the Hang Seng gaining 0.9%.

The ASX 200 is eyeing a firm break of the 7 March high and should we see China ramp up into the close, then it seems fair to think we will print a higher high and onwards and upwards it seems.

There has been so much chatter that US-China trade is in the price and there is obvious merit to that as we have been talking about “progress” for many months. However, I think if we saw an announcement from both leaders, showing solidarity and improved relations and existing trade tariffs dropped then we go higher in risk.

In FX land, the USD index has come onto the radar again, and although we are seeing modest selling through Asia, the price is moving into what could be described as a triple top and I am a willing seller into the top of the range at 97.50. As we can see, the price is grinding higher, supported on pullbacks into the 5-day EMA (the red line) and this keeps me from being short the USD at this juncture. While most will trade EUR/USD over the USD index (the EUR contributes 57% towards this USD index – reach out for more clarity here), there will be a lot of talk on the trading floors should the USD break this ceiling. I suspect it will have a hard time though, hence my desire to fade the move, especially with some of the more dovish members of the Fed now openly talking about Fed rate cuts.

So, the daily of USD index is on the high-watch list and should it prove that USD bulls can push price through the ceiling, then we have to ask what would the ramifications be in other markets, notably emerging markets? In a low growth world, a rising USD would not be good at all, although it’s the rate of change in price that is the bigger concern.

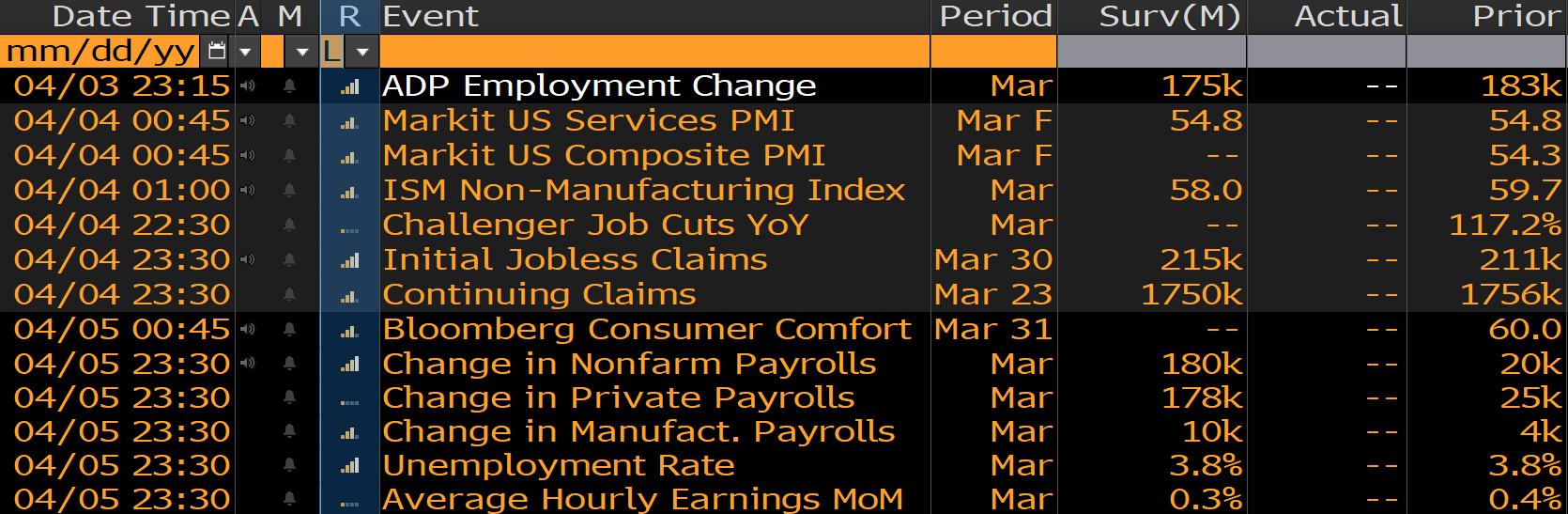

In terms of event risk, we focus on the remaining US data flow for the week. I personally don’t see huge volatility risk from the ADP private payrolls or ISM services print, but payrolls are always a bit of a tough one. We just don’t look at the level of jobs created in isolation and we need to take a more holistic view, with consideration on hourly earnings (wages), the unemployment rate and the participation rate. Economists will also look at the U6 rate, which is a far broader measure of employment, and considered a better representation of slack in the US economy. The U6 rate does not appear on this Bloomberg calendar.

A key twist in the Brexit saga

The GBP/USD has once again been well traded, and it continues to be one for the brave, and there is no clear trade for me here, although I feel the risks are skewed for a move into 1.3200. EUR/GBP continues to consolidate between 0.85 and 0.86 and feels like a coiled spring ready to unload. As mentioned yesterday, we reached a point when Theresa May needed to radically change tact, and it seems we are seeing that play out now, with PM May has reached cross-party to engage with Jeremy Corbyn.

There will be a further request to the EU for a short extension, but this is the moment we potentially stare at the implosion of the Tory party; that is should we see May and Corbyn actually agree on either a second referendum or a Customs Union model to then sell to their respective parties. On this development, aside from the likely resignations from the Brexiteers, GBP should find buyers, that is unless we genuinely believe a general election becomes a reality. Of course, the two ‘leaders’ may well not find common ground, and we stare at the fourth vote on May’s Brexit deal, in which case the ERG party would have no choice but to vote it through.

AUD bid on a solid retail sales

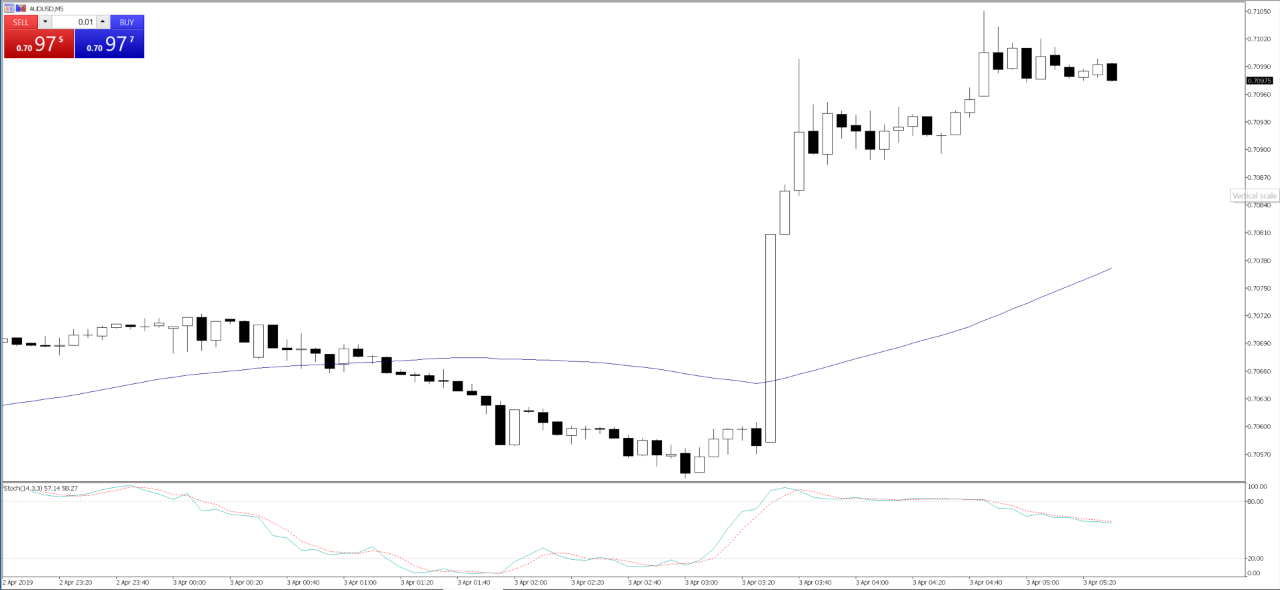

The question of what will push the AUDUSD through 70c has come up time and time again, but the AUD is a stubborn old beast and today's February retail sales (0.8% vs 0.3% expected), and trade balance ($4.8b) won't have done AUD bears any favours. AUDUSD spiked 40 pips or so in 71c on the Aussie data, but was also complimented by the FT headlines hitting the market at same time and the move seems to have been driven by a weaker USDCNH

For those hoping for a break of 70c understand that there is some solid wood for AUD bears to chop to push AUD/USD through 70c, and this is made even more pronounced given positioning from leveraged funds (namely hedge funds) is already held short. What’s more, when we look at relative current account dynamics, we can see the current Australian government forecasts (in this week’s budget) a surplus of 0.8% of GDP in FY22. Compare this to the US where we will see ever ballooning twin deficits.

Relative current account dynamics do matter for currencies longer-term valuation, and from this perspective, the relative fiscal position increases the probability the AUD/USD should remain supported above 70c. An improving economic picture in China is also supporting the AUD. That said, while the Reserve Bank will be somewhat enthused that fiscal levers should stimulate the economy, the market is still pricing 19 basis points (bp) of cuts by July and 26bp (one full cut) by August. This suggests the market feels on balance that the Aussie economy will still need a monetary policy response.

Revert to Tuesday’s RBA statement and specifically the last paragraph, where we saw a subtle, yet meaningful, tweak to guidance, with the statement, “the Board will continue to monitor developments and set monetary policy to support sustainable growth in the economy and achieve the inflation target over time.” Consider this was the first change in guidance from RBA governor Lowe since he was recruited in September 2016. Subsequently, we feel the door is now ajar to cut, with a strong emphasis on the role the labour market plays in achieving the RBA’s economic projections.

Therefore, should we any deterioration in the labour market then the RBA will swing to an outright easing bias in May, and look to cut in July and perhaps again in September.

The labour market is absolutely fundamental to any lasting trend now in the AUD, and the four key labour market data points, which traders should have on their radar as we head into April are ANZ jobs ad’s (released 8 April), ABS employment rate (18 April), job vacancies (24 April) and lastly, capacity utilisation (14 May). While the rates market is already pricing in a strong degree of easing, but any vulnerabilities in these labour market reads will install a genuine belief the RBA will swing to an outright easing bias, and this will be a very powerful force. Keep these data points on the radar.